Every successful person has two beliefs

I have seen too many traders that randomly add condition after condition to their trading strategy, hoping that it will increase their hitrate. What they are trying to do is to add assumption after assumption to their hypothesis, until their hypothesis (“price will move in to this or that direction for this or that amount”) is hopefully correct more often than not.

Going this way usually ends in paralysis through analysis or in total chaos because there are so many conditions when entering a trade that it is impossible for a human brain to follow the system, thus inducing mistakes.

Enter: Occam’s Razor

Occam was one of those scholastic philosophers, living around 1300 A.D. He developed a principle called Occam’s Razor which states that “among competing hypotheses that predict equally well, the one with the fewest assumptions should be selected. Other, more complicated solutions may ultimately prove to provide better predictions, but—in the absence of differences in predictive ability—the fewer assumptions that are made, the better.” But Occam was not the first, even Aristotle, who was living a mere 2000 years ago, theorized about this concept.

Now the thing is that of course when you add or remove certain conditions to your trading strategy, the predictive ability of your strategy will vary thus rendering Occam’s Razor seemingly invalid. Seemingly. Because trading is a game of incomplete information, we can never exactly know the predictive ability of a model.

Even after testing thoroughly, we will always only get an estimate (our winrate). Because of this fact you should base your trading strategy on as few assumptions as possible. (more…)

Barely over a week ahead of release of the official GDP data, research and analytical firm ZyFin today estimated India’s economy to expand by 4.7% in the second quarter of the current financial year. The methodology used by ZyFin is distinct and it claimed that it uses variables which are lead indicators to the official data. If GDP indeed grows by this rate, the Finance Ministry’s hopes of GDP growth between 5-5.5% in 2013-14 may be dashed.

– Trading is all about making decisions.

– Making good decisions comes with experience.

– Experience comes from making bad decisions.

Refresh Your Memory :

On 12th Janaury ,I had written to buy Fertilizer Stocks (Nag.Fert was boldly recommended to buy @ 36.

Chambal Fert/FACT /MADRAS FERT/NFL :All stocks on fire in last 6 days.

Apart from Fertilizer stocks ,We recommended PSU stocks to our Subscribers i.e Andrew Yule @ 62 on 7th Jan ,Yesterday it was 79.And many other stocks ,All blasted in last 10 sessions.

On 12th Jan recommended to Sell Sugar Stocks

I don’t want to write anything…just check price level of Sugar stocks on 12th and of Yesterday……and think is it power of chart or Magic ?

Apart from all these recommendations ,you all might have seen Nifty Future was not able to cross 5280-5313 level and Yesterday crashed.Writing since last 1 week avoid long in Sensex Stocks.Every 2nd stock is looking weak and tired.

Just read shortly about Messages I had sent Yesterday to our Subscribers.

Updated at 7:51/20th Jan/Baroda

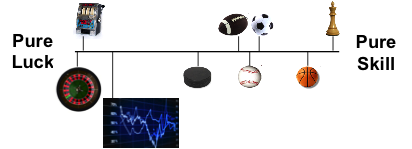

Basketball comes closest to chess in terms of being the game with the most skill involved. In comparison, hockey looks more like the lottery (and don’t even ask about trading).

The bottom line is that the law of smaller numbers allows for more variance in individual player and game outcomes in a sport like baseball or hockey – in baseball the most skilled hitter only gets up to bat a few times per game and in hockey the star players aren’t on the ice much more than a period or two out of three. Less plate appearances or ice time can mean that it is more likely that a fluke of some sort, good or bad luck, can make an impact. This is in contrast to basketball where there are only five players at any time and the stars typically play most of the game – more playing time means a bigger sample, by extension this means less variance.

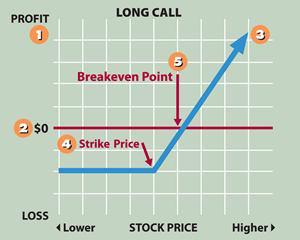

One of the most frustrating things a trader can experience is being dead on right about a trade, taking it, BUT.. still losing money! How can this be? This can happen in five different ways, each of the first four contain a lesson for better planning the fifth way to lose money in this list is just part of the game.

One of the most frustrating things a trader can experience is being dead on right about a trade, taking it, BUT.. still losing money! How can this be? This can happen in five different ways, each of the first four contain a lesson for better planning the fifth way to lose money in this list is just part of the game.