- Look at your trading as a series of probabilities, don’t focus on any single profit or loss.

- Want what the market wants.

- Do your homework. Come prepared to each day’s trading.

- Never take a trade on the open in the direction of a that day’s gap.

- Don’t risk too much of your trading capital on any single idea.

- Remain flexible.

- Believe what you see. If the market’s going up or down, it’s going up or down.

- Anything can happen. The wildness lies in wait.

- Verify your trading methods or systems.

- Caveat emptor (“Let the buyer beware.”) when buying a trading system or hiring a mentor.

- Your own personal psychology will express itself regardless of your chosen method.

- An opinion isn’t worth much, your own or someone else’s.

- Watch how the markets react to the news.

- Learn from your mistakes.

- Stay in the now. Don’t trade yesterday, today. Don’t trade tomorrow, today.

- Don’t worry about a missed opportunity. Another one is on the way. Besides there were several that just passed of which you were totally unaware.

- If you don’t risk, you can’t make money. If you lose all your trading capital, you can’t trade. Find balance.

- Markets don’t go in a single direction. The trend will wobble on it’s way to its destination.

- The trend is your friend. Unless you’re a counter trend trader, and then only it’s end is your friend.

- Tomorrow’s another day, a whole new trading opportunity. Be optimistic.

- Forgive yourself. Take the lesson, and move on.

Latest Posts

rssMichael Steinhardt on the elements of good trading

Hope in Trading-Very Dangerous

My Blackberry Is Not Working! Great Technology Humor

Some great British humor for the weekend, mentioned in a recent Casey Research newsletter. You will hear about Apples (AAPL), Research In Motion’s (RIMM) BlackBerry, and Microsoft’s (MSFT) Windows. By the way, non-techies should know before they watch: Orange is a European cell phone service provider, a dongle is a short wire adapter that connects a computer to an Internet cable, and black spots are wireless dead zones.

Today's Market :Such a great picture…. Speaks a thousand words

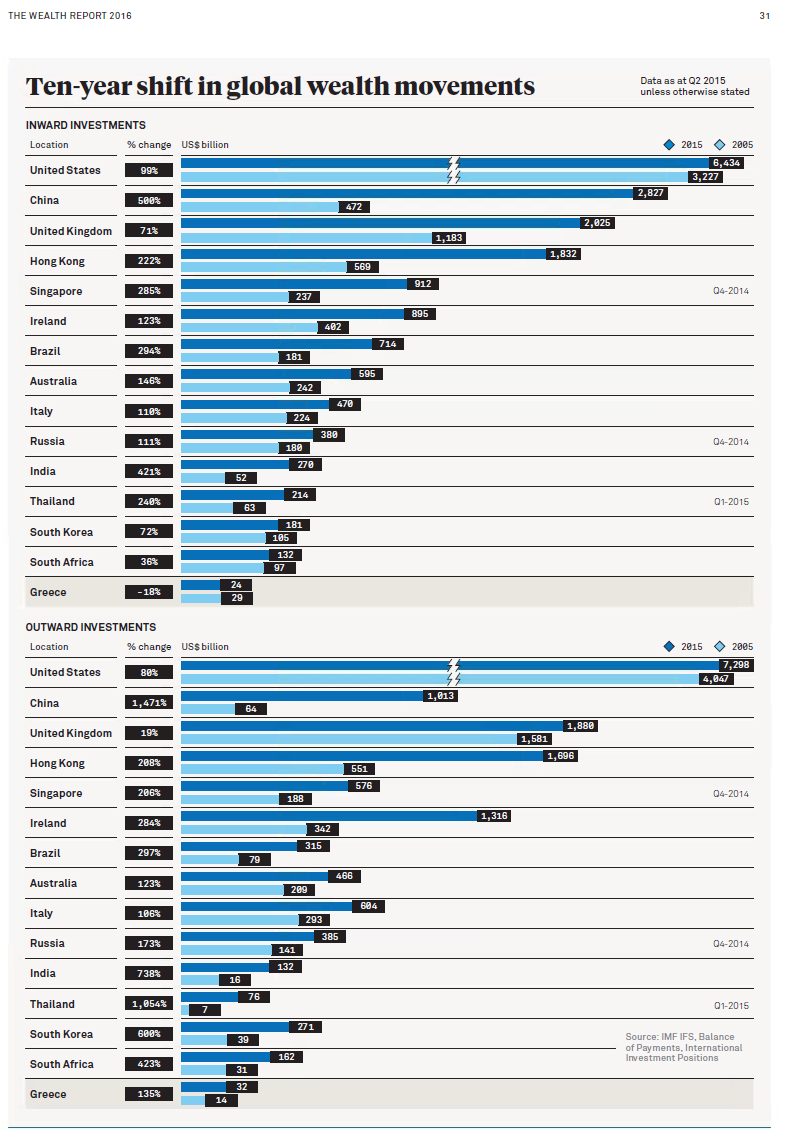

10 -year shift in global wealth movements

Turn Off the TV,Turn Off the Distractions

Rising interest rates in this world of debt:

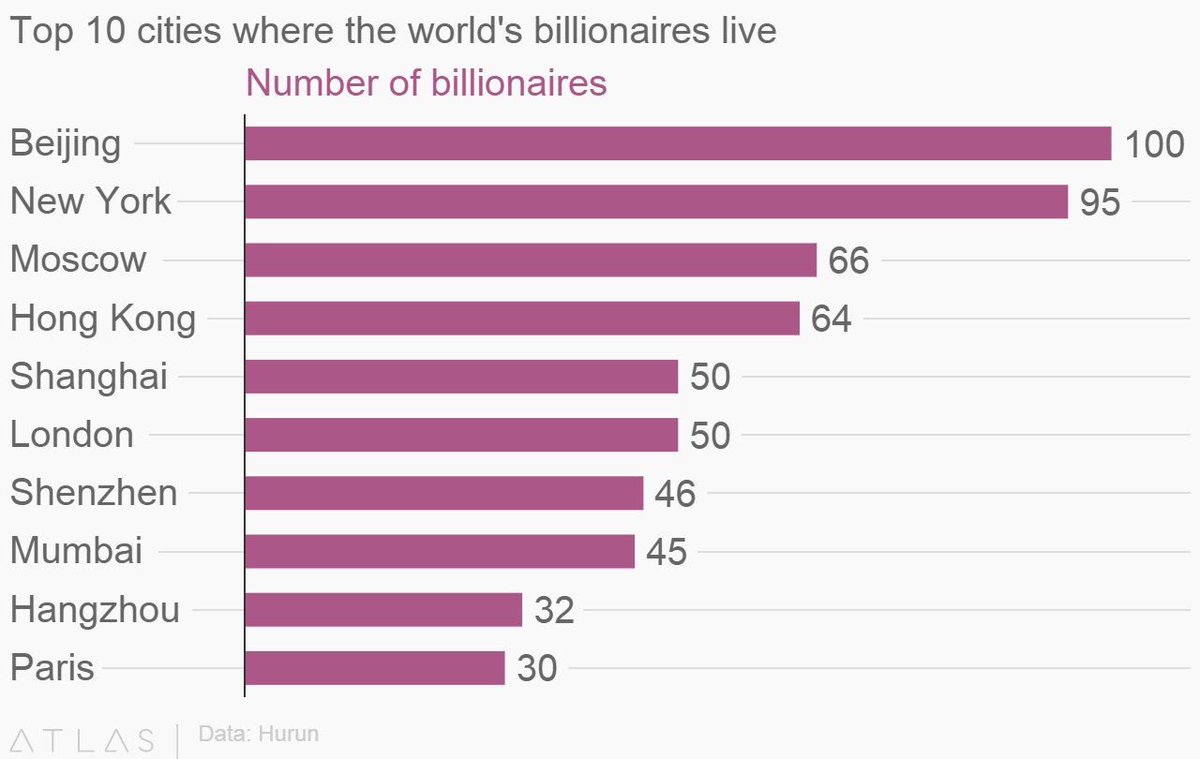

Top 10 Cities Where the World Billionaires live -Mumbai having 45

Hardy Oil+Reliance Encounter Dry Well In KG D9 Block-stocks sink

Hardy Oil and Gas, the exploration and production group with interests predominantly in India, has kicked off a four-well drilling campaign on its D9 exploration licence with a dry well.

Hardy Oil and Gas, the exploration and production group with interests predominantly in India, has kicked off a four-well drilling campaign on its D9 exploration licence with a dry well.

The exploratory well KGD-A1 drilled to a total depth of 4,875m and while it did hit some background gas, the well encountered poor reservoir sands in both the middle and lower miocene target levels. It will now be plugged and abandoned.

Hardy said the data obtained from the first exploration parametric well was very significant and would be integrated with the existing geological model to improve the prospectivity of the block before drilling subsequent wells.

Hardy holds a 10% participating interest in the D9 block, which is located in the Krishna Godavari basin on the east coast of India. Reliance Industries Ltd is the operator and holds a 90% stake.