Stop trying to outsmart the market. NO ONE knows exactly where it will go.

Stop trying to outsmart the market. NO ONE knows exactly where it will go. - With each decision you make comes stress:

- The more decisions you make, the more likely you are to be wrong.

- The more decisions you are used to making, the more pressure you’ll put on yourself to make even more decisions.

- No one can be that right.

- Forget about the “whys’ of the market. After all is said and done, the reasons will be known.

- Don’t apply logic. Markets move on emotions — period!

- Plan your trade and trade your plan.

- Reduce the amount of decisions you make.

- Make decisions and live with them (also a life lesson!).

- Good decisions come from experience.

- Experience comes from bad decisions.

Latest Posts

rssTrading Commandments From A Samurai

1. “Accept everything just the way it is.”

= accept the market reality in front of you.

2. “Do not seek pleasure for its own sake.”

= don’t trade for pleasure

3. “Do not, under any circumstances, depend on a partial feeling.”

= don’t jump or out of trade on shallow half-baked impulsive feelings.

4. “Think lightly of yourself and deeply of the world.”

= don’t take your trading skills too seriously, take the ability of market to surprise seriously.

5. “Be detached from desire your whole life long.”

= make money, but don’t let money make you.

6. “Do not regret what you have done.”

= smile at your mistake, laugh off your profit.

7. “Never be jealous.”

= what you’ve got is good and enough and incomparable

8. “Never let yourself be saddened by a separation.”

= a loss is never final. it either stays back as lesson or returns as profit.

9. “Resentment and complaint are appropriate neither for oneself or others.”

= accept the reality, keep the power with yourself by not complaining.

10. “In all things have no preferences.”

= don’t measure your profit or loss, just measure them by the lesson or experience.

11. “Do not act following customary beliefs.”

= dare to think!

12. “Do not collect weapons or practice with weapons beyond what is useful.”

= a handful of tools are enough if you are willing to submit.

13. “Do not fear death.”

= do not fear unforeseen loss.

14. “Do not seek to possess either goods or fiefs for your old age.”

= don’t trade under pressure to accumulate profit. if you remain alive, markets will always be there. just keep learning the game.

15. “Respect Buddha and the gods without counting on their help.”

= respect luck, acknowledge god’s blessing, but don’t drag them in the market.

German economic optimism on the rise in August

Germans are feeling much better than expected about their economy, with the just-released ZEW sentiment index giving a reading of 42, up from 36.3 in July.

Germans are feeling much better than expected about their economy, with the just-released ZEW sentiment index giving a reading of 42, up from 36.3 in July.

The Zew Institute’s Current Conditions Index rose even more – to 18.3 from 10.6 in July.

Analysts expected readings of 40 and 12 respectively for the two indices and sentiment is at its highest since March.

The institute comments that the “first signs of an end to the recession in important Eurozone countries may have contributed to the indicator’s rise…. furthermore, the economic optimism is supported by the robust domestic demand in Germany”.

There has also been a strong increase in economic expectations for the Eurozone, the index climbing 11.2 points to 44.

Eurozone industrial production numbers for June are also out. They show an increase of 0.7 per cent, compared to economist expectations of 0.8 per cent and a decline of 0.3 per cent in May.

95% of Traders ,TV Analysts ,Blue Channel Watchers -Look Chart This Way and Lose Money Easily

Don't tell me you can't. Maybe you quit dreaming or planning.. But don't tell me you can't. Life is built on dreams!

10 Mental Errors

The weakest link to any trading strategy is the trader that is suppose to be executing it. It is usually the mental and emotional errors of the trader that cause the 90% of unprofitable traders to lose money. Trading success is determined more by the mindset of the trader than their skills with math, economics, or macro knowledge.

- The ego takes over the trader and being right becomes the #1 priority. This causes the trader not to take losses becasue they don’t want to be proven wrong.

- Greed causes traders to trade too big because they want to make a huge amount of money in one trade.

- Fear causes a trader to exit to early with a very small profit because they are afraid it will disappear.

- Discouragement causes a trader to quit before they have given themselves or their systems enough time to win.

- Coat tailing is when a trader follows a guru’s trades instead of learning to trade correctly themselves.

- Style drift is when a trader changes their method instead of sticking to it and letting it play out when the right market environment emerges.

- Arrogance leads a trader to trade too big and take on too much risk, this usually happens after a big winning streak or outsized win. (more…)

Investor Behavior in the October 1987 Crash

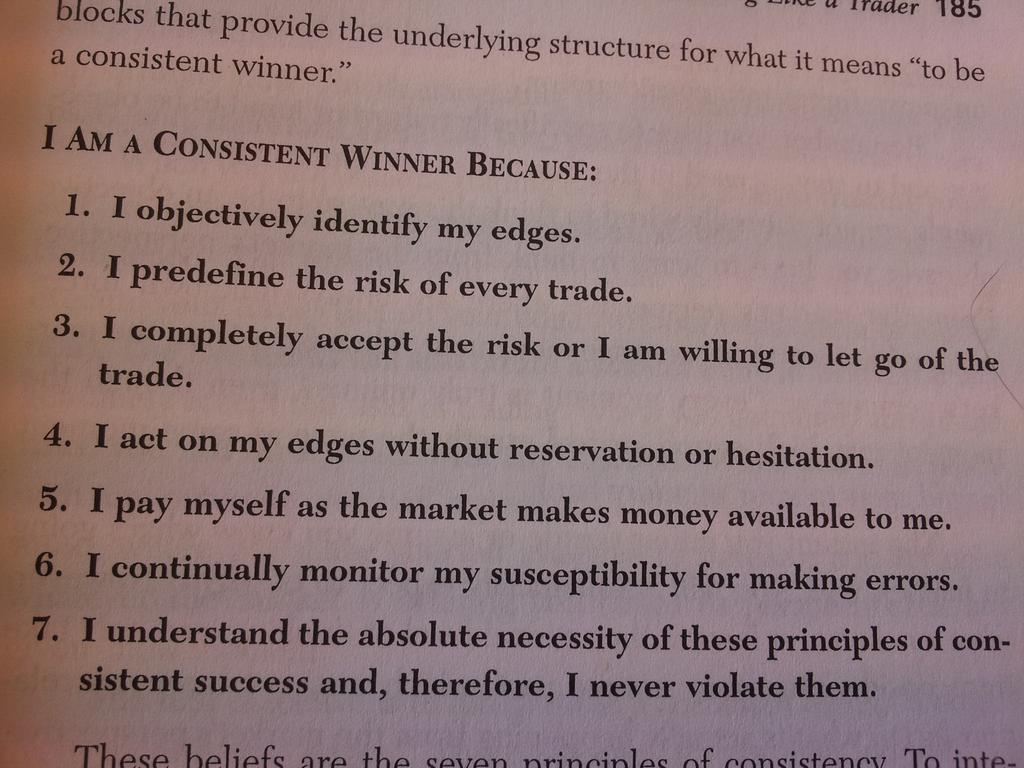

We & Our Subscribers Are Consistent Winners …..Read These 7 Points

Favorite Wall Street Movies

Wall Street Movies: After a long day at the desk, what’s more relaxing than kicking back and watching a movie about investing or trading? Here are 4 flicks for your favorite keyboard jockey:

– Eddie Murphy Trading Places ($9) Only tangentially related to trading, but filled with lots of oft quoted lines, this comedy is good for everyone.

– Wall Street ($10) Blue Horseshoe loves Anacott Steel. Dated, but watchable. Skip the 2010 version — its awful.

– Boiler Room ($6) Know a retail stock jockey? This gritty flick will show him what the bad old days were like in the land of penny stocks. A cautionary tale with a great cast.

– Wolf of Wall Street ($14) Director Martin Scorsese uses Leonardo DiCaprio, Jonah Hill, Margot Robbie and Matthew McConaughey to great effect in this tale, based on real life story, of a talented salesman seduced by fast money and penny stocks.

– Margin Call ($7) This 2011 film set during the financial crisis has already been called the greatest Wall Street movie ever made.

– The Big Short The Great FInancial Crisis gets the Michael Lewis treatment . . .

Stop trying to outsmart the market. NO ONE knows exactly where it will go.

Stop trying to outsmart the market. NO ONE knows exactly where it will go.