Do math, manage risk

* There are basically two types of over trading. Trading too often and trading too many shares/contracts.

* Remember that there really is no good reason to trade constantly, since extreme over-trading creates stress, produces high commissions and can often lead to more losses.

* Market forces do not last forever and time has shown various examples of the law of gravity in the trading market- that whatever comes up must go down. – and vice versa.

* Instead of grabbing every opportunity that comes along (or thinking that it is an opportunity) make sure each trade setup meets the criteria of your trading plan, don’t be over confident or scared of making trades.

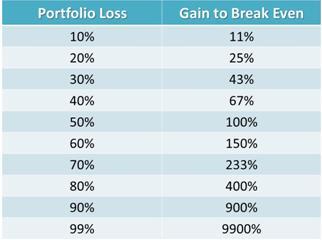

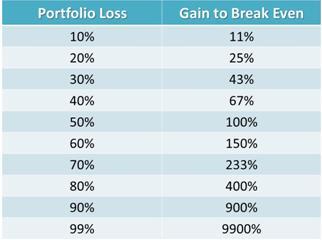

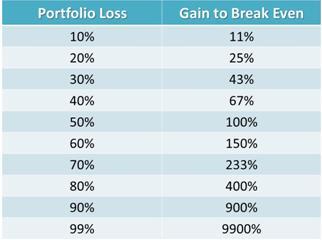

* Utilizing a risk calculator to determine the appropriate position size before you enter a trade can help you determine how many shares/contracts you initially buy. You can start off with a small position and add as the trade continues in your favor. It relieves stress to know that the amount at risk for each position you hold is well proportioned to the size of your entire account and this is great asset management.

* Whenever you feel that you did not stick to your trading plan and made a mistake, quickly learn from that and let it go.

Confusion and frustration is part of the learning curve. Frankly, if you’re not getting confused by the array of opinions and information out there, then you’re doing something wrong. The key is to keep working though it and continue learning as much as you can. With time and effort, the confusion you have now will be replaced with a clear understanding of key elements of trading that can’t be learned in a different way. But, it takes time

Confusion and frustration is part of the learning curve. Frankly, if you’re not getting confused by the array of opinions and information out there, then you’re doing something wrong. The key is to keep working though it and continue learning as much as you can. With time and effort, the confusion you have now will be replaced with a clear understanding of key elements of trading that can’t be learned in a different way. But, it takes time

Don’t Miss to Watch

Arguably one of the greatest traders of all time with his trend following system.

Charles Faulkner tells a story about Seykota’s finely honed intuition when it comes to trading: I am reminded of an experience that Ed Seykota shared with a group. He said that when he looks at a market, that everyone else thinks has exhausted its up trend, that is often when he likes to get in. When I asked him how he made this determination, he said he just puts the chart on the other side of the room and if it looked like it was going up, then he would buy it… Of course this trade was seen through the eyes of someone with deep insight into the market behavior

Psychology

“To avoid whipsaw losses, stop trading.”

“It can be very expensive to try to convince the markets you are right.”

“A fish at one with the water sees nothing between himself and his prey. A trader at one with his feelings feels nothing between himself and executing his method.”

Risk Management

“The elements of good trading are cutting losses, cutting losses, and cutting losses.”

“Here’s the essence of risk management: Risk no more than you can afford to lose, and also risk enough so that a win is meaningful. If there is no such amount, don’t play.”

“In your recipe for success, don’t forget commitment – and a deep belief in the inevitability of your success.”

Trading System

“The trend is your friend except at the end when it bends.”

“If you want to know everything about the market, go to the beach. Push and pull your hands with the waves. Some are bigger waves, some are smaller. But if you try to push the wave out when it’s coming in, it’ll never happen. The market is always right.”

“Systems don’t need to be changed. The trick is for a trader to develop a system with which he is compatible.”

“I don’t predict a nonexisting future.”

Ed Seykota is a legend in the trend following community and has returns that would make Bernie Madoff jealous, because his are real. If you can fully grasp what Ed is saying in these quotes it will improve your trading dramatically.

When you are wrong admit it , learn from it and go on to the next trade. The market rewards intellectual arrogance with losses and pain. If you want to stick to your point of view no matter what the evidence may be to the contrary… become a politician.