Modest gains for the major indices

The European stock markets are closed with major indices are closing higher. Spain’s Ibex rose 0.9%. UK FTSE was flat.

The provisional closes are showing:

- German DAX, +0.2%

- France’s CAC, +0.3%

- UK’s FTSE, flat

- Spains Ibex, +0.9%

- Italy’s FTSE MIB, +0.67%

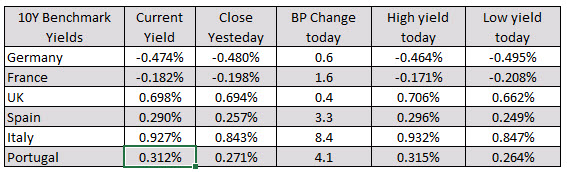

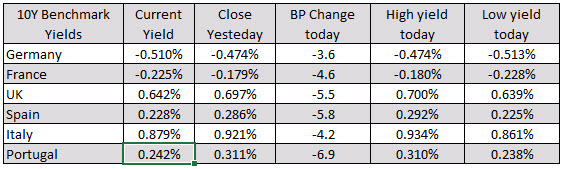

In the European debt market, yields for the benchmark 10 year sector are closing lower.

In other markets:

- spot gold is up $9.28 or 0.60% at $1510.50

- WTI crude oil futures are down $0.95 or -1.65% at $58.37. Crude oil inventories rose 1058K which was higher than the -2250K estimate.

IN the US stock market, major indices are lower:

- S&P index -9.37 points or -0.31% at 2996.40

- NASDAQ index -29.86 points or -0.36% at 2156.29

- Dow industrial average -84.58 points or -0.31% at 27026.68

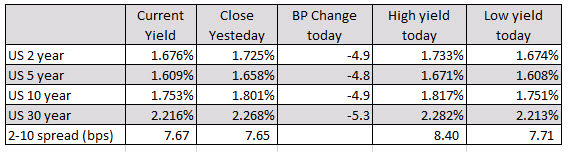

In the US debt market yields are also lower and trading near the lows for the day.