Positive sentiment is likely to persist into the signing of the US-China phase one trade deal on Wednesday January 15

USD/JPY is having an OK sort of session, on approach to its Friday high above 109.65. Yen crosses are generally higher also, AUD/USD is putting in some consolidation above 0.6900, kiwi also is near its recent highs and EUR is about to test its Friday high also. All these were helped along by some USD weakness on Friday on that disappointing NFP result.

Meanwhile the offshore Chinese yuan is pushing higher agisnt the USD also, benefitting also from phase1-itis.

Having said all this, the ranges here are not large for the majors, it is Asian after all. Its also a holiday in Japan today (markets closed).

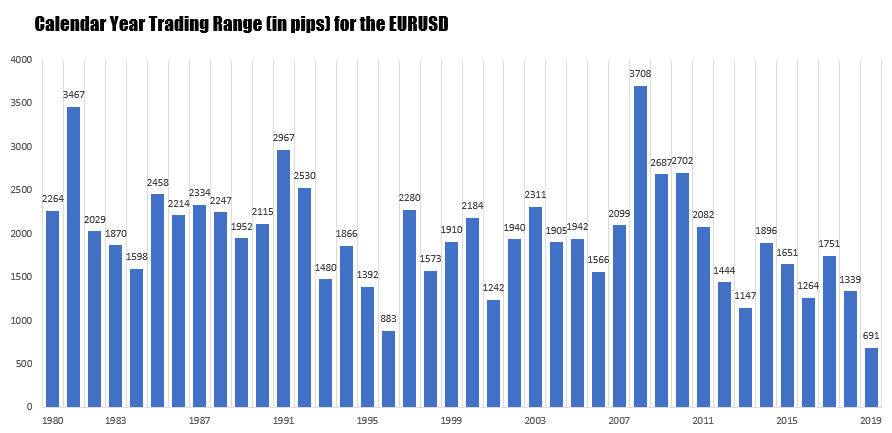

The low to high trading range for the EURUSD in 2019 could only extend to 691 pips. That was the lowest range going back to 1980. The prior low was 883 pips back in 1996. In 1997, the range rose to 2280 pips.

The low to high trading range for the EURUSD in 2019 could only extend to 691 pips. That was the lowest range going back to 1980. The prior low was 883 pips back in 1996. In 1997, the range rose to 2280 pips.