IMF lowers 2019 global growth estimate for the sixth straight quarter

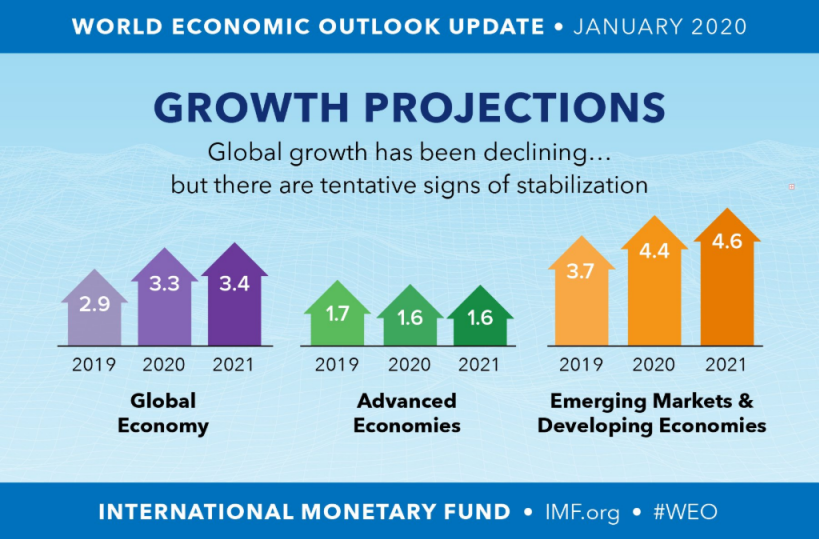

2019 is over but the outlook for growth keeps getting worse. The IMF lowered its 2019 global growth forecast to 2.9% from 3.0% in October. It was the sixth consecutive cut to the 2019 outlook.

The 2021 forecast was also lowered to 3.4% from 3.6%.

On the upside, the IMF maintained its 2020 GDP forecast at 3.3% and said that economic uncertainty is diminished with risks “less skewed” toward negative outcomes, albeit still tilted to the downside.

The big loser in this round of forecasts was India with the 2020 forecast cut to 5.8% from 7.0% on declining credit growth.

Other highlights:

- 2020 Eurozone GDP seen at 1.3% vs 1.4% in Oct due to manufacturing contraction in Germany

- Boosts China 2020 GDP to 6.0% from 5.8% on trade deal

- Cuts 2020 US GDP to 2.0% from 2.1%

- UK forecast unchanged at 1.4%

For me, these forecasts don’t have much value on their own (as you can see from the frequent revisions) but they are a valuable way to visualize and interpret the evolving growth picture.