Archives of “Economy” category

rssOECD cuts 2020 global economic forecast to 2.4% from 2.9% previously

OECD warns that the global economy may shrink in Q1 2020

This follows their November forecast here previously. Notably, they have slashed China’s growth forecast to 4.9% from 5.7% previously. Meanwhile, in the US they forecast a 1.9% growth for the year – slightly lower by 2.0% previously.

As for the euro area, OECD sees growth of 0.8% this year, down from 1.1% previously. They note that the forecasts are currently based on the coronavirus epidemic peaking this quarter and says Japan and Europe risks a recession in their downside scenario.

Eurozone February final manufacturing PMI 49.2 vs 49.1 prelim

Latest data released by Markit – 2 March 2020

The preliminary release can be found here. Little change of note relative to initial estimates and this also just reaffirms some mild improvement – not significant – in factory activity with supply chain disruptions being the standout issue in the report for last month.

Total departures from China’s 25 busiest airports

China official PMIs February: Manufacturing 35.7 (expected 45.0) Non-manufacturing 29.6 (expected 51.0)

China’s economy was hit hard right from the Lunar New Year holiday and the weeks after from the coronavirus outbreak.

- deaths now number >3,000 in China

- Severe travel restrictions

- Severe actions on public health

- Business closures

Manufacturing 35.7, this is the lowest ever recorded for this indicator.

- expected 45.0, prior 50.0

Non-manufacturing 29.6 … I mentioned during the week I was surprised the ‘expected’ for this was still in expansion. And here we are, deepest in contraction ever recorded

- expected 51.0, prior 54.1

Composite 28.9

- prior 53.0

Bank of America revises global GDP forecast to weakest since 2009

Thursday note from Bank of America / Merrill Lynch

- Project global growth for 2020 at 2.8%

- slowest since 2009

- Expect China to be weakest since 1990

And …

- risks are still skewed to the downside

- Our forecasts do not include a global pandemic that would basically shut down economic activity in many major cities

—

And, just thinking out loud …. does the coronavirus mean the yield curve inversion was right all along?

IMF likely to downgrade global growth outlook

IMF spokesperson

The week or so ago the IMF lowered the global growth forecast by 0.1% as a result of the coronavirus (why even announce it).

A spokesperson is now saying that the IMF is likely to downgrade global growth in the next world economic outlook as a result of the virus.

He/she adds:

- expects decision soon on impact of coronavirus on spring meetings of IMF/world bank. Issue under active review

The IMF is pretty much stating the obvious.

Coronavirus – JP Morgan slash their global growth outlook

JPM are not listening to the platitudes emanating from the Trump press conference.

- damage to China is severe

- largely due to the significant degree to which authorities have acted to contain the outbreak

- mindful of the damage already being done in China .. we have marked down yet gain our growth numbers around the world

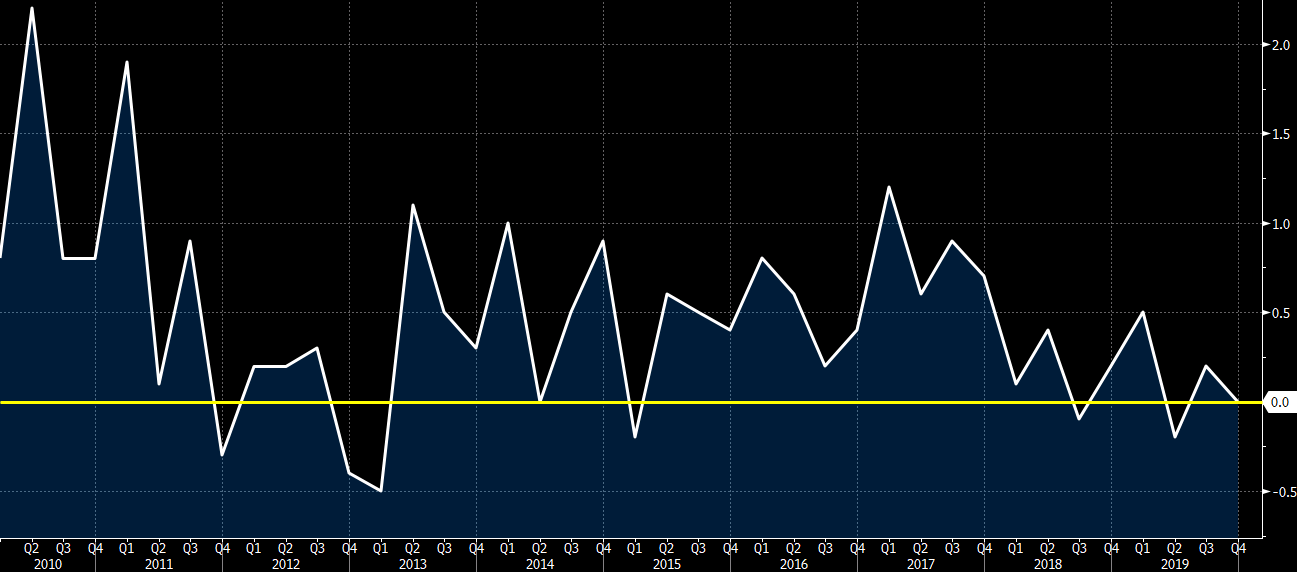

Germany Q4 final GDP 0.0% vs 0.0% q/q prelim

Latest data released by Destatis – 25 February 2020

- GDP non-seasonally adjusted +0.3% vs +0.3% q/q prelim

- GDP working day adjusted +0.4% vs +0.4% q/q prelim

Slight delay in the release by the source. The preliminary report can be found here.

No change to initial estimates as this just confirms that the German economy stagnated in the final quarter of last year. Private consumption also flat-lined with a 0.0% q/q reading (compared to +0.5% q/q in Q3) with capital investment falling by 0.2% q/q.

The 2020 Blak Swan #coronavirus From Murenbeeld Gold Monitor