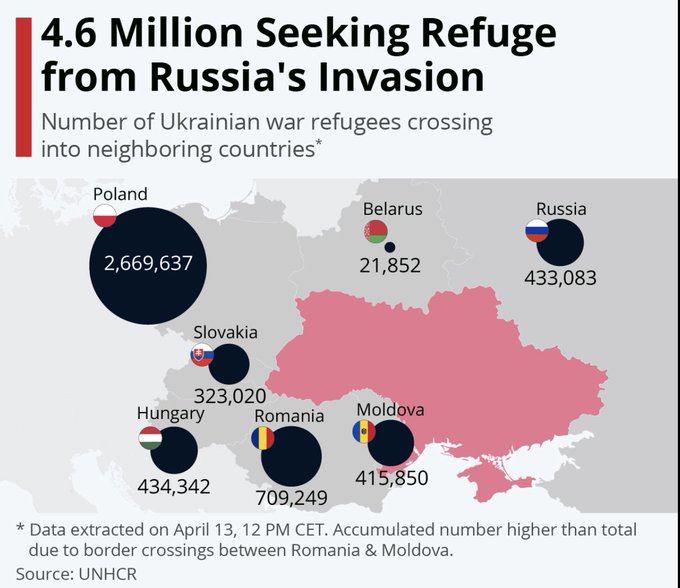

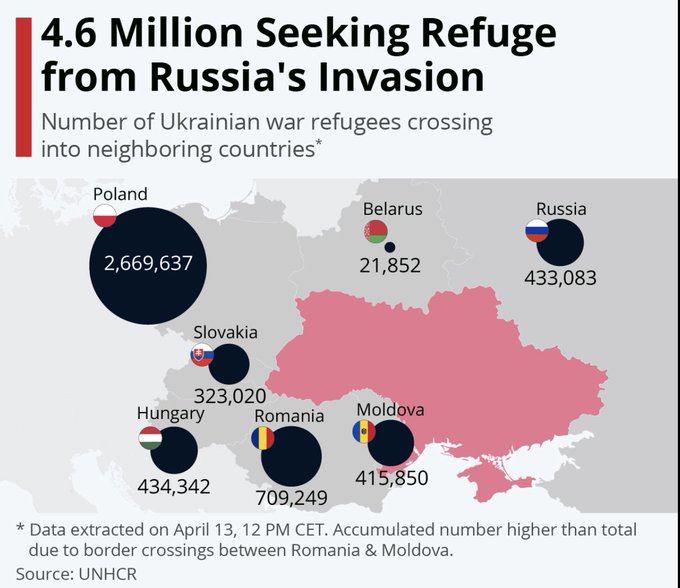

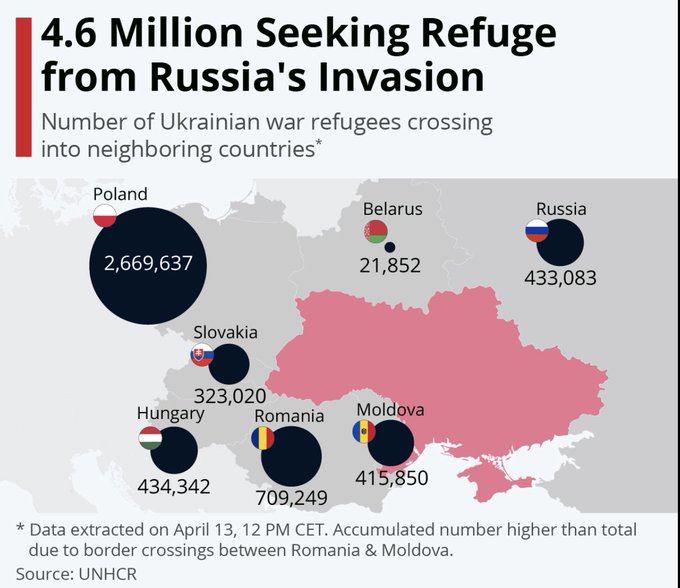

Now a context point. Poland is hosting more Ukraine war refugees than all other countries together

Gazprom says that is has completely suspended gas supplies to PGNiG and Bulgargaz due to non-payment in rubles. Adding that supplies will be halted until payment is made. From earlier:

Sky Arabia with the news (in Arabic)

This in summary from Reuters:

The White House is worried Iran could develop a nuclear weapon in weeks, press secretary Jen Psaki said on Tuesday, after Secretary of State Antony Blinken noted earlier in the day the country has accelerated its nuclear program.

“Yes it definitely worries us,” Psaki said, adding the time needed for Iran to produce a nuclear weapon is down from about a year.

Deutsche Bank

This

info via Bloomberg (gated)

The major US stock indices are down sharply for the second time in three trading sessions. The Dow industrial average fell nearly 1000 points two days ago and is down by another 800 points today. The NASDAQ index has shed over 500 points or -3.95%. Ouch.

Microsoft and Alphabet the earnings after the close

A look at the final numbers shows: