Fed to start tapering by year-end

I didn’t expect Powell to be so explicit about it but he even outlined the timeline for the entire thing, which now the market may likely expect something of an average pace of around $20 billion at each meeting starting from December.

They may likely start slow before gradually stepping things up and looking for a conclusion around the middle of next year.

As things stand, a November announcement is very likely before tapering begins at the December meeting – fitting with expectations coming into yesterday’s meeting.

So, what happens next?

The focus in the market will start to shift towards interpreting how fast does the end of tapering translate to higher rates by the Fed.

Equities are not too concerned but they have been living in their own world for so long that it might take a while to get their head out of the sand. That said, perhaps we’ve already moved past that and the supposed “taper tantrum” isn’t quite as bad as feared.

In other words, the period of easy money has even helped to soothe market fears on this, just like everything else during the pandemic.

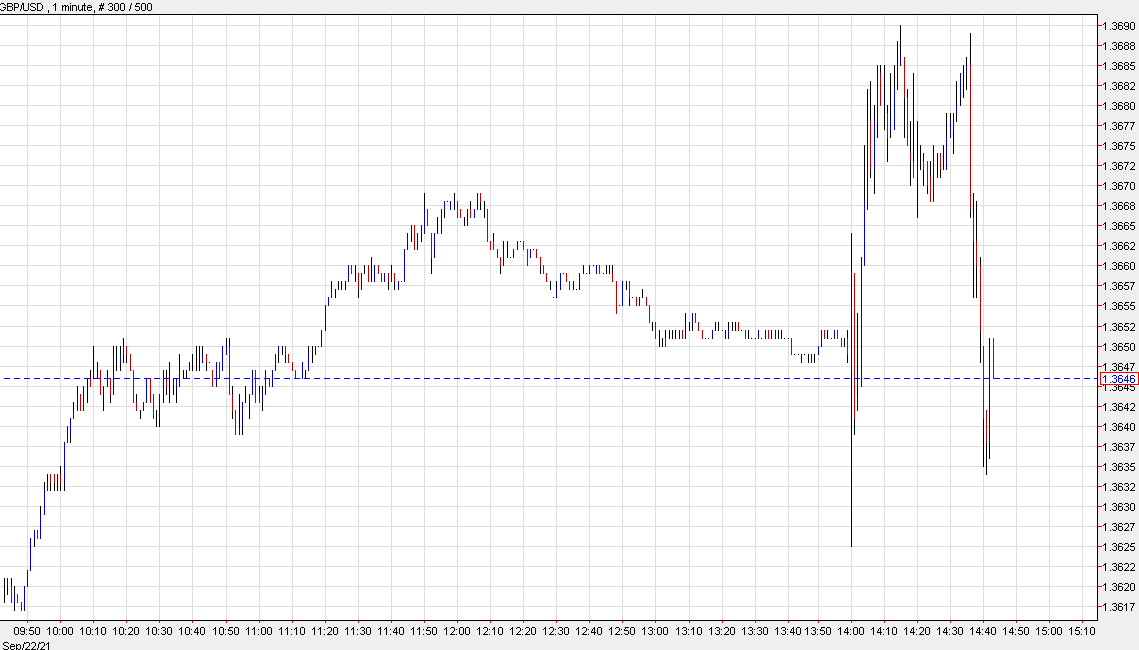

The more interesting spots to watch are perhaps the dollar and the bond market.

The mixed dollar reaction yesterday was peculiar (though there has been a lot of head fakes in the reaction to prior FOMC meetings) but I reckon the bulls were certainly hoping to have had some backing from Treasury yields, which did not take flight:

(more…)