Archives of “September 6, 2021” day

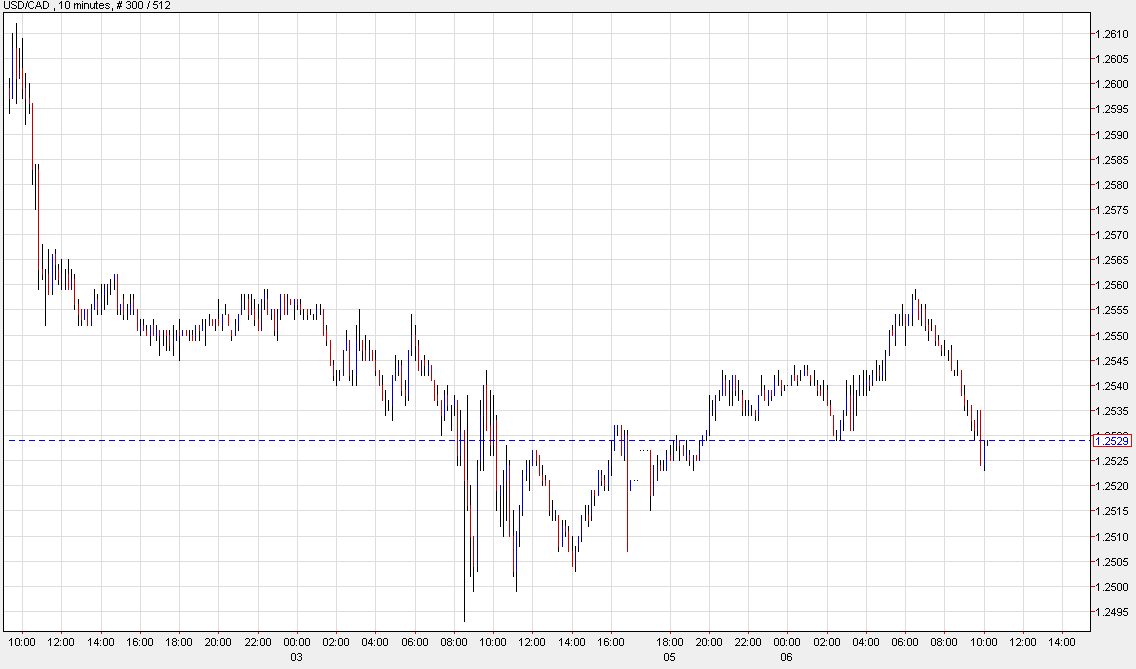

rssUSD/CAD stifled by holidays but grinds lower as oil rebounds

Canadian and US markets closed today

It’s a quiet one today in New York and Toronto but USD/CAD has had some life as it tracks a thinned oil market.

WTI fell as low as $68.25 but it’s grinded back to $69.41 and unchanged on the session. With that, USD/CAD rose up to 1.2559 but has slipped back to 1.2528.

In broader terms, the earlier US dollar strength is also fading aside from cable, which remains at session lows.

How hard can it be to find out who owns a pipeline?

The baffling source of an oil spill in the Gulf of Mexico underscores an industry begging for regulation

There’s a pipeline in the Gulf of Mexico leaking oil and no one seems to know who it belongs to.

It’s a baffling example of incompetence from regulators and industry.

The saga starts on the weekend when The Citizen Lab, a research center based at the University of Toronto, found an oil slick in the aftermath of Hurricane Ida.

Not the government, not the regulators, not oil companies; but researchers looking at satellite date.

The images spread and it was discovered that Talos Energy had operated there. So the company sent clean-up crews via a non-profit set up by oil companies for that purpose.

At the same time, Talos said it stopped production in the area in 2017 and removed its infrastructure from the site.

“The source of the release is not proximate to any of the plugged wells, nor to the former locations of Talos subsea infrastructure,” Talos said.

In any case, the non-profit sent divers to try and figure out what was going on and using sonar they discovered a 12-inch pipeline that “appears to be bent and open ended.”

Talos continues to pay for the containment and cleanup of the oil but reiterated that it’s not the source of the leak.

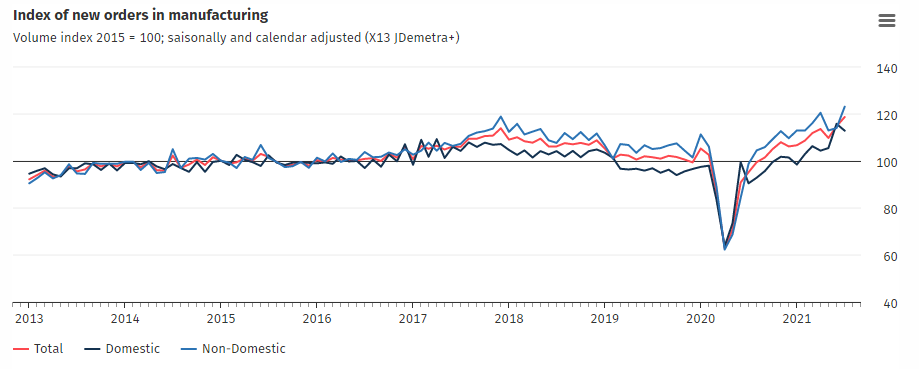

Germany July factory orders +3.4% vs -1.0% m/m expected

Latest data released by Destatis – 6 September 2021

- Prior +4.1%

- Factory orders WDA +24.4% vs +18.9% y/y expected

- Prior +26.2%

That’s a surprise jump after the solid bump in June, as new orders rise to its highest levels since the beginning of the survey all the way back to 1991.

The surge higher in July was largely due to major orders as excluding that, there was a decline of 0.2% observed for the month.

In any case, relative to February 2020 i.e. before the pandemic, new orders in July were 15.7% higher in terms of seasonally and calendar adjusted terms.

China’s major state-owned banks reportedly seen buying US dollars late last week

Reuters reports, citing sources familiar with the matter

The yuan advanced to its highest since June on Friday but saw a late bounce in the final half-hour, where USD/CNY climbed from roughly 6.4350 to 6.4450.

With not much else to work with so far today, it could be part and parcel of the slight bid in the dollar to start the week too with USD/CNY stabilising around 6.4500.

It looks like China wants to keep the yuan in more of a stable region still, with USD/CNY having traded in between 6.45 and 6.50 for the most part since mid-June.

What now FED? Print more? Taper? Mfers are trapped.

There is a packed agenda of Federal Reserve speakers coming up this week

The Fed, though, will roll out the talking heads from Wednesday.

Wednesday 8 September:

- Federal Reserve Bank of New York President John Williams will speak on the economic outlook and monetary policy

- Fed Dallas President Robert Kaplan will participate in Discussion of Economic Developments and Implications for Monetary Policy

- Fed Chicago President Charles Evans will give welcome remarks before a virtual “Exploring Career Pathways in Economic and Related Fields” event

Thursday

- Federal Reserve Bank of San Francisco President Mary Daly will present a paper in “The Economic Gains From Equity”

- Federal Reserve Board Governor Michelle Bowman will speak on “Community Bank Access to Innovation”

- Federal Minneapolis President Neel Kashkari, Fed Boston President Eric Rosengren, Fed Dallas President Robert Kaplan and Fed New York President John Williams will participate in virtual “Racism and the Economy: Focus on Health” event

Friday

- Federal Reserve Bank of Cleveland President Loretta Mester will speak before virtual Bank of Finland-CEPR “New Avenues for Monetary Policy” Conference

Its a big central bank week ahead – RBA, BoC, ECB

The FX week looks like it’ll be getting off to a slow start with a holiday in the US and Canada on Monday likely to be enough to see lacklustre Asian FX markets today.

Tuesday it’ll kick off more actively though with the Reserve Bank of Australia decision due (0430 GMT 7 September 2021). The RBA will be grappling with the question of whether or not to stick to their taper plan in the face of long and ongoing lockdowns of nearly half of the Australian population in its two largest population cities and states. I’ve posted up a few previews already from about the place:

Wednesday will bring the Bank of Canada. I’ll have previews posted on approach, but for now, with the approaching election, I am not expecting much of note from the Bank this week, certainly no substantial policy shift. BoC statement will come at 10am ET on Wednesday 8 September 2021, which is 1400 GMT.

On Thursday if the European Central Bank. Ditto on previews to come.

- 7.45am ET (which is 1145 GMT) and President Lagarde will speak 8.30am ET (1230 GMT)

Reminder – Monday 6 September 2021 is market holiday in the US and Canada

North America will be on holiday for a long weekend today, Monday 3date – Labor Day in both the US and Canada.

- NYSE, NASDAQ, Bond markets are all closed.

- CME is closed, for the full details on this link is here

Thought For A Day