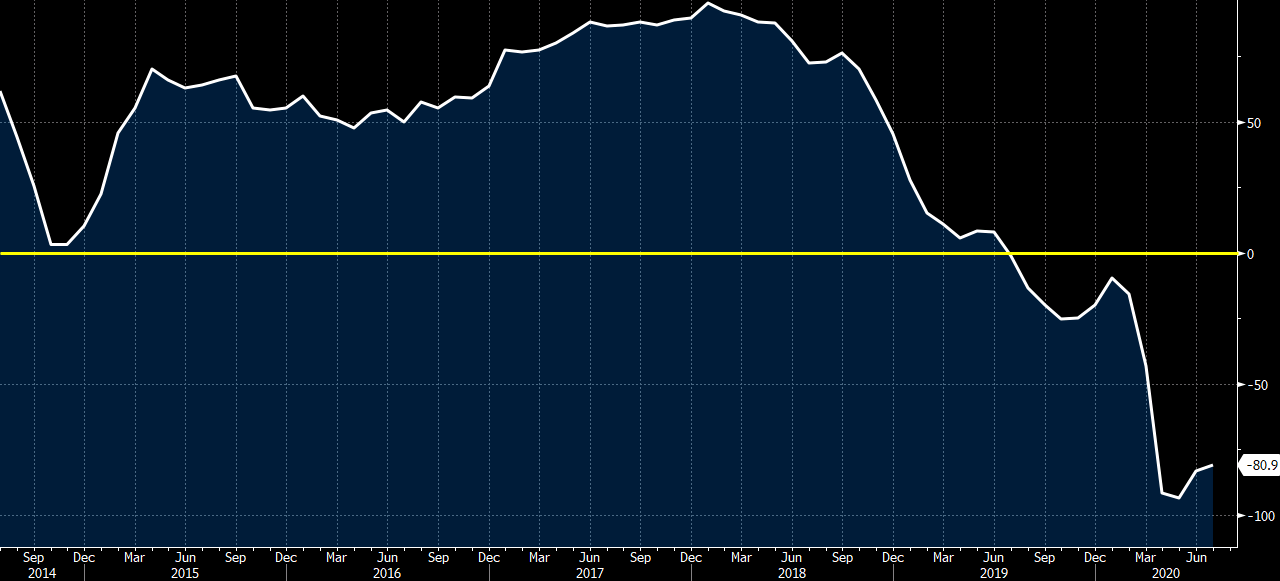

Latest data released by ZEW – 14 July 2020

- Prior -83.1

- Expectations 59.6 vs 60.0 expected

- Prior 63.4

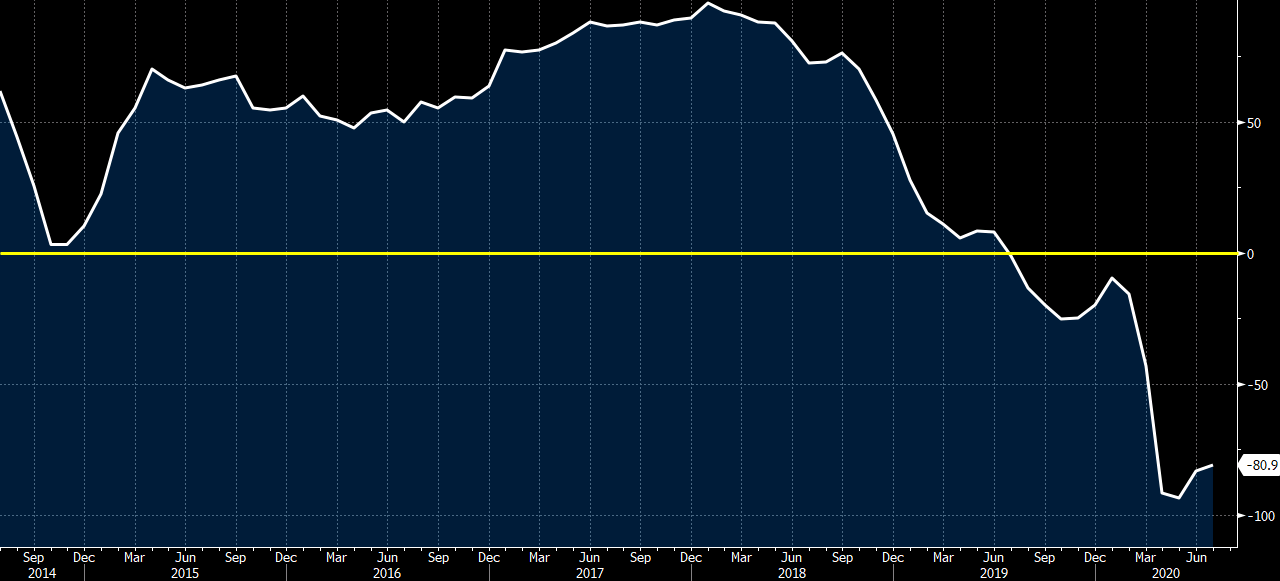

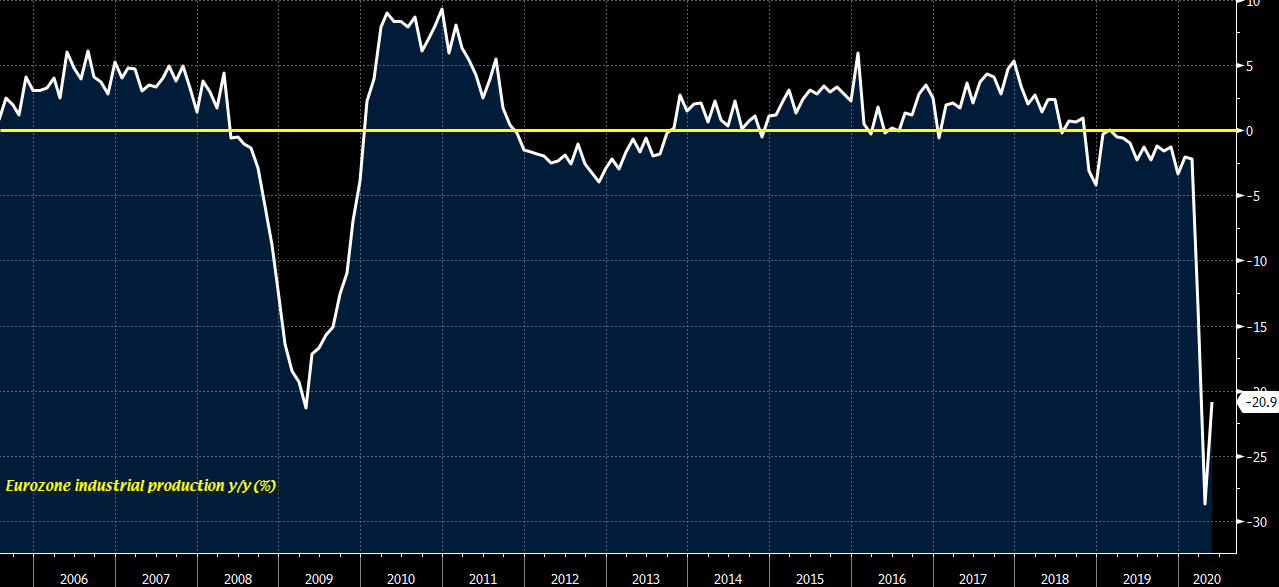

Factory output rebounded in May but not as robust as anticipated, with the annual reading highlighting the plight faced by the euro area economy despite the gradual easing of lockdown measures. June should also reflect a rebound but new normal conditions and the pace of the recovery will likely only be seen in July to August or later in Q3.

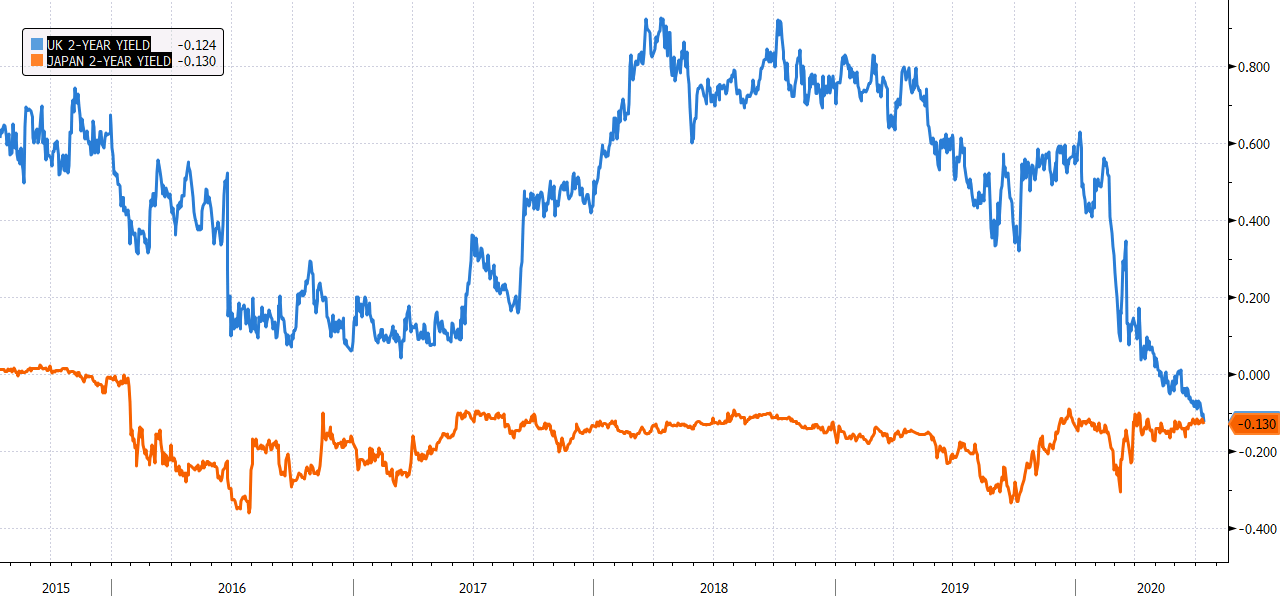

German bunds were trading at -0.46% yesterday on the 10 year chart which is 10bps lower than a Bloomberg modelled curve mentioned on the Bloomberg Live Blog yesterday. This is most likely due to positioning ahead of the European Council’s summit.

On Friday and Saturday of this week EU policy makers will meet to discuss the proposed €750 billion recovery plan.The big questions is whether nations like Austria, Denmark, Sweden, Netherland and Finland will block the plan. The issue is that these countries are opposed to the idea of large handouts on principle.However, despite their reluctance, the present crisis means their reticence may be seen as mean spirited in a time of shared humanitarian crisis. The pressure is for the countries concerned about the ideas of grants rather than loans to approve this proposed fund.On July 10 we had a German official state that Netherlands is unlikely to block the EU recovery fund which is supportive of the fund being accepted.

On Thursday we have the ECB rate meeting with little change expected. With the PEPP program increasing by €600 billion euros last month it is unlikely that we see any changes to the PEPP program on Thursday.

The risk

If the recovery fund is rejected by the frugal four expect immediate downside for the EUR. However, given that the second day of the meeting is taking place over the weekend this is going to be weekend risk for the EUR.

USD terms:

trade balance: expected CNY 425bn, prior was CNY 442.75bn

Exports have now risen for 3 consecutive months

The data is only dribbling out, do not have the trade balnce announced from China yet, nor the figures in USD terms. Nevertheless, bounce of both imports and exports is encouraging for the Chinese economy.

China has said trade with the US is down 6.6% y/y in H1.