Archives of “July 2020” month

rssWSJ: “The world has never had so many economic problems in a year as in 2020.”

Here is the list (so far) of the crypto hacked Twitter account

Accounts hacked so far by the Bitcoin scam, asking you send coins to a bogus address

- Bill Gates

- Elon Musk

- Joe Biden

- Warren Buffett

- Kanye West

- Michael Bloomberg

- Apple

- Uber

- Jeff Bezos

- Barack Obama

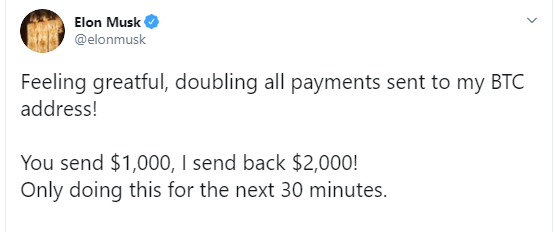

Tweet looks like this – DO NOT SEND COINS TO ANYONE AT ALL RIGHT NOW until this thing is fixed:

A huge Twitter hack appears to be underway

Elon Musk and crypto exchanges targeted

The Twitter accounts of many the largest cryptocurrency exchanges and influences appear to have been hacked, along with Elon Musk and others. They’re directing people to make bitcoin donations. Some on the list:

- Cz

- Binance

- Gemini

- Bitlord

- Coindesk

- Justin sun

- Kucoin

- Coinbase

- Charlie lee(Satoshi lite)

- Gate.io

- Angelobtc

- Tron

- Bitcoin

It’s tough to imagine that the were hacked individually. Rather this looks like it’s something internally via twitter or some third party service involved with twitter. That looks bad for the company.

Let me tell you, if I wanted to make money and could hack Elon’s account, I would be buying TSLA puts/calls, rather than asking for Bitcoin donations.

Update: They got Bill Gates too.

Fauci says will have an effective COVID-19 vaccine by the end of 2020

Anthony Fauci speaking with Reuters on the coronavirus

- Says that US will have an effective coronavirus vaccine by year-end

- Moderna’s vaccine trial results were especially promising

- He does not think China will be first with a vaccine, at least not by much

Latest Quinnipiac poll shows Biden deals Trump 52% to 37%

Lead wideness to 15%

The latest Quinnipiac poll shows VP Biden leading Pres. Trump 52% to 32%.. Last month all showed Biden up by 8 percentage points 49% to 41%.

Trump job approval drops to 36% from 42% last month.

S&P index leads the way. NASDAQ lags but closes higher for the 2nd straight day

S&P index closes just below breakeven level for 2020

The US stocks are ending the session with gains across the board. The gains are led by the S&P index which rose by 0.91%. The NASDAQ index lagged, but still gained 0.59%.

For the S&P index, it toyed with closing above the breakeven level for the year for the 1st time since February 25. However, that quest failed. The index is ending the day 0.13% from that breakeven level (2019 closes at 3230.78 while the close today is at 3226.56).

This week there has been a rotation out of the high flying tech stocks vs. the broader/industrial stocks. For the last 5 trading days the Dow industrial average is up 3.08% and the S&P index is up 1.79%, while the tech heavy NASDAQ index is up only 0.55%.

Nevertheless both the NASDAQ and the S&P index are up for 2 consecutive days. The Dow is riding a 4 day win streak.

The final numbers are showing:

- S&P index +29.03 points or 0.91% at 3226.55

- NASDAQ index up 61.915 points or 0.59% at 10550.49

- Dow up 227.51 points or 0.85% at 26870.10.

Will tomorrow be the day for the S&P index to close the black? Maybe, but going forward headline news from more earnings releases, coronavirus cases, vaccines and therapeutics will continue to exert their influences. Each of which could upset the apple cart in a bullish or bearish direction.

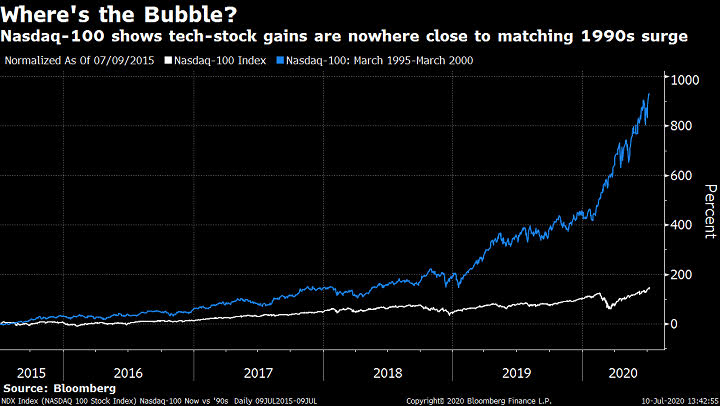

Thought For A Day

Nasdaq-100 Comes Nowhere Near Reprising Bubble-Era Surge

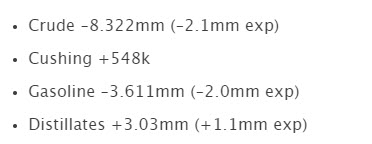

DOE crude oil inventories for July 10 week -7.493M vs -2.098 million estimate

DOE crude oil inventories for the week of July 10, 2020

- crude oil inventories -7.493 million vs. -2.1 million estimate

- gasoline inventories -3.147 million vs. -1.3 million estimate

- distillates inventories -0.453 million vs. 1.5 million estimate

- Cushing OK crude inventories 0.949 million vs. 2 point to 0 6 million last week

- US refinery utilization 0.6% vs. 0.5% estimate

- crude oil implied demand 17637 vs. 17586 last week

- gasoline implied demand 9248.4 vs. 9290.0 last week

- distillates implied demand 5023.7 vs. 4380.1 last week

The private API data released near the close of yesterday’s trade showed a bigger than expected drawdown of -8.322. Today’s crude oil inventory data was below the API data by about 900 K. Below are the private data results:

Crude oil is trading at $40.50 just prior to the report. The current price is trading at $40.64