Italy and Portugal indices move higher

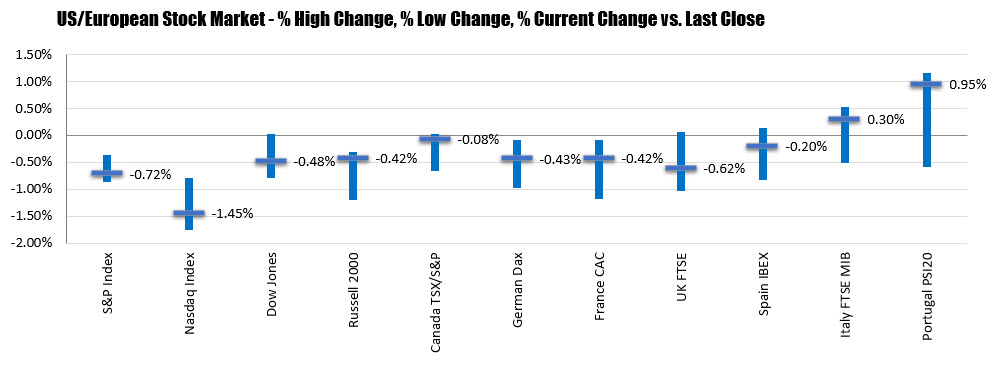

the major European indices are ending the session with mixed results. Germany, France, UK and Spain show declines while Italy and Portugal eked out gains. The closes are showing:

- German DAX, -0.43%

- France’s CAC, -0.42%

- UK’s FTSE 100, -0.62%

- Spain’s Ibex, -0.2%

- Italy’s FTSE MIB, +0.3%

- Portugal’s PSI 20, +0.95%

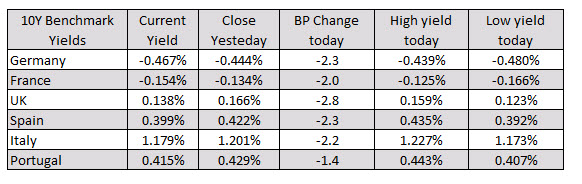

In the European debt market, benchmark 10 year yields fell across the board with UK yields down the most at -2.8 basis points.

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit:- spot gold $-4.25 or -0.23% $1806.05. The high for the day reached $1813.48. The low extended to $1802.97

- WTI crude oil futures fell $0.19 or -0.46% to $41.01. It’s high price reached $41.18 while the low extended to $40.60. The September contract is currently down $0.21 or -0.51% of $41.19

In the forex market,

- GBPUSD. The GBPUSD is trading at new session highs in the currently hourly bar. In the process, the price has moved back above its 200 and 100 hour moving average. That tilted the bias back to the upside in what has been an up and down market over the last 7 or so trading days. On the topside a trendline connecting highs from this we currently comes in at 1.2634. The high from yesterday reached 1.26487. The high for the week on Monday reached 1.26652.

- EURUSD: The EURUSD moved higher in the London session after finding support buyers near the 38.2% retracement of the move up from the Friday low at 1.13759. The high price reached 1.1441. The high price from yesterday reached 1.14512. There is close support at 1.14223 area