Archives of “June 3, 2020” day

rssWHO chief scientist: No evidence that any drug reducing mortality of patients

Runs counter to the implied talking points from Pres. Trump

The WHO chief scientists is on the wires saying that:

- No evidence that any drug reducing mortality of patients that have Covid 19.

He adds nevertheless that:

- experts advise the continuation of all forms of the solid parity trial including hydroxychloroquine srm

- No reason to modify clinical trial of hydroxychloroquine in Covid 19

There has been some leakage to the downside in the US stock indices of the last few minutes. The NASDAQ index is currently trading at 9649 after trading is highs 9678.77. The S&P index is trading at 3114.66 vs. a high of 3119.95.

Other Covid 19 news headlines.

UK’s Johnson says:

- the air quarters only to be considered when it is a safe

- no one is safe until we all are safe from the virus

- urges people to not move outdoor gatherings indoors if it rains

- there could be a 2nd wave of virus across the world

- the UK chief science advisor adds have to tread cautiously in lifting UK lockdown

in Italy, PM Conte is saying:

- facts show that virus has disappeared

- virus reconstruction is the time for long-delayed reforms

- government working to speed up 8 payments

Italy reports 321 new coronavirus cases vs. 318 on Tuesday. The death toll rose by 71 vs. 55 on Tuesday

New York said that the cases rose by 0.3% vs. the 7 day average of 0.4%.

Finally New Jersey’s governor Murphy is out saying:

- deaths reach 11,880 and cases reach 162,068

- he urges protesters to keep distance and wear masks during George Floyd demonstrations.

- At least 6 demonstrations today in New Jersey

Major European indices close with solid gains once again

German Dax up 3.88%

The major European indices closed higher for the 3rd day in a row this week. The German DAX (which was close on Monday but which rose over 3.5% yesterday) tacked on 3.88% in trading today to lead the charge.

The other indices also rose rather nicely. Below are the percentage changes in percentage ranges for the major indices.

Meanwhile in the US, the gains are more modest with the Dow industrial average leading the way at +1.6%.

Not only is there a rotation that seems to be taking place into the European indices (the German DAX is still down -5.75% on the year, France’s CAC is down -15.99% and the UK FTSE is down -15.38%), but that rotation is occurring in the US market as well. The Dow industrial average is still down over -8.35% on the year, while the NASDAQ is up 7.71%. Traders seem to be buying cheap in hopes of a return to normal

DOE crude oil inventories -2077K vs 3000K estimate

The weekly Department of Energy inventory data

- crude oil inventories -2077K vs. +300K estimate

- gasoline inventories 2795K vs 300K estimate

- distillates inventories 9934K vs 2900K estimate

- Cushing OK inventories -1739K vs -3395K last month

- US refinery utilization 0.50% vs 0.90% estimate

- crude oil implied demand 17676 vs 17467 last week

- gasoline implied demand 7811.0 vs 7463.9 last week

- distillates implied demand 3457.9 vs 4150 last week.

The private data yesterday showed:

- crude oil -483K

- Gasoline +1706K

- Distilates +5917K

- Cushing -2200K

Crude oil July futures were trading at $36.75 just prior to the report. The price is currently trading at $36.67

Saudi’s propose moving OPEC meeting to mid June

Purposes to help evaluate compliance

Saudi Arabia is proposing to move the OPEC meeting to mid June. This according to a OPEC delegate. The delay to OPEC meeting would allow time to review the May production and compliance data.

Crude oil is currently trading up $0.18 or 0.46% at $36.99. The high price reached $38.18 today while the low extended to $35.88.

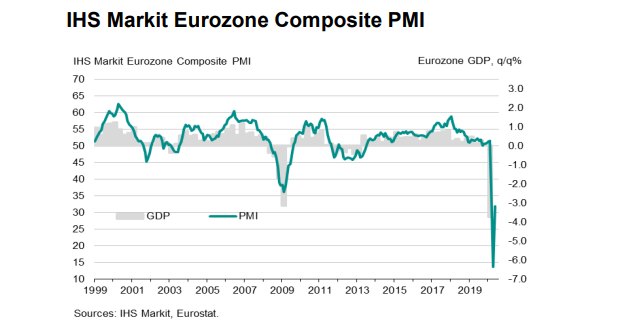

Eurozone May final services PMI 30.5 vs 28.7 prelim

Latest data released by Markit – 3 June 2020

- Prior 12.0

- Composite PMI 31.9 vs 30.5 prelim

- Prior 13.6

The preliminary release can be found here. A slight revision higher to the initial estimates, similar to the French and German readings but overall conditions still to point to a significant contraction in the euro area economy in May.

Again, the headline services reading only reflects that conditions are better from April to May but a continued sharp fall in new business, new work and further cuts to employment are still weighing on overall economic conditions in general.

Markit notes that:

“The scale and breadth of the eurozone downturn was highlighted by the PMI data showing all countries enduring another month of sharply falling business activity. Eurozone GDP is consequently set to fall at an unprecedented rate in the second quarter, accompanied by the largest rise in unemployment seen in the history of the euro area.

“Encouragingly, while rates of decline of both business activity and employment remained shockingly steep for a third successive month in May, the downturn has already eased markedly in all countries surveyed. Optimism about the outlook has also returned in Italy and, to a lesser degree, France, while pessimism has moderated markedly in all other countries.

“Providing there is no resurgence of infection numbers, the planned lifting of lockdowns will inevitably help boost business activity and sentiment further in coming months.

“However, the outlook is scarred by the prospect of demand remaining weak due to household spending being hit by high levels of unemployment and corporate spending being subdued as companies repair balance sheets.

“Consumer-facing services are likely to continue to take the hardest hit from those COVID-19 containment measures that may need to stay in place the longest, acting as a particular drag on the overall recovery.

“We therefore remain cautious with respect to the recovery. Our forecasters expect GDP to slump by almost 9% in 2020 and for a recovery to prepandemic levels of output to take several years.”

Short positions on S&P 500 futures are at the highest level in 5 years (and this was as of last week)

UK PM Johnson says he might offer 3m HK residents a route to UK citizenship

UK Times reports on an idea from PM Boris Johnson for Hong Kong residents to move to the UK

- floating offering route to the UK and possible citizenship

Early days for this.

ICYMI – China warns of swift retaliation against the US

The Global Times is a branch of state media in China, yesterday pulling no punches:

- China Global Times accuses Trump of brazen hypocrisy

After that that came more from the outspoken media group:

- US political establishment is under siege amid nationwide riots that have plunged the country into chaos

- US officials, instead of addressing profound domestic woes, waged a new series of attacks against China

- US’ national security claims are so vaguely defined that all Chinese personnel and businesses could be at risk of a US crackdown and if such actions occur, they will surely be met with swift retaliation from China

(more here ICYMI)

Its difficult to disentangle the trade issues from all the other points of contention between the two countries, but on the bright side at least China is buying soybeans:

- China continues to purchase US soybeans in line with market rules, unaffected by external factors

Major US indices close near session highs

Dow industrial average rising by over 1%. Posts 2 day win streak

the US major indices are closing near session highs. The Dow industrial average led the index is charged with a 1.05% gain. S&P and NASDAQ posts the 6th gain in 7 trading days. The NASDAQ index is closing lesson 3% from the record high set in February.

The final numbers are showing:

- S&P index up 25.09 points or 0.82% at 3080.82. The high price reached 3081.07. The low price extended to 3051.64

- NASDAQ index rose 56.326 points or 0.59% at 9608.37. The high price reached 9611.22. The low price extended to 9472.08

- Dow industrial average rose by 267.63 points or 1.05% at 25742.65. The high price reached 25743.13. The low extended to 25523.74.

Some winners today included:

- Chewy, +9.6%

- Square Inc., +6.3%

- Qualcomm, +6.2%

- Alcoa, +4.53%

- General Electric, +4.29%

- Alibaba, +3.79%

- FedEx +3.42%

- Slack, +3.2%

- Citigroup, +2.79%

- Broadcom, +2.76%

- Southwest Airline, +2.56%

- American Express, +2.36%

Some losers today included:

- LYFT, -2.85%

- Wynn Resorts, -2.73%

- Beyond Meat, -2.61%

- Gilead, -2.53%

- Tesla, -1.87%

- Amgen, -1.43%

- Raytheon technologies, -1.28%

- Northrop Grumman, -1.16%

- Intuit, -1.03%

- Booking.com -1.0%

- Starbucks, -0.69%

- Costco, -0.39%