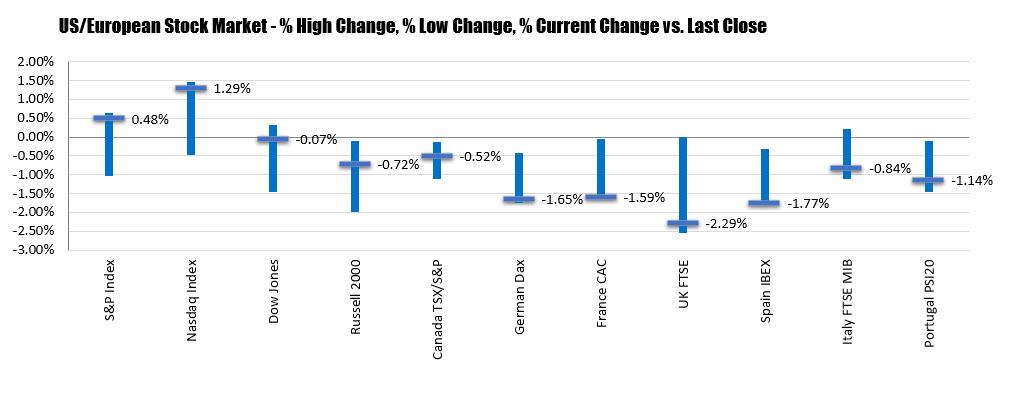

Dow has best performance in 7 weeks. Second straight week of gains for the major indices

The major US stocks and see some squeeze higher into the close as sanctions on China are less than feared. The NASDAQ led the way with a gain of 1.29%. The Dow ended lower as investors shifted back to the technology growth stocks.

The final numbers are showing

- S&P index up 14.58 points or 0.48% at 3044.31

- NASDAQ index rose by 120.88 points or 1.29% at 9489.87

- Dow industrial average fell by 17.53 points or -0.07% to 25383.13.

In Europe today the story was different with most the indices closing near their session lows.

For the trading week, the Dow industrial average led the way with a 3.71% gain in the US. The NASDAQ index lagged as earlier in the week the flow funds were into the more beaten down industrial stocks. Nevertheless the NASDAQ gained by 2.21%. The S&P index rose by 3.25%.

For the trading week, the Dow industrial average led the way with a 3.71% gain in the US. The NASDAQ index lagged as earlier in the week the flow funds were into the more beaten down industrial stocks. Nevertheless the NASDAQ gained by 2.21%. The S&P index rose by 3.25%.In Europe, the France’s CAC rose by 5.64% and the Spain’s Ibex nearly rose 6%. The UK FTSE was the under performer with a 1.02% gain.