It’s almost June

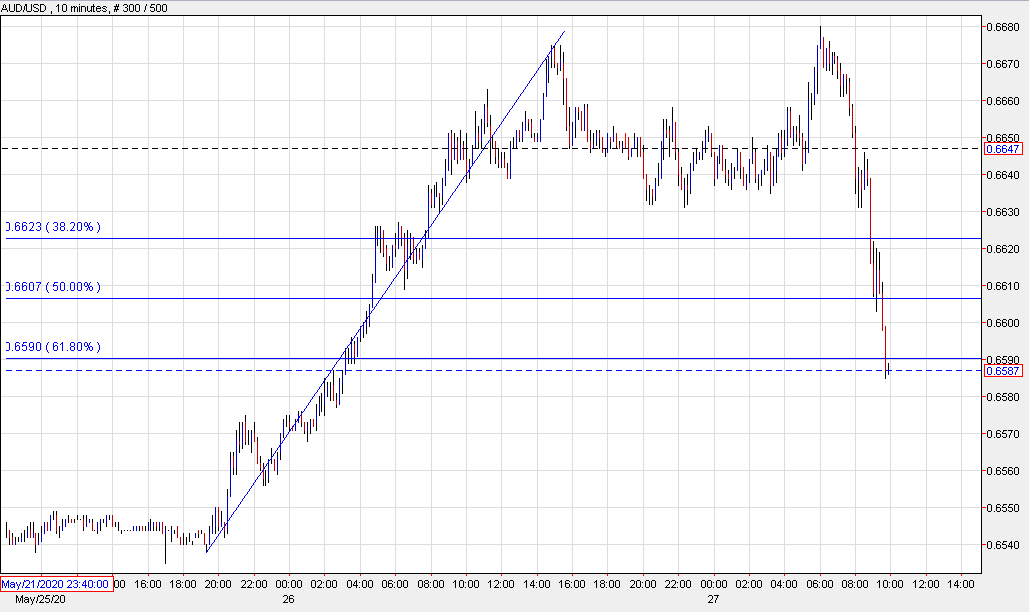

Citi’s month-end rebalancing model flags a strong USD sell signal against EUR and GBP at this month-end

“Our Asset Rebalancing Model notes a rotation from equities into bonds at May month end. The signal is moderately strong coming in at -1.4/+1.3 historical standard deviations (hist. std. dev.) for equities and bonds respectively.

The FX impact notes selling of USD against EUR and GBP at month end,” Citi notes.

Typically, month-end FX re-balancing flows is felt most going into the 4pm London fix on the last trading day of the month.