Archives of “March 2020” month

rssBreaking – US Federal government coronavirus relief package has been delayed

While the US House of Representatives is expected to pass a coronavirus relief bill Thursday evening US time the Senate will not

- the Senate just closed up for the week despite the work being done on the bill

- Which Means that final action on any bill will be delayed until next week

Goldman Sachs expect the Federal Reserve to cut 100bp on March 18

Federal Open Market Committee meet March 18

I though the Fed may have cut again before then, although arguments were it’d just create more panic. Which has happened anyway. March 18 is Wednesday next week so there’s still time!

Anyway, back to GS, here’s the in a nutshell version:

- We now expect the FOMC to cut the funds rate 100bp on March 18

- a faster return to the crisis-era 0-0.25% rate than under our previous call for two 50bp steps in March and April

More:

- To alleviate stresses in funding markets that have emerged as the coronavirus outbreak has spread, the NY Fed announced today that it will take two steps to boost liquidity and reserves in the banking system over the next month. First, the ongoing $60bn of monthly reserve management purchases in bills will now be spread across a range of Treasury maturities through mid-April. These secondary market purchases will help to clear some of the off-the-run Treasuries on dealer balance sheets. Second. the NY Fed announced a slate of weekly term lm and 3m repo operations over the remainder of the monthly schedule with a minimum size of $500bn each (full schedule here). The substantial increase in operation limits is in keeping with the NY Fed’s commitment to provide cash to banks as needed during Treasury market disruptions.

- In light of the continued growth in coronavirus cases in the US and globally, the sharp further tightening in financial conditions, and rising risks to the economic outlook, we now expect the FOMC to cut the funds rate 100bp on March 18, a faster return to the crisis-era 0-0.25% rate than under our previous call for two 50bp steps in March and April.

German leader Merkel says situation is more extraordinary than the banking crisis

German Chancellor Merkel, more:

- debt brake foresees exceptions in extraordinary situations and we are in an extraordinary situation

Merkel set to loosen the fiscal purse strings.

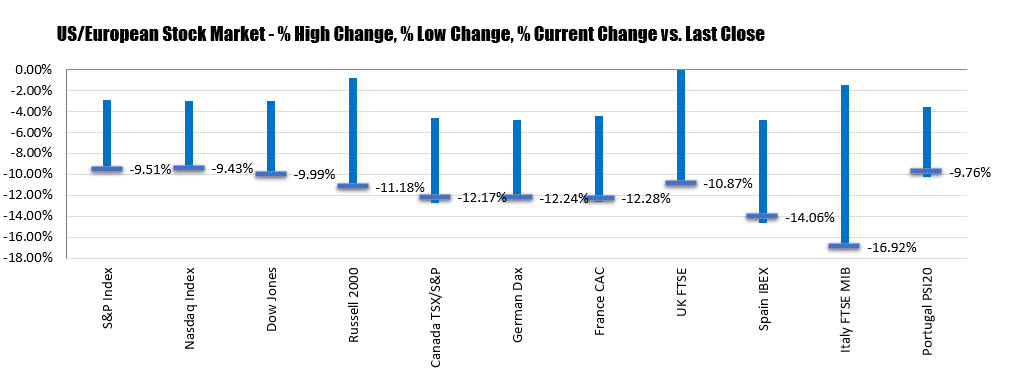

US stocks go out at the lows. The Dow tumbles 10%

NASDAQ and S&P index fall over 9.4%

The US stocks are going out at the lows and down sharply after the markets were not impressed with the President’s address to the nation and the headlines continue to point to slower growth. The US sporting events are shutting down. The number of infected and deaths continued to grow in Europe. A massive liquidity add by the Fed could not help.

The final numbers are showing:

- S&P index -260.6 points or -9.51% at 2480.78

- NASDAQ index -750.25 points or -9.43% at 7201.80

- Dow industrial average -2352.33 points or -9.99% at 21200.85.

Year to date numbers are showing:

Year to date numbers are showing:

- Dow, -25.71%

- S&P, -23.22%

- Nasdaq, -19.74%

- Canada S&P/TSX index -26.69%

- Euro Stoxx 50, -32.04%

- UK FTSE 100 -30.56%

- German DAX, -30.85%

- France’s CAC, -32.35%

- Japan’s new guy, -21.55%

- Hong Kong’s Hang Seng -13.77%

- Australia’s S&P/ASX 200, -20 64%

There is nothing good coming out the stock market.

Year to

Thought For A Day

European equity close: Complete blood bath

What a horrific day

Look at these numbers:

- UK FTSE -10.9%

- French CAC -11.4%

- German DAX -11.4%

- Spain IBEX 11.6%

- Italy MIB -16.6%

The eurozone banking index was down 15% on the day.

These numbers are crazy. Here is a look at the FTSE 100:

White House says no need for Trump and Pence to be tested for coronavirus

That’s comforting

The White House is aware of reports a Bolsonaro aide tested positive for COVID-19, although the “confirmatory testing is pending,” Stephanie Grisham says. Trump and VP “had almost no interactions” with him “and do not require being tested at this time.”

I don’t understand this. Do they think that announcing they were being tested would spread some kind of panic? It just looks irresponsible.

ECB leaves rates unchanged, announces new LTRO, expands QE by 120B

ECB announces measures

No changes in any rates

- ECB raises monthly bond purchases by 120B by year-end (not per month)

- Additional LTROs will be conducted to provide immediate liquidity

- Says considerably more favourable terms will be applied during period from June 2020 to June 2021

- Rates on new LTROs will be 25 bps below average rate applied in eurosystem’s main refinancing operations

- Raises amount taht counterparties can borrow in LTROs to 50% of their stock of eligible loans

- Continue to expect QE programs to run as long as necessary and end shortly before ECB ready to raise rates

The market was sniffing around for an interest rate cut and it didn’t come. The euro has risen

EURUSD falls to a new low

Price moves below its 200 hour MA ahead of the ECB decision.

The EURUSD has moved to a new session low on the day. The low just reached 1.12081. Headlines that Germany is ready to ditch balanced-budget to combat coronavirus is so far not giving the EUR a boost. The ECB decision will be out shortly where they are expecting to cut rates and potentially announce more QE and liquidity measures.

The price of the EURUSD remains below its 200 hour moving average. That is close risk for the pair now. The lows from March 6 and March 20 at 1.1273-78 are also risk for shorts. The topside channel trend line comes in at 1.13035. Staying below those levels still more bearish technically, and keeps the sellers more in control.

On the downside the 1.1183 area is the next target, followed by the downward sloping channel trendline at 1.1170. Below that the 50% retracement of the move up from the February 21 low comes in at 1.11368 and the 200 day moving average comes in at 1.10995.