Thought For A Day

him

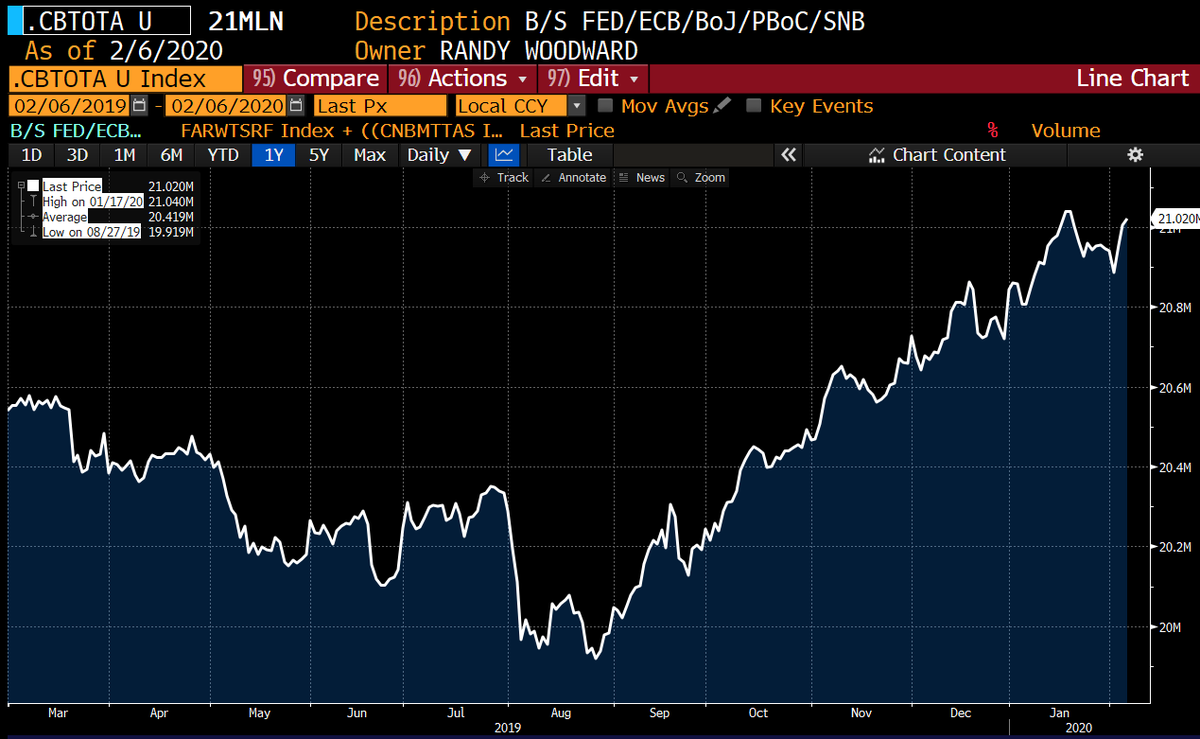

Will delay economic recovery

Citi looks for Q1 GDP at an annualised -0.3% … A huge drop from the previous forecast at +0.8%

Apple’s plan to drastically ramp up AirPods production is under threat from the coronavirus outbreak, which has forced suppliers in China to halt operations for two weeks and could leave them short of components even after work resumes on Monday, multiple sources told the Nikkei Asian Review.

The U.S. tech giant had ordered its suppliers to produce up to 45 million units in the first half of the year to keep up with surging demand for the wireless earphones.

Now, however, the current stock of AirPods is running low, with most of the finished products reserved for Apple’s own online and offline stores, the sources said. Currently, the standard AirPods are still in stock, according to Apple’s official online store, while there is a one-month waiting period for the premium AirPods Pro launched last September.

Luxshare Precision Industry, also known as Luxshare-ICT, Goertek and Inventec, the three key manufacturers of the AirPods, have halted the majority of production since the Lunar New Year break began, two people familiar with the matter told Nikkei. The three companies now have at most two weeks’ worth of materials and components needed for AirPods assembly, and must wait for component makers across China to restart operations in order to receive fresh supplies, the people said.

“Because of the virus outbreak, it has already been about two weeks since the assemblers have shipped any new AirPods series,” said a person familiar with the situation. “All of the stores and carriers selling Apple products are really counting on suppliers to resume work next week.”

The three major AirPods assemblers, like other Apple suppliers, are scheduled to resume work on Monday, but their production utilization rates may reach just 50% at best in the first week given the current conditions, a source familiar with the matter said. (more…)