Closing changes for the main European equity bourses:

- UK FTSE 100 +0.7%

- German DAX +0.5%

- French CAC +0.5%

- Spain IBEX +0.4%

- Italy MIB +0.9%

That’s a decent rebound but we’re seeing a shift in the risk trade right now so that’s the spot to watch.

That’s a decent rebound but we’re seeing a shift in the risk trade right now so that’s the spot to watch.

The report says that Chinese officials are evaluating whether the target for economic growth this year – touted to be ‘around 6% growth’, should be softened as part of a broader review of how the government’s plans will be impacted by the new coronavirus outbreak.

The sources say that most OPEC members agree on the need to cut oil output further and that they are considering to have a meeting on 14-15 February now. Just one to keep in mind as such a move may provide some relief to oil prices in the near-term.

I’m not sure how much details they’ll be going into on the specific points but we’ll know in due time. In any case, just keep an eye on this as a potential key risk event for the pound.

I’m sure China isn’t too happy about the negative attention it is getting in the media because of the coronavirus outbreak situation.

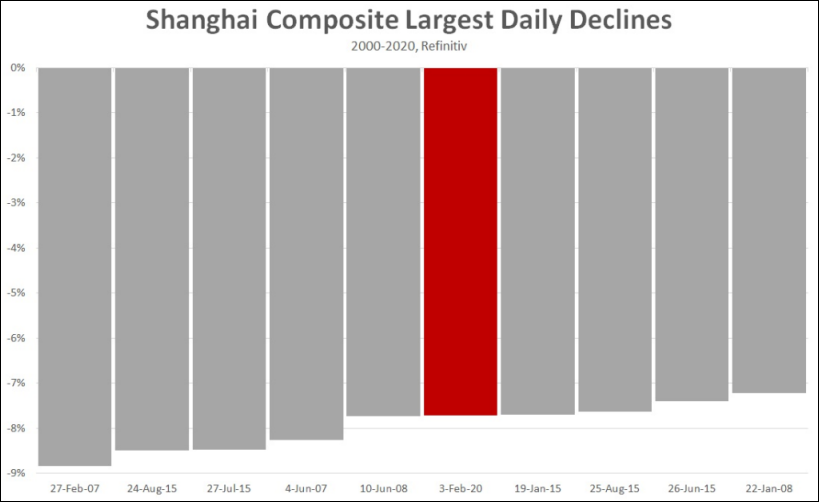

The talk over the weekend is whether or not we will see Chinese equities be battered down by more than 10%. That didn’t quite happen but the nearly 9% drop in the early stages enough to trigger a flurry of measures by Chinese officials to try and keep the calm.