1% richest annual income in different countries.

I wonder if politics played a role in removing the currency manipulator label from China? LOL, I’m kidding. I am not wondering at all.

Sr Administration Official tells me Foreign Exchange report is expected to come out before China signs Phase One trade deal. Source in #China tells me today the Chinese will be removed as a currency manipulator in the report. Chinese trade sources wanted off to sign #trade deal.

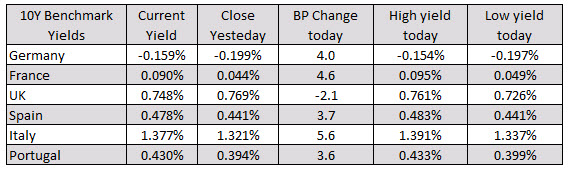

The major European indices are ending the day with mixed results. Looking at the provisional closes:

The update reads:

The Chinese trade delegation led by Vice Premier Liu He has left Beijing en route to Washington DC to sign the phase one #tradedeal with US officials, a source told the Global Times on Monday. #tradetalks #tradewar