Archives of “January 8, 2020” day

rssPentagon statement

Is this it? Are the US and Iran at war?

These reports of attacks aren’t fake

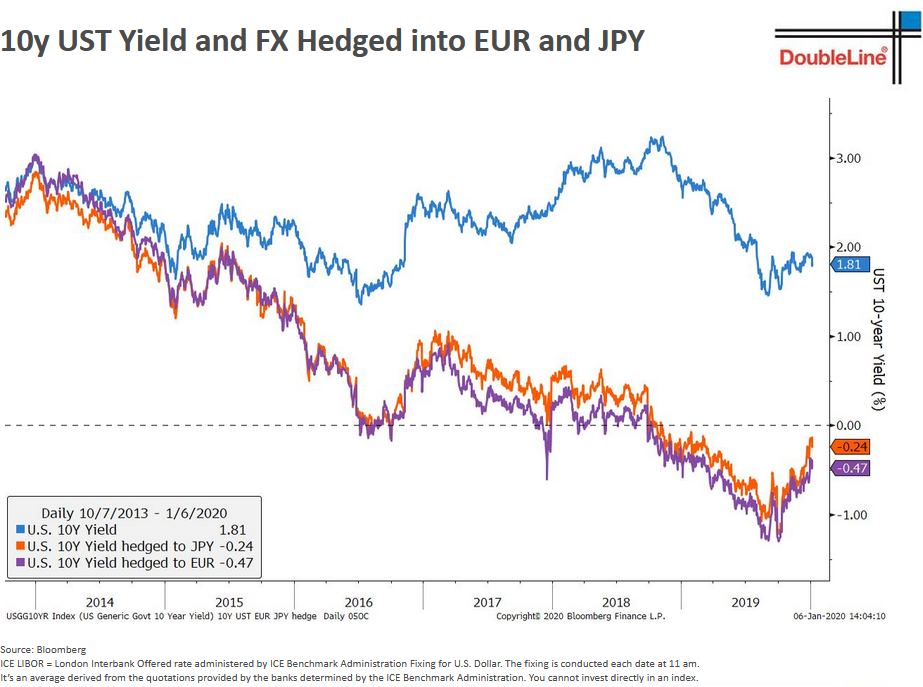

This was the best chart from Jeff Gundlach’s presentation

It’s impossible to hedge

USD/JPY: Intra-day range In 2019 narrowest since 1976; Where next? – MUFG

Can the low volatility continue?

MUFG Research discusses USD/JPY outlook and targets the pair at 107, 106, 105, 104 in Q1, Q2, Q3, and Q4 respectively.

“The intra-day high-to-low trading range for USD/JPY in 2019 was 7.6% – that’s the narrowest trading range since 1976 according to Bloomberg data. Taking the last three years the trading range has been just 13.5% underlining the remarkable stability of USD/JPY. 3mth ATM implied volatility fell to 4.99% in December, a record low underlining the conditions conducive to carry. These conditions helped keep the yen weak but failed to trigger any notable sell-off of the yen,” MUFG notes.

“In our view that is a reflection of underlying positives for the yen that will contribute to yen strength this year, even if financial market conditions remain relatively benign…We see limited upside for USD/JPY from current levels. The factors above will act to limit yen weakness. We do not assume any major risk-off event this year but the assassination of Qassem Soleimani in Baghdad on 3rd January is a clear near-term upside risk for the yen that has emerged as 2020 commences,” MUFG adds.

Stock indices end lower. All S&P sectors close lower on the day

Late day selling hurts major indices

- S&P index -9.13 points or -0.28% to 3237.15. The high reached 3244.91.The low extended to 3232.43

- NASDAQ index fell -2.883 points or -0.03% to 9068.58. The high reached 9091.93. The low extended to 9042.55

- Dow fell -119.97 points or -0.42% to 28583.43. The high reached 28685.50. The low extended to 28565.28.

Thought For A Day