The man who conquered inflation dies

The US-China trade war drags on

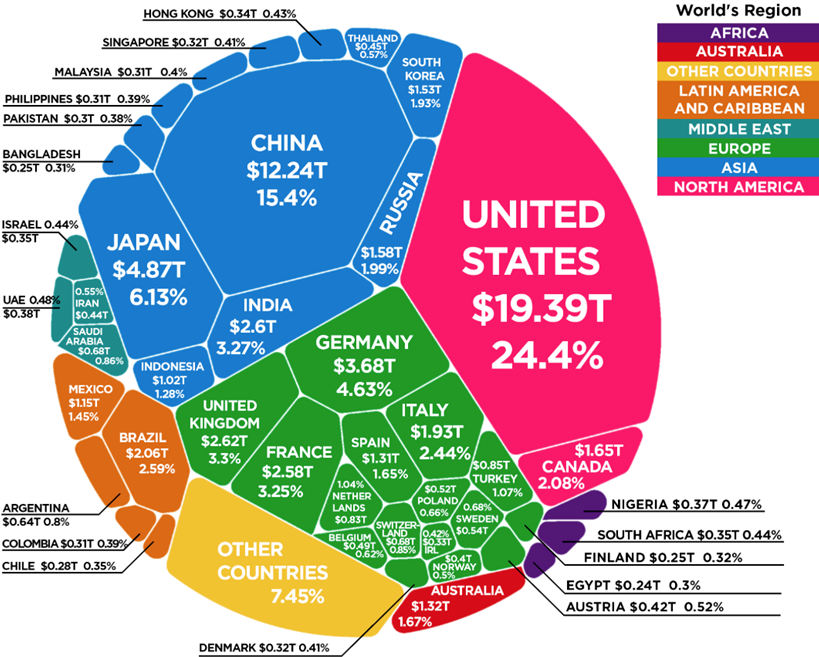

So, the market’s concern with the ongoing US-China trade dispute is really an ongoing concern about global growth. That is why a fall out between the US and China impact global financial markets.

The market wants the US-China trade dispute resolved as soon as possible. The markets have become used to a game of ‘ping-pong’ where some news prompts optimism about a US-China trade deal and then some other, conflicting news, encourages pessimism about the US-China trade deal. It’s truly a game of geo-political ping pong!

At the moment the market is digesting the latest news on Tuesday last week where US President Trump announced that it is probably better to wait until after the 2020 presidential election for a China deal and that there is no timeline on trade.

Then, on Wednesday, some sources quoted by Bloomberg said that a deal was much closer than the recent heated dialogue would otherwise indicate. Another game of ping pong! However, it is worth being aware that the US-China trade dispute could actually get much worse.

Two of the ways it could deteriorate would be if the US goes ahead with restricting US capital flows into China and if the impact of the Hong Kong riots spill over to further political moves from the US or China.

This has been the source of all the problems and riots that have been taking place recently. To make matter worse, at the end of November, President Trump signed new human rights legislation authorising sanctions on Chinese and Hong King officials responsible for human rights abuses in Hong Kong.

In this way the US are signaling support for pro-democracy activists. China responded to this legislation by calling it an illegal interference in its own affairs. The current expectations are that this in itself is not enough to de-rail US-China trade talks and Donald Trump.

However, it is an added tension in an already difficult relationship. President Trump has tried to avoid antagonising the situation by signing the bill in private and not having a large press conference.

The Japanese Yen is a traditional safe haven currency. Negative interest rates, like the Bank of Japan currently has, would typically discourage currency capital inflows. However, the debt structuring of Japan means that the currency is considered very stable and safe for uncertain times. As a result, when investors and speculators are fearful, there are sudden and marked inflows into the Japanese Yen.

The pair that stands out for particular downside in a fresh round of the ongoing US-China trade war would be the AUD/JPY pair. As around 30% of Australia’s economy is made up of trade with China it stands to lose out on a US-China trade war. Further trade strain would result in AUD weakness and JPY strength on safe haven flows.

Let us take a look at what else is on the agenda:

In case you missed the news from earlier today, North Korea has set a year-end deadline for the US to change its policies or Kim Jong Un may “embark on a new path” as denuclearisation talks between the two countries appear to have broken down.

Early bids have helped push the pound to a high of 1.3181, closing in on the May high of 1.3185 as we get into what will be a crucial week for the pound.