Archives of “September 2019” month

rssWatch Warren Buffett’s first ever television interview

Major Global Stock Market Caps

President Trump grants exemptions on 400 tariffs

Schedule for Week of September 22, 2019

Iran envoys says won’t rule out war

Iranian Foreign Minister Mohammad Javad Zarif refused to rule out military conflict in the Middle East after the US sent more troops and weapons to Saudi Arabia in response to an attack on oil fields the US has blamed on the Islamic Republic.

“I’m not confident that we can avoid a war,” Zarif said in an interview with CBS to be broadcast Sunday on its “Face the Nation” program.

“I’m confident that we will not start one, but I’m confident that whoever starts one will not be the one who finishes it.”

When asked to elaborate, Zarif said: “That means that there won’t be a limited war.”

Zarif was interviewed in New York, where he will attend the United Nations General Assembly session.

The US said Friday it will send a “moderate” number of troops to the Middle East and missile defence capabilities to the Saudis in response to last weekend’s attack on oil facilities.

The foreign minister criticised the move. “I think it’s posturing,” Zarif said, according to a transcript provided by CBS. “I think it’s all going the wrong direction in addressing this issue.”

US and Saudi analyses of the attack have described the strike as complex, involving a mix of low-flying drones and cruise missiles coming from the north.

The attack exposed vulnerabilities in Saudi Arabia’s defence capabilities, despite the Kingdom having spent hundreds of billions of dollars on weaponry in recent years.

American officials blame Iran for the attack that knocked out half the production of oil from a key Saudi field.

Houthi rebels fighting a Saudi-led coalition in Yemen took credit for the attack.

“I’m confident that Iran did not play a role,” Zarif said. Anybody who “conducts an impartial investigation will reach that conclusion,” he said.

Saudi Arabia floats change to Japan oil supply, sparks concern

Saudi Aramco has notified Japan’s top oil distributor about a potential change in shipments, stoking concerns about the kingdom’s ability to supply crude following attacks on its major refineries a week ago, Nikkei learned Saturday.

State-owned Aramco did not say why it wants to change the oil grade it supplies to JXTG Nippon Oil & Energy from light to heavy and medium, starting in October, JXTG officials said.

But the move indicates that the Saudi national oil company is having a hard time restoring its production as quickly as it has promised, despite repeated assurances that the company’s supply would be restored by the end of September.

Two of Aramco’s refineries were attacked in what is believed to be a drone and cruise missile strikes on Sept. 14. The attacks, which were claimed by Iran-backed Houthi rebels in Yemen, knocked out more than half the country’s oil production.

JXTG officials said they suspect that Aramco is taking more time than expected to repair its desulfurization facility, which is necessary to produce light-grade crude used in the production of gasoline and light gas oil.

Saudi Arabia accounted for almost 40% of Japanese oil imports in fiscal 2018. (more…)

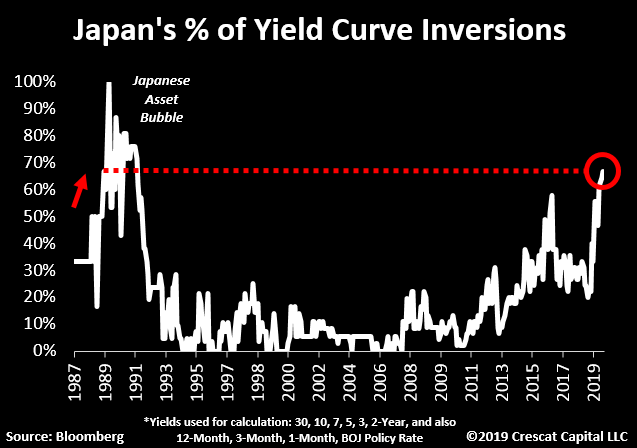

Japan’s yield curve now 64% inverted. Its only analog is November 1989.

Thought For A Day

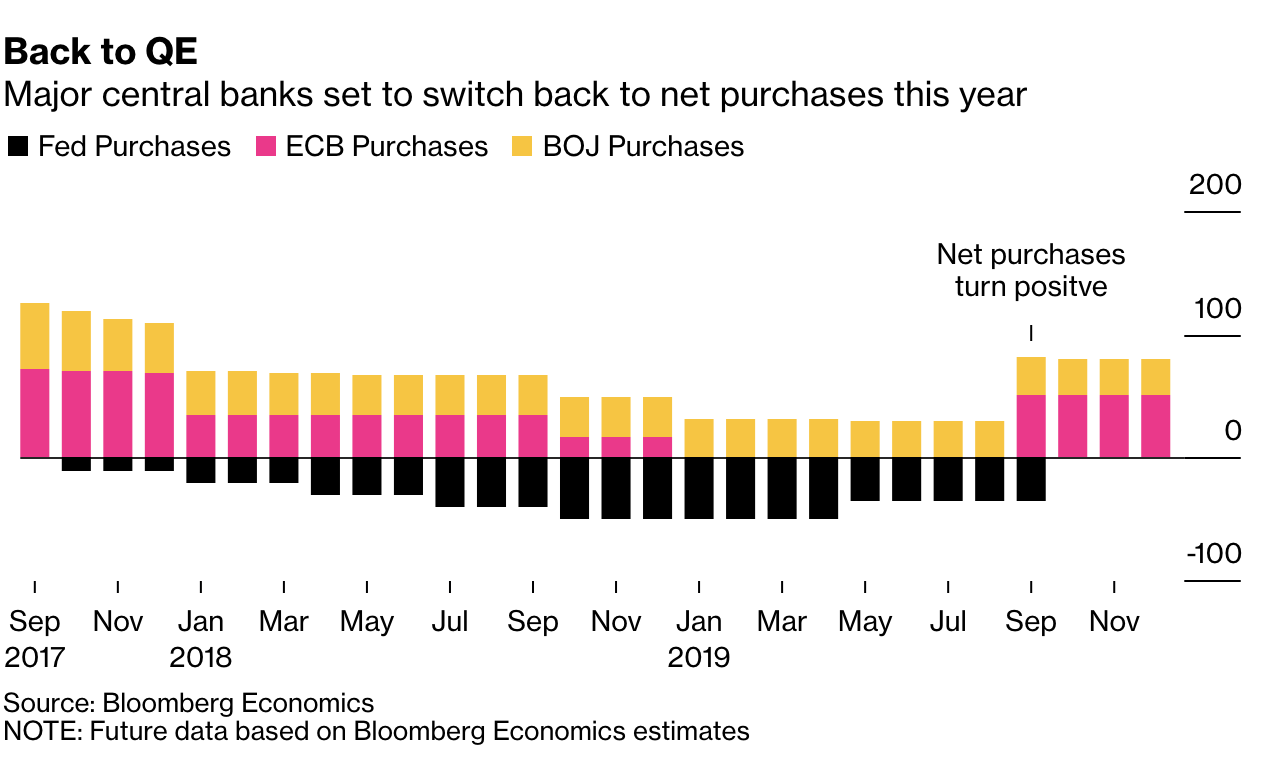

Quantitative Tightening to End as Central Banks Retreat