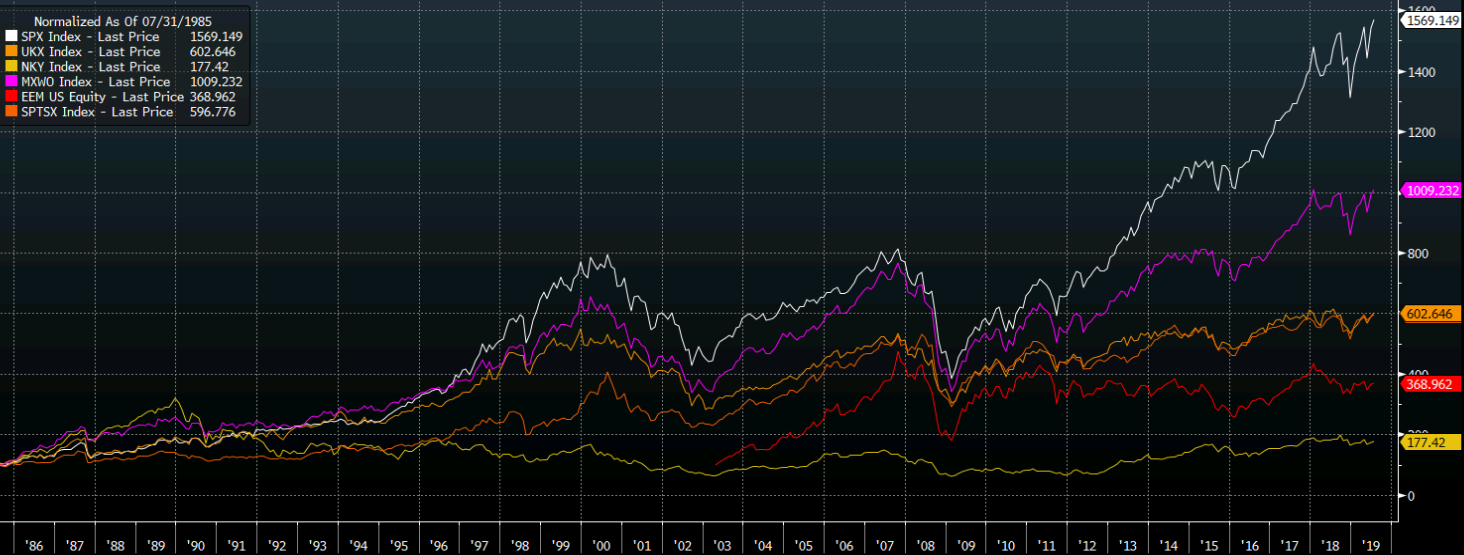

Interesting chart in gold

Asian equities are posting cautious gains being sandwiched by the fact that US markets were closed yesterday and traders/investors are all anticipating the US jobs report later today. Chinese equities are also up by around 0.1% on the session, underscoring the more flat mood seen across multiple asset classes so far today.

Despite the difficulties, China remained cautiously optimistic that a deal would be reached, a source close to the Chinese government said.

“There will be a deal at a time before Trump’s presidential election run, though the talks process will be painful,” the Chinese source said.

Samsung Electronics estimated its operating profit more than halved in the second quarter, amid growing concerns over US trade sanctions on Huawei and Japan’s export controls of high tech materials to South Korea. The poor earnings guidance comes as the semiconductor industry is buffeted by the slowing global economy, the US-China trade war and US export controls on Huawei. The US campaign against Huawei has increased chip inventories as the Chinese telecoms maker is one of the Korean tech sector’s biggest customers. South Korean chipmakers face a gloomy outlook following Japan’s decision this week to impose tighter restrictions on exports of key chemicals used for chips and smartphones amid political disputes over wartime labour compensation. Operating profit at the world’s largest maker of memory chips and smartphones was estimated at Won6.5tn ($5.6bn) for the April-June period, down 56.3 per cent from Won14.9tn a year earlier. Still, Samsung’s guidance was better than market estimates of Won6tn provided by Reuters. Sales were estimated to have fallen 4.2 per cent year on year to Won56tn. The company is set to announce detailed earnings later this month. Chip prices have continued to fall since late last year, but shares of Samsung have gained nearly 20 per cent so far this year on expectations of a second-half recovery in the chip cycle. However, the downturn is expected to continue through the second half as external headwinds grow.

This now via Westpac from a Friday note, in brief: