Why is abbreviated such a long word?

Why does monosyllabic have five syllables?

Why isn’t phonetic spelled the way it sounds?

Why is a carrot more orange than an orange?

Why are there interstate highways in Hawaii?

Why do we drive on parkways and park on driveways?

Why are they called apartments, when they’re all stuck together?

Why do scientists call it research when looking for something new?

Why do they call it a building? It looks like they’re finished. Why isn’t it a built?

Why is it when you transport something by car, t’s called a shipment, but when you transport something by ship, it’s called cargo?

If vegetarians eat vegetables, what do humanitarians eat?

If price and worth mean the same thing, why priceless and worthless are opposites?

Is there another word for synonym?

Is it possible to be totally partial?

Archives of “February 2019” month

rssThe Luckiest Day Of My Life

Warren Buffett says that one of the luckiest days of his life was when he was 19-years-old and happened to have picked up Benjamin Graham’s book, The Intelligent Investor.

That book changed his investment philosophy and his whole life.

He says that had it not been for the book, he would’ve been a different person at a different place.

10 Trading Mistakes: Are You Guilty?

- Are you trading without a plan? Trading without a plan makes you emotional and a gambler.

- Do you ever trade too big for your trading account size? Big trades are bad trades for the emotional engagement and risk of ruin that they entail over the long term.

- Do you risk losing more if you are wrong than you will make if you are right? The biggest driver of profitability in your trading will be big wins and small losses. Big losses and small wins is a sure path to losing your trading capital.

- Have you traded without studying charts to see what has happened historically with similiar price patterns? If you do your homework you can make money understanding possibilities and probabilities from past patterns. Trading your own opinions will usually put you on the wrong side of the market.

- Did you trade a system before you back-tested it?Or are you just trading blindly?

- Have you ever exited a trade due to fear instead of due to hitting your stop loss or trailing stop? The right exit is what determines your profitability and whether your win is a big one or your loss is a big one.

- Have you ever entered a trade becasue of greed without an entry signal? Chasing a trade after the trend is over is a great way to lose money consistently and quickly.

- Have you ever copied someone else’s trade not knowing their time frame or position size? Ultimately you have to trade your own system and your own method that matches your own personality and risk tolerance. Only you can make yourself profitable with faith in yourself and your method.

- Are you that person that loves to short during market up trends and miss a whole up move?The easy money is on the side of the trend in your time frame going against the trend is a great way to lose money.

- Are you that knife catcher that keeps going long at the worn time in a down trend? When everyone is exiting a market that is the worst time to be getting long as wave after wave of holders are leaving.

10 points -Risk Managment

1. Never enter a trade before you know where you will exit if proven wrong.

2. First find the right stop loss level that will show you that you’re wrong about a trade then set your positions size based on that price level.

3. Focus like a laser on how much capital can be lost on any trade first before you enter not on how much profit you could make.

4. Structure your trades through position sizing and stop losses so you never lose more than 1% of your trading capital on one losing trade.

5. Never expose your trading account to more than 5% total risk at any one time.

6. Understand the nature of volatility and adjust your position size for the increased risk with volatility spikes.

7. Never, ever, ever, add to a losing trade. Eventually that will destroy your trading account when you eventually fight the wrong trend.

8. All your trades should end in one of four ways: a small win, a big win, a small loss, or break even, but never a big loss. If you can get rid of big losses you have a great chance of eventually trading success.

9. Be incredibly stubborn in your risk management rules don’t give up an inch. Defense wins championships in sports and profits in trading.

10. Most of the time trailing stops are more profitable than profit targets. We need the big wins to pay for the losing trades. Trends tend to go farther than anyone anticipates.

Buffett on Stock Prices

Its early in this potential correction, but let me remind you of Buffett’s interesting (1997) comments:

“If you plan to eat hamburgers throughout your life and are not a cattle producer, should you wish for higher or lower prices for beef?

Likewise, if you are going to buy a car from time to time but are not an auto manufacturer, should you prefer higher or lower car prices?

These questions, of course, answer themselves. But now for the final exam: If you expect to be a net saver during the next five years, should you hope for a higher or lower stock market during that period?

Many investors get this one wrong. Even though they are going to be net buyers of stocks for many years to come, they are elated when stock prices rise and depressed when they fall. In effect, they rejoice because prices have risen for the “hamburgers” they will soon be buying. This reaction makes no sense. Only those who will be sellers of equities in the near future should be happy at seeing stocks rise. Prospective purchasers should much prefer sinking prices.”

–Warren Buffett, chairman’s letter, Berkshire Hathaway annual report, 1997

Its worth thinking about, regardless of whether the recent investor nervousness turns into something more significant . . .

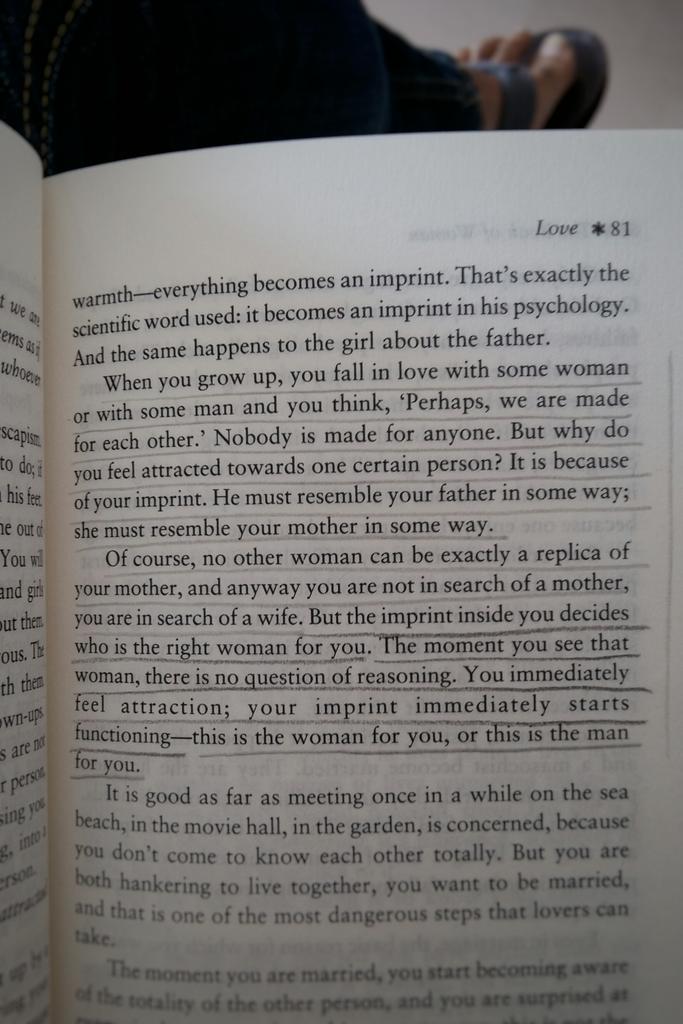

Osho on how we fall in love. Rings a bell? Agree?

SIMPLICITY IS SUPREME

Trading is a mental game. Successful traders know this.

They spend a large majority of their time creating an environment of emotional calm. One of the many ways they do so is by keeping things simple because as anyone who has traded for any length of time knows the markets are complicated.

Successful traders read books that help them hone their mental skills. One such book I recommend is Jim Afremow‘s The Champion’s Mind.

For instance, here is his take on simplicity.

Keep everything as basic as possible. Keep the process simple and straightforward. Be on a focused mission. Specialize. Get rid of the useless “noise”.

Be a Champion Trader.

China’s Corporate Cash Holdings Rise to Record

FEAR

Fear is the main source of superstition, and oneof the main sources of cruelty. To conquer fear is the beginning of wisdom… Bertrand Russell

Fear is the main source of superstition, and oneof the main sources of cruelty. To conquer fear is the beginning of wisdom… Bertrand Russell

Fear is a misunderstood emotion, and one that gets a pretty bad rap these days. We owe our survival as a species to the hard-wired fear that protected and kept us safe from physical threats for hundreds of thousands of years. But what about the litany of fears that plagues traders every day? Fear of losing, of watching profits disappear, making mistakes, missing out, taking profits too soon…the list goes on.

Perhaps the larger question is this: If there is so much fear and almost every trader feels fear, why do millions of people continue to trade? The answer lies in the way that fear is perceived.

For many, fear is a predator that is constantly lurking, sneaking up on them and ready to attack at any moment. In this brain set, they are always running away from fear, crouching in a corner or looking for a safe place to hide. Fear blinds them to opportunity in much the same way that greed blinds them to danger.

Fear is that little darkroom where negatives are developed… Ferdinand Pritchard (more…)

Count to 10 before you trade