13 Insights From Paul Tudor Jones

1. Markets have consistently experienced “100-year events” every five years. While I spend a significant amount of my time on analytics and collecting fundamental information, at the end of the day, I am a slave to the tape (and proud of it).

2. Younger generation are hampered by the need to understand (and rationalize) why something should go up or down. By the time that it becomes self-evident, the move is over.

3. When I got into the business, there was so little information on fundamentals, and what little information one could get was largely imperfect. We learned just to go with the chart. (Why work when Mr. Market can do it for you?)

4. There are many more deep intellectuals in the business today. That, plus the explosion of information on the Internet, creates an illusion that there is an explanation for everything. Hence, the thinking goes, your primary task is to find that explanation.

As a result of this poor approach, technical analysis is at the bottom of the study list for many of the younger generation, particularly since the skill often requires them to close their eyes and trust price action. The pain of gain is just too overwhelming to bear.

5. There is no training — classroom or otherwise — that can prepare for trading the last third of a move, whether it’s the end of a bull market or the end of a bear market. There’s typically no logic to it; irrationality reigns supreme, and no class can teach what to do during that brief, volatile reign. The only way to learn how to trade during that last, exquisite third of a move is to do it, or, more precisely, live it. (more…)

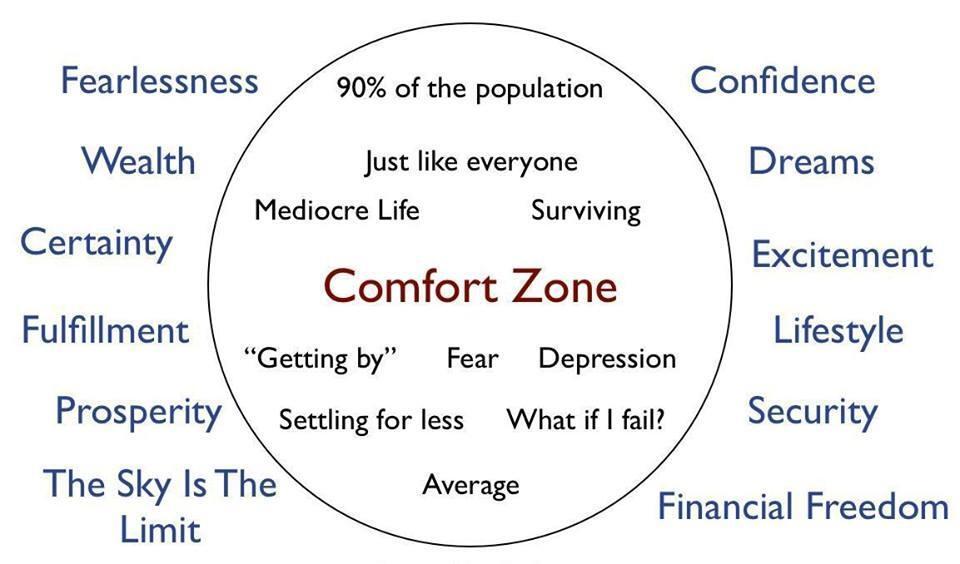

Images can be powerful. Here is one I particularly liked from Robert Koppel’s Bulls, Bears, and Millionaires (Dearborn Financial Publishing, 1997), p. 55, compliments of Timothy McAuliffe.

Images can be powerful. Here is one I particularly liked from Robert Koppel’s Bulls, Bears, and Millionaires (Dearborn Financial Publishing, 1997), p. 55, compliments of Timothy McAuliffe.