Archives of “February 2019” month

rssCourage Conquers our only adversary–Fear. Crush it today!

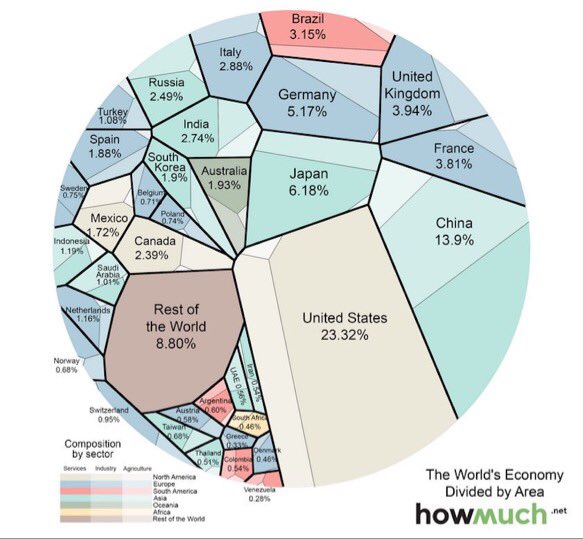

The Global Economy (nominal GDP) US 23.3% China 13.9% Japan 6.2% Germany 5.2% UK 3.9%

Trading Success -SKILL VS. LUCK? -Video

SELF HELP

The positive circle of trading

Three Essential Components

Every winner needs to master three essential components of trading; a sound individual psychology, a logical trading system and good money management. These essentials are like three legs of a stool – remove one and the stool will fall, together with the person who sits on it. Losers try to build a stool with only one leg, or two at the most. They usually focus exclusively on trading systems. Your trades must be based on clearly defined rules. You have to analyze your feelings as you trade, to make sure that your decisions are intellectually sound. You have to structure your money management so that no string of losses can kick you out of the game.”

Every winner needs to master three essential components of trading; a sound individual psychology, a logical trading system and good money management. These essentials are like three legs of a stool – remove one and the stool will fall, together with the person who sits on it. Losers try to build a stool with only one leg, or two at the most. They usually focus exclusively on trading systems. Your trades must be based on clearly defined rules. You have to analyze your feelings as you trade, to make sure that your decisions are intellectually sound. You have to structure your money management so that no string of losses can kick you out of the game.”

YTD Best Performance :VIX Up 31.48% ,Cocoa Up 14.85% ,Worst Performance Brent Crude Down 42.31%

Ed Seykota – “Everybody Gets What They Want From The Markets”

When Jack Schwagger interviewed legendary trend following trader Ed Seykota for his book “Market Wizards” in 1989, it’s clear he was not ready for the answers that Ed Seykota gave. Not many people are.

But by far the greatest and most provocative answer that Ed gave was that of “Everybody gets what they want out of the market”. Not only did it incite an almost angry response from Schwagger, it has confused and enlightened an entire generation of traders since.

The Famous Ed Seykota Interview

Jack Schwagger asks his interviewee: “Don’t all traders want to win?”

And Ed replies with: “Win or lose, everybody gets what they want out of the market.

“I know one trader who seems to get in near the start of every substantial bull move and works his $10 thousand up to about a quarter of a million in a couple of months. Then he changes his personality and loses it all back again. This process repeats like clockwork. Once I traded with him, but got out when his personality changed. I doubled my money, while he got wiped out as usual. I told him what I was doing, and even paid him a management fee. He just couldn’t help himself. I don’t think he can do it any differently. He wouldn’t want to.

- “He gets a lot of excitement, he gets to be a martyr, he gets sympathy from his friends, and he gets to be the centre of attention. Also, possibly, he may be more comfortable relating to people if he is on their financial plane.

“On some level, I think he is really getting what he wants.”

Does This Sound Like Someone You Know? Maybe Someone You Know… Intimately?

Even back then, Ed Seykota had a fantastic grasp on the dangerous psychology pitfalls that almost every trader has to work through before they become a success in the markets.

So you need to ask yourself: (more…)