“The game of speculation is the most uniformly fascinating game in the world. But it is not a game for the stupid, the mentally lazy, the man of inferior emotional balance, nor for the get-rich-quick adventurer. They will die poor.” – Jesse Livermore

“The game of speculation is the most uniformly fascinating game in the world. But it is not a game for the stupid, the mentally lazy, the man of inferior emotional balance, nor for the get-rich-quick adventurer. They will die poor.” – Jesse Livermore

Archives of “February 13, 2019” day

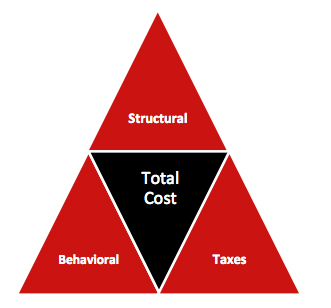

rssRick Ferri’s Triangle of Investor Costs

Rick Ferri has a new book coming out that I can’t wait to read. In the meantime, here’s something he put together illustrating the three costs that investors must control if they’re going to be successful…

Figure 1: The Investment Cost Triangle with Components

Some costs in Figure 1 are easy to identify and quantify while others are not. Structural costs are generally available because most fund fees and expenses are required to be disclosed by law. However, tax costs are more difficult in that they have to be extracted from tax return data. Behavioral costs are the most elusive and difficult to quantify because there’s very little data available. It also doesn’t help that human beings are overconfident and don’t want to be reminded of behavioral shortcomings.

Read the rest, this is the important stuff – much more important than the latest macro opinions on Greece or Guernica.

Trading in the Zone and focusing on discipline

IQ to be correlated with rationality

Our New Motto

Loss of discipline & Failure of willpower

Consider the following scenarios:

* We decide to enter a position at a particular price level, it hits that level, and we create an excuse and fail to take advantage of an opportunity;

* We set a stop loss on a position, but rationalize staying in the position when that level is hit, creating a loss that wipes out many days of gains;

* We establish a process for researching markets and keeping ourselves in peak condition, but become distracted by life events and fail to follow our process;

* We take an unplanned trade after losing money and widen our losses.

In each of these cases, we have what traders commonly call a loss of discipline. In fact, it is a failure of willpower: an inability to sustain intention.

Our focused attention–our intentionality–is a finite resource. It becomes fatigued with use. When we frame trading problems as one of lack of discipline, we treat our challenges as character flaws. When we frame trading problems as one of lack of willpower, we open the door to strategies that preserve the willpower we possess and expand our level of willpower over time.

Process over outcome trading mindset risk

PRICE is the only data point that pays.(Ignore Everything else )

Trading -Speculation :Must Read

Developing The Right Mindset

First, you need to find a systematic method which removes most (if not all) of the emotion and discretionary judgment from your trading. Be prepared… this could take years. Once you have identified a system that can be profitable over the course of time, then you have to develop a mindset in which you:

- Focus on executing your system perfectly for each individual trade;

- Focus on weekly or monthly gains and not the results of individual trades;

- Track and quantify your performance mercilessly;

- At the end of each day, each week, and month evaluate your actions and then commit to doing better tomorrow;

- Stay positive in your thoughts and spoken words;

- Stay away from negative influences that cause you to have doubts and fears about your ability as a trader;

- Teach others to maximize their performance and, in so doing, maximize your own.