- It’s all about risk management … never risk what you can’t comfortably lose.

- Never fall in love with a stock.

- To be succesfull in trading; study, understand and practice. The rest is easier.

- Always start by assuming your analysis is WRONG and that people much smarter and with more recent information are already positioned opposite you.

- Never take on a position larger than your comfort zone. (Don’t overtrade)

- Patience. never chase a stock.

- Before entering the trade very think carefully what will make you wrong, write it down clearly and put it infront of you where you trade, and when your wrong get out happy you’ve followed your trading discipline.

- Buy strength, sell weakness. Most traders are essentially counter-trend; most traders lose.

- No one ever went broke taking a profit!

- Once you find a good one, hang on unless of course they do you wrong.

- Never add to a losing position! (Unless scaling in was part of the plan).

- Whenever you think you’ve found the key to the lock, they’ll change the lock.

- Do not overtrade.

- Trade price not perception.

- Know the difference between stocks that you want to stay married to and those that are just a fling.

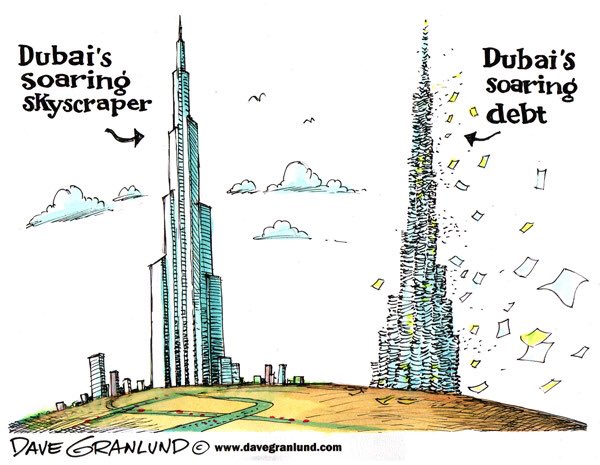

- The only sure way to make a small fortune is to start with a large one.

- Cut your losses quickly and you may have a chance.

- An indicator works until it doesn’t.

- “MR. MARKET” IS ACTUALLY “MRS. MARKET” ONLY WOMEN CAN THINK, AND ACT THE WAY THE MARKET DOES. THAT IS WHY -ON AVERAGE -WOMEN ARE BETTER TRADERS THAN MEN, THEY UNDERSTAND WHAT THEY DEALING WITH! (more…)

and to paraphrase Will Rogers: Buy only stocks that will go up. Don’t buy the ones that don’t go up. “THIS is GAMBLING.”