“Play to win and win to play. Playing to win is one of the finest things you can do. It enables you to fulfill your potential. It enables you to improve the world and, conveniently, develop high expectations for everyone else too. And what if you lose? Just make sure you lose while trying something grand. Avinash Dixit, an economics professor at Princeton, and Barry Nalebuff, an economics and management professor at the Yale School of Organization and Management, say it this way: “If you are going to fail, you might as well fail at a difficult task. Failure causes others to downgrade their expectations of you in the future. The seriousness of this problem depends on what you attempt.” In its purest form, winning becomes a means, not an end, to improve yourself and your competition. Winning is also a means to play again. The unexamined life may not be worth living, but the unlived life is not worth examining. The rewards of winning – money, power, satisfaction, and self-confidence – should not be squandered. Thus, in addition to playing to win, you have a second, more important obligation: To compete again to the depth and breadth and height that your soul can reach. Ultimately, your greatest competition is yourself.” (more…)

“Play to win and win to play. Playing to win is one of the finest things you can do. It enables you to fulfill your potential. It enables you to improve the world and, conveniently, develop high expectations for everyone else too. And what if you lose? Just make sure you lose while trying something grand. Avinash Dixit, an economics professor at Princeton, and Barry Nalebuff, an economics and management professor at the Yale School of Organization and Management, say it this way: “If you are going to fail, you might as well fail at a difficult task. Failure causes others to downgrade their expectations of you in the future. The seriousness of this problem depends on what you attempt.” In its purest form, winning becomes a means, not an end, to improve yourself and your competition. Winning is also a means to play again. The unexamined life may not be worth living, but the unlived life is not worth examining. The rewards of winning – money, power, satisfaction, and self-confidence – should not be squandered. Thus, in addition to playing to win, you have a second, more important obligation: To compete again to the depth and breadth and height that your soul can reach. Ultimately, your greatest competition is yourself.” (more…)

Archives of “February 8, 2019” day

rssAbraham Lincoln Quote- Our Politicians Must Read

Humour Time -But It's Naked Truth

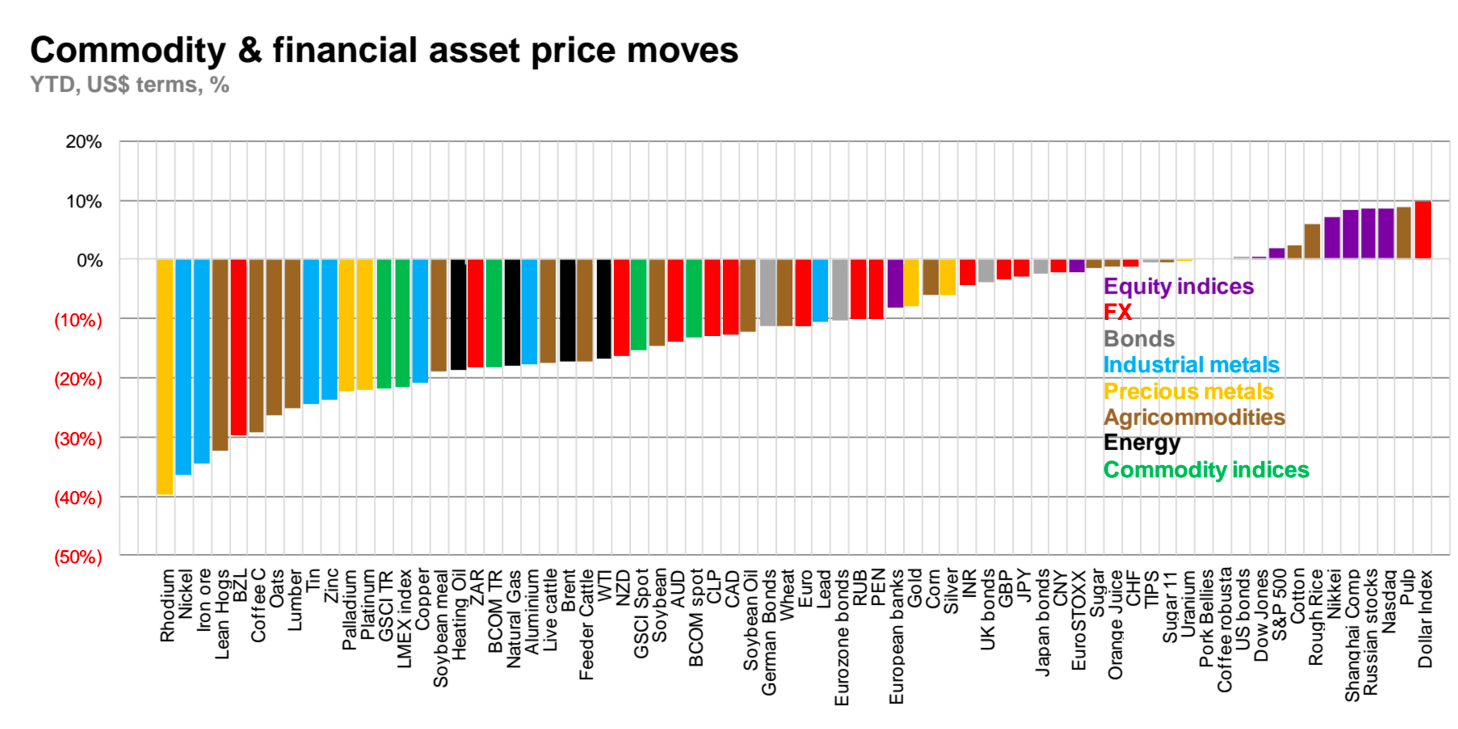

Collapse of Commodities in One Simple Chart

Losses

Losses are a simple cost of doing business. Don’t try to justify a bad trade by convincing yourself that it will sooner or later turn into a good trade. Accept losses easily! Successful traders are able to ride through downturn periods. The confidence in their methods reassures them about their future success.

Losses are a simple cost of doing business. Don’t try to justify a bad trade by convincing yourself that it will sooner or later turn into a good trade. Accept losses easily! Successful traders are able to ride through downturn periods. The confidence in their methods reassures them about their future success.

The markets offer endless and plentiful possibilities. Missed opportunities exist only in your mind. Prices keep changing and generate other opportunities. The goal of trading is make a net profit after a sequence of trades. It is, therefore, necessary to accept some losses and to look forward without punishing oneself.

See Power of US Fed

Number one Manipulators in World :Central Bankers

2nd :Corporates (ACROSS GLOBE )

3rd :Insiders + Fund Managers 4) Media -BLUE CHANNELS !!

Traders: When to be Flexible & when to be Rigid

- raders should have a very flexible mindset about which way a trade can go when they enter it, but be very rigid about taking their stop loss when it is hit.

- Traders should be very flexible on profit expectations during each market cycle but very rigid about following their robust method during each cycle.

- Traders must be very flexible about allowing a winner to run but very rigid on cutting losses short.

- Traders must be flexible about their opinions and change them when proven wrong but they must be rigid about their risk management and never risk more than planned.

- Traders should be flexible about their watch list but rigid about their trading plan.

- Traders should be flexible about what will happen next in the market but rigid about their rules.

- Traders should be flexible about the direction of the trend when it changes but rigid about positions sizing.

- Traders should be flexible about profit targets but rigid about entering with a minimum risk/reward plan.

- Trades should be flexible about entries and exits as the market action develops but rigid about managing the risk of ruin at all times.

- Traders should be flexible about expectations on when they will have a huge winning streak that will change their financial lives but rigidly pursue success in the markets until it does happen.

I Wish I Could Quit You

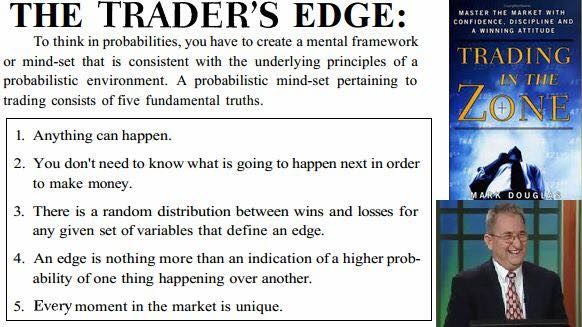

Mark Douglas' Trading Truths

Being right vs. being profitable (Being Profitable in important in Trading ,Nothing else )