- Anything can happen

- You can make money without knowing what is going to happen next

- There is a random distribution of wins and losses that define an edge

- An edge is just the greater probability of one thing happening over another

- Every moment in the market is unique

Archives of “February 1, 2019” day

rssThe art of fishing, mastered by a bird! -Traders must learn something

What's Your Trading Brain Type?

Five Types

Five Types

To summarize, there are five general brain types. Among traders and investors, the three most important brain types are Compulsive, Impulsive and Anxious.

People with Compulsive Brains tend to get stuck in a particular thought about the market. “It’s too high.” “It’s too manipulated.” “It’s too risky.” It’s too…” whatever. People with Compulsive Brains tend to operate entirely on their own terms and are generally not open to feedback or other options.

People with Impulsive Brains are the exact opposite. They are unpredictable and lack impulse control in trading/investing and in daily life. Without much discipline, they start many more projects than they finish. They live for creativity and for what’s possible.

People with Anxious Brains live with a rain cloud overhead. They pay more attention to the obstacles to their own success (or the success of others) than to the ways that something might work. They don’t like to try new things and don’t appreciate novelty. (more…)

Trading Lessons & Secret Knowledge

Know specifically what you want in great detail. Not just how much money you want to make but how much time you want to spend trading, the amount of draw downs you are willing to experience and the amount of risk you are willing to put up with, and be realistic. For example if you say I want to make 100% on my account per year, I want no draw downs, I want to look at my positions once a week and not take on any risk. That’s like saying I want to make a million dollars a year as a pro basketball player, and all I’m willing to do to is buy some courses on how to play basketball and practice a few times a week. It’s not going to happen that way and you’ll need to change your expectations or you are wasting your time. It’s the same way with trading.

Take action with intention. Make lots of trades, not just one per month, try 30 per month or more. Find someone who is getting the results you want in the fashion you’d like to get them and model them. Decide on a system or set of systems that have the potential to get the results you want and then work with that system until it works for you. This is key, you are not going to find some set of rules that are instantly going to get you the results you want. You are going to have to pick a system and work with it for extended periods of time and experience many failures before it works for you, and even then, you will still experience losing periods. That’s just part of trading and if you cannot deal with it save yourself a lot of time and money and find a new profession. (more…)

10 Points for Traders

- Understand the psychology of the trade: never believe you are smarter than the markets as the markets will always win.

- Acquire the knowledge on how the markets truly work then test and retest your ideas and concepts until you feel confident.

- Develop a working knowledge of what types of entry and exit orders work best.

- Understand how to manage risk by employing the use of options strategies.

- Pick a strategy that matches the market conditions.

- Manage the strategy. You should always know what your next reaction point will be and what prompts you to take it.

- Watch what moves. To be successful, you have to become a media hound.

- Integrate fundamental, technical, and sentiment analysis into a real world trading approach that enables you to best understand market performance.

- Specialize in one sector and one strategy at a time.

- Give yourself the winner’s edge by always continuing to actively pursue the learning process.

PROBABILISTIC MINDSET

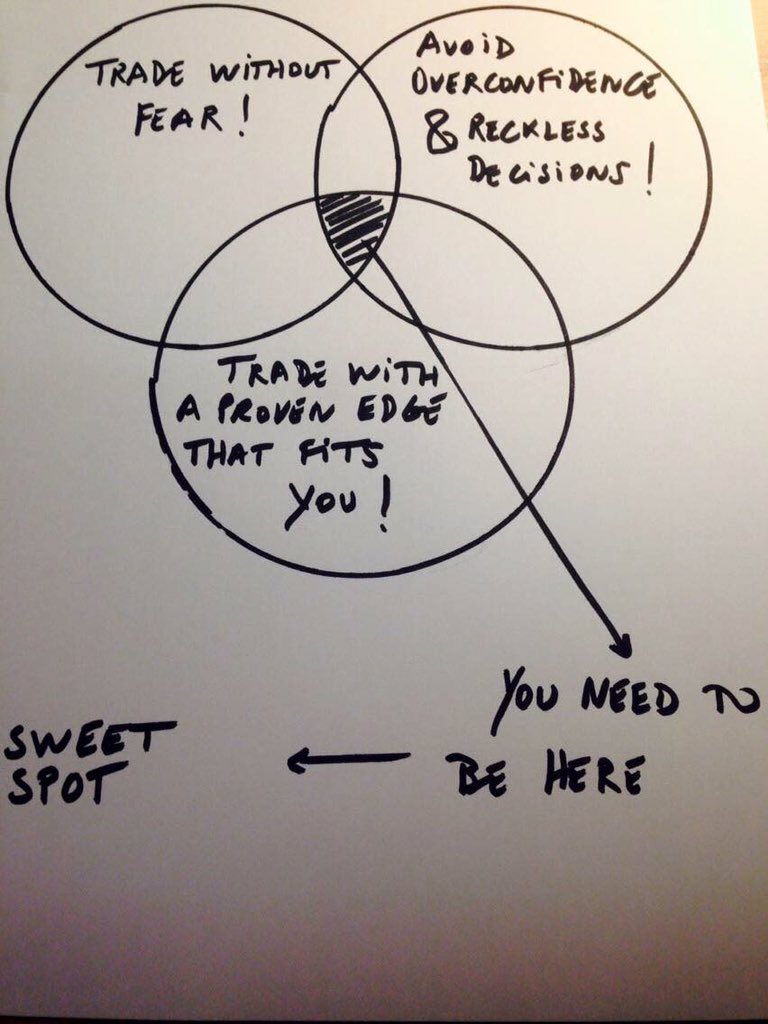

The trading sweet spot

Gold, the Titanic & Lifeboats – Why it's Important to Own Physical Gold

Successful Traders & Courage

| Successful traders constantly ask themselves: What am I doing right? What am I doing wrong? How can I do what I am doing better? How can I get more information? Courage is a quality important to excel as a trader. It’s not enough to simply have the insight to see something apart from the rest of the crowd, you also need to have the courage to act on it and stay with it. |

Naked Truth