- EU Summit: The European Council (heads of state) hold a virtual meeting on June 18 to ostensibly discuss the EU’s May 27 Recovery Fund proposal. Some have heralded the proposal as a key turning point in the evolution of Europe, and the possibility of a so-called Hamiltonian moment, a major set toward fiscal union, has been suggested. We have been less sanguine; recognizing the potential scaffolding for a greater union, but also that projecting emergency actions into the future is fraught with danger. Austria and Denmark, which have pushed back against grants instead of loans, could be won over by assurances that their rebates will remain intact. Others, including Eastern and Central European members, may be more difficult to persuade. Although expectations are running high, we suspect an agreement will remain elusive, in which case another try will be at the July summit, which, with a little luck, could be in person. Disappointment could weigh on the euro.

Archives of “World” tag

rssJapan Quarterly Business Sentiment Index survey (Q2): large Japanese companies worst in 11 years

Business Sentiment Index (BSI) survey conducted by the Ministry of Finance and the Economic and Social Research Institute (a part of Japan’s Cabinet office) is conducted quarterly.

- worst result in 11 years

- 3rd quarter in a row in negative territory

- and for mid- to small-companies minus 61.1

- each also at their worst ever

Quarterly Business Sentiment Index (BSI) survey, conducted May 15

- This survey analyses business leaders’ assessments of and forecasts for the economy

- Its purpose is to get information for tracking economic trends

- It covers about 15,000 companies that have established their headquarters or principal offices in Japan and have capital stock of 10 million yen or more

Venezuela asks Bank of England to sell its gold

Venezuela is asking the Bank of England to sell part of the South American nation’s gold reserves, send the proceeds to the United Nations to help with the country’s coronavirus-fighting efforts

- It was not immediately evident how much gold Venezuela was asking the Bank of England to sell.

- Venezuela’s information ministry and central bank did not respond to requests for comment.

- The Bank of England said it does not comment on individual customer relationships.

White House: G7 leaders agree to remain committed to global response to coronavirus

White House comments regarding G7 leaders

- G7 leaders agreed to remain committed to global response to humanitarian, economic calamity stemming from pandemic and to launch a strong and sustainable recovery

- leaders called for a thorough review and reform process that World Health Organization

- much of G7 leaders call centered on lack of transparency and chronic mismanagement of the pandemic by the World Health Organization

- G7 leaders discussed efforts to pool research on coronavirus by sharing data and making it publicly available

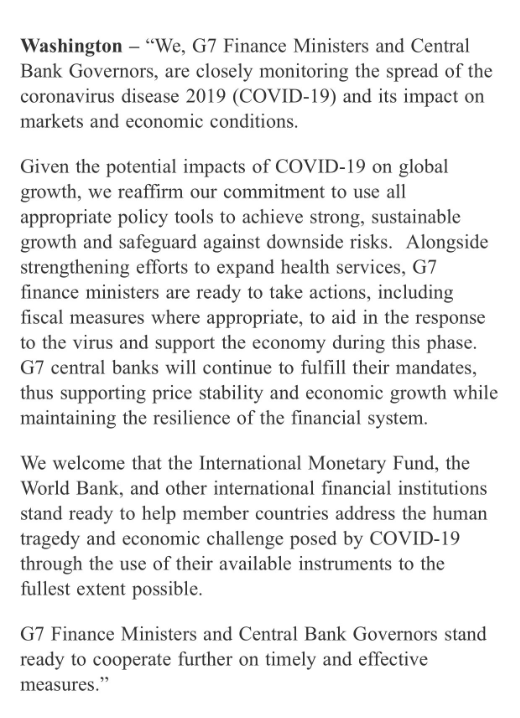

G7: “We will do whatever is necessary” to restore confidence

G7 statement

- We are taking action and enhancing coordination on domestic and international policy efforts to respond to epidemic

- We pledge to promote global trade and investment

- Says they are pushing liquidity support and fiscal expansion

Statement of G7 Finance Ministers and Central Bank Governors

Consistent with the direction from G7 Leaders, we are taking action and enhancing coordination on our dynamic domestic and international policy efforts to respond to the global health, economic, and financial impacts associated with the spread of the coronavirus disease 2019 (COVID-19). Collectively, G7 nations have already enacted a wide-ranging set of health, economic, and financial stability measures. We will do whatever is necessary to restore confidence and economic growth and to protect jobs, businesses, and the resilience of the financial system. We also pledge to promote global trade and investment to underpin prosperity.

Our nations are working together to fight the COVID-19 outbreak and mitigate its impact, treat those affected, and prevent further transmission. G7 finance ministries are helping advance this effort by providing the funding needed to respond to the situation. In particular, we recognize the urgent need to increase support for the rapid development, manufacture, and distribution of diagnostics, therapeutics, and a vaccine for COVID-19. We are providing bilateral and multilateral assistance to strengthen foreign governments’ prevention efforts and their health and emergency response systems.

The G7 is committed to deliver the fiscal effort necessary to help our economies rapidly recover and resume the path towards stronger and more sustainable economic growth. Alongside our nations’ efforts to expand health services, G7 finance ministries are undertaking, and recommend all countries undertake, liquidity support and fiscal expansion to mitigate the negative economic impacts associated with the spread of COVID-19.

G7 says ready to take action, including fiscal tools, where needed

The US Treasury releases the G7 statement on its website

The full statement:

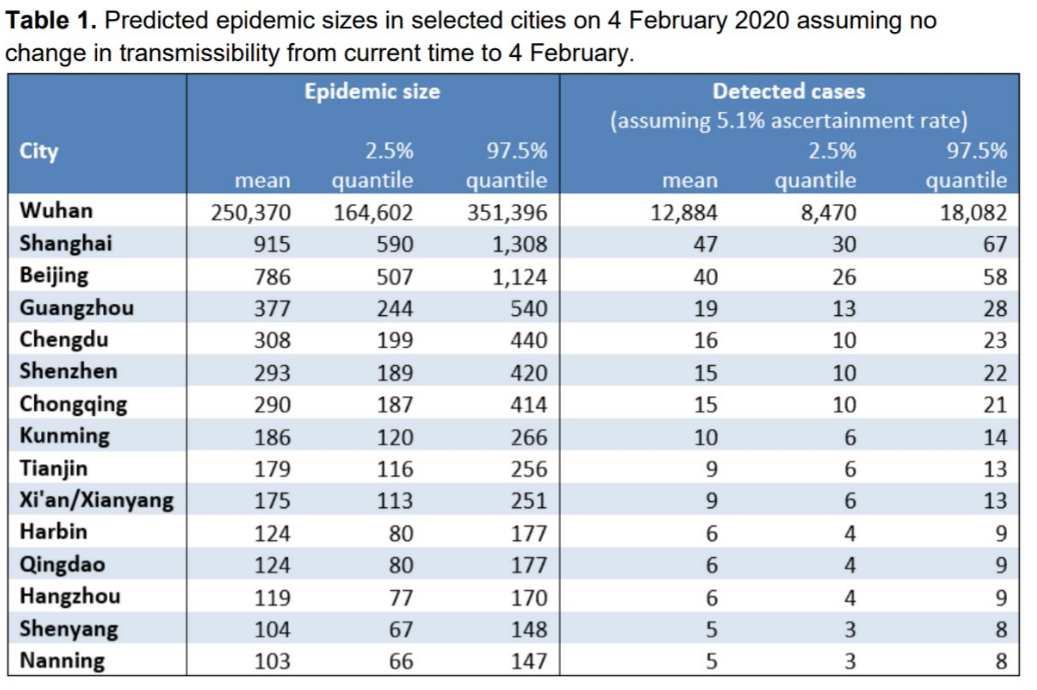

UK virus researchers estimate 250,000 people in Wuhan will have coronavirus in 13 days

It will spread to nearby cities and countries next

Some geopolitical comments from China and France are hitting the news wires

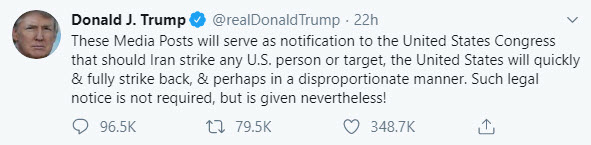

Speaking on the Middle East risks

- if tensions are not diffused today than there is a real risk of war in Middle East

- there is still room for diplomacy on Iran crisis

- Iran must refrain from reacting, start broader talks

- says Soleimani was a key player in destabilizing the region

- latest decision by Iranians enables them to enrich uranium without constraints

- we can question the validity of nuclear deal in long-term

- decision on triggering Iran nuclear deal dispute mechanism process will be made in coming days

- US unilateral use of force has violated international law and destabilizes the region

- Urges US not to use a further force in Middle East, calls on all parties to exercise maximum restraint

Finally, the Trump administration has said that they would provide closed-door briefing on Iran to the full US Senate on Wednesday. Secretary of State Pompeo, defense secretary Esper and CIA director Haspel, and Joint Chiefs of Staff chairman Milley will address the Senate.

US negotiators offer to cut Chinese tariffs by up to 50% on $360B in imports – WSJ sources

Breaking report

- US would reimpose original tariff level if China fails to carry out pledges

- Would also cancel planned Dec tariffs

- US tariff offer made in recent days as both sides seek trade deal

- US asking China for firm commitments on increased US products

- The tariff-reduction offer was made in the past five days or so

- US side has demanded that Beijing make firm commitments to purchase large quantities of US agricultural and other products, to better protect US IP rights and to allow greater access to China’s financial-services sector

International Monetary Fund wants Indian government to be more credible, transparent on fiscal numbers

New Delhi needs to become more “transparent” on the fiscal numbers as it is a “laggard” among the G20 peers on this front, a senior official from the International Monetary Fund said here on Wednesday.

The government has been missing its budgeted fiscal targets for the past few years and there is a need for a “credible fiscal consolidation” which is more ambitious as well, the official said, adding this is more so as government has not addressed how it will make up for the massive Rs 1.45 lakh crore tax giveaways in the form of corporate tax cuts.

The comments come amid allegations of the budget math not adding up with some pointing to a Rs 1.7 lakh crore hole in the estimates, and also over 100 economists questioning the official data computation.

“Fiscal transparency should be increased. It is fairly difficult for the private sector to get the full picture on fiscal standing,” the fund’s deputy director Anne-Mary Gulde said speaking at an NSE event here.

“India is somewhat lacking in a programme on G20 data initiative on fiscal transparency where comparative countries have all made greater progress,” she added.

She said there is also a need for more credible fiscal consolidation as such a move will help reduce the relatively high level of debt and free up financial resources for the private sector. (more…)