Major indices down over 7%

The European stock markets are now close for the day and the nightmare is over. The major indices all closed over 7% lower. For the year the declines are near the -20% level. Ouch.

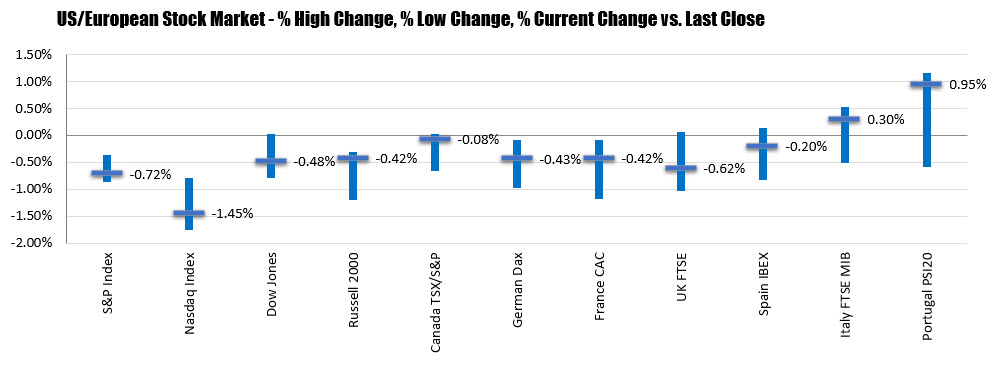

The provisional closes for the major indices are showing:

- German DAX, -7.4%

- France’s CAC, -7.9%

- UK’s FTSE 100, -7.3%

- Spain’s Ibex, -8.1%

- Italy’s FTSE MIB, -11.1%

For the trading year, the provisional changes are showing

- German DAX, -19.8%

- France’s CAC, -20.67%

- UK’s FTSE 100, -20.3%

- Spain’s Ibex, -18.9%

- Italy’s FTSE MIB, -20.3%

In other markets as London/European traders look to exit:

- spot gold is down $6.20 or -0.37% at $1667

- WTI crude oil futures are down $8 or -19.43% at $33.26

In the US stock market:

- S&P index is down -169 points or -5.7% the 2802

- NASDAQ index is down -425 points or 4.98% at 8148

- Dow is down -1600 points or -6.2% at 24263

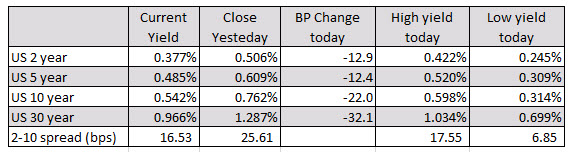

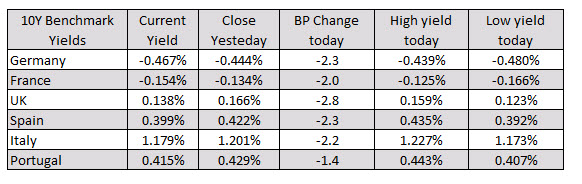

In the US debt market yields remain sharply lower.

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit: