EUR/USD up 92 pips today

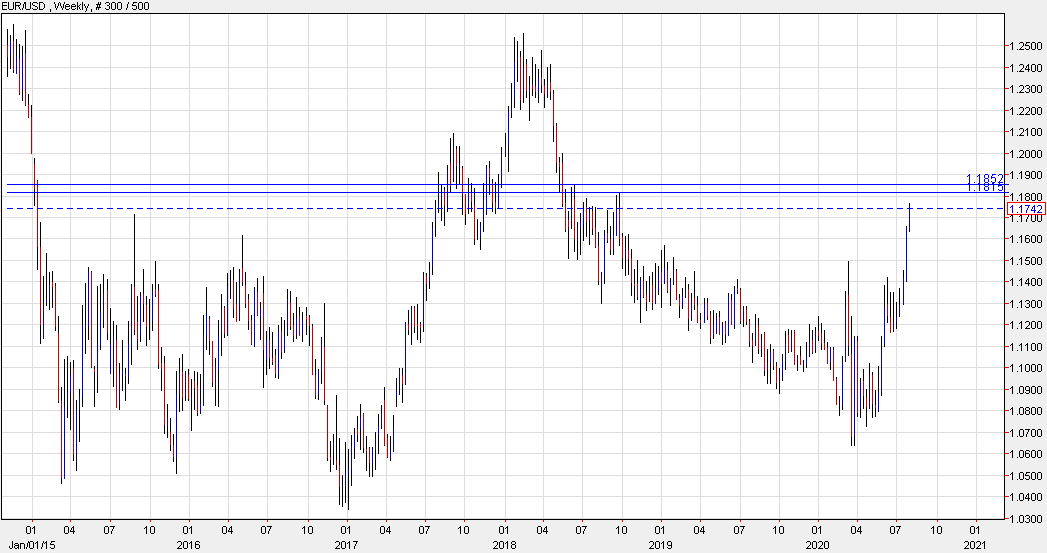

The euro cracked 1.17 in Asia and has continued to run higher, hitting 1.1764 as New York arrived before pulling back to 1.1747 at the moment. Today’s durable goods orders report hasn’t been a factor.

The impetus for the seven-day run in the euro was a successful European recovery fund negotiation. At the same time, the US is struggling with COVID-19 and European economies are closer to normalcy with virus counts low (although some hotspots are appearing).

Overbought indicators are obviously flashing warning signs for the euro but there is still a lot to like. 1.17 isn’t particularly high and assets in Europe are still relatively cheap. Carry is dead almost everywhere so that’s not going to be a big drag.

I’ll keep it simple on the technicals and highlight the June and Sept 2018 highs at 1.1852 and 1.1815 as resistance. I like the euro against the US dollar but the risk-reward at the moment is mediocre.

The US stocks are ending the day just off the lows for the day. The NASDAQ index by the way with a -1.27% decline.

The US stocks are ending the day just off the lows for the day. The NASDAQ index by the way with a -1.27% decline.