29 April to 5 May inclusive (Thursday to Wednesday)

Friday 30th sneaks in, its not actually a holiday but will be taken by many.

Tokyo FX markets will be absent for the holidays with therefore reduced liquidity during the Asian timezone.

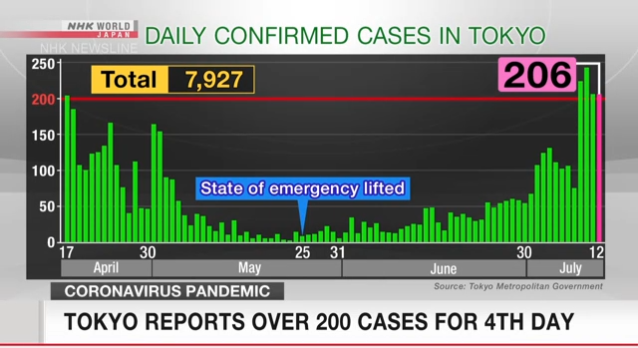

Holidays in the 4 prefectures, Tokyo and the western prefectures of Osaka, Kyoto and Hyogo, with a state of emergency will be subdued. Residents of the four prefectures have been asked to reduce outings, to a minimum and refrain from travelling outside the prefectures. Residents of other parts of the country were urged not to travel to the four prefectures.