- Don’t trade your opinions trade a carefully written trading plan that expresses a methodology with an edge.

- Don’t trade your emotions trade your quantified entry set ups.

- Stop exiting when your scared and exit with your trailing stop is hit.

- Only trade when the market environment gives your system a green light, go to cash when the market gives your system a red light.

- Stop trying to force trades, trade the signals not the noise. Wait for a reason to trade.

- In losing streaks trade smaller and smaller until you start winning again.

- Quit trying to make some great public “call” about a bottom and focus on making money.

- Sometimes it is not about making money it is about keeping what you have and playing a strong defense.

- The sloppy the price action the pickier you have to be with your entries.

- The more volatile the market the smaller you should be trading.

Archives of “Technical Analysis” tag

rssWisdom from William Eckhardt

1. What is the state of the market?

2. What is the volatility of the market?

3. What is the equity being traded?

4. What is the system or the trading orientation?

5. What is the risk aversion of the trader or client?

Regardless of how you trade or invest … you better have those answers in advance of betting real money.

The Ultimate Algorithmic Trading System Toolbox -George Pruitt :Book Review

I am in the process of learning to code in Python and am, I must admit, no programming genius. So I was delighted to see that George Pruitt, best known for his book on TradeStation’s EasyLanguage (Building Winning Trading Systems with TradeStation) had written a new book that covered not only the TradeStation platform but also AmiBroker, Excel (with VBA), and Python. The Ultimate Algorithmic Trading System Toolbox: Using Today’s Technology to Help You Become a Better Trader (Wiley, 2016) is a how-to manual for the non-quant who wants to incorporate algorithms into his trading.

I am in the process of learning to code in Python and am, I must admit, no programming genius. So I was delighted to see that George Pruitt, best known for his book on TradeStation’s EasyLanguage (Building Winning Trading Systems with TradeStation) had written a new book that covered not only the TradeStation platform but also AmiBroker, Excel (with VBA), and Python. The Ultimate Algorithmic Trading System Toolbox: Using Today’s Technology to Help You Become a Better Trader (Wiley, 2016) is a how-to manual for the non-quant who wants to incorporate algorithms into his trading.

Pruitt’s focus in this book is not so much on system development per se as it is on popular programming tools for building and back testing technical trading systems. Yes, he has chapters on “Genetic Optimization, Walk Forward, and Monte Carlo Start Trade Analysis” and “An Introduction to Portfolio Maestro, Money Management, and Portfolio Analysis,” but what will most likely draw traders to Pruitt’s book is his extensive array of clearly explained sample code. (more…)

5 Trading Lessons-Must Read

- Most of the time, markets are very close to efficient (in the academic sense of the word.) This means that most of the time, price movement is random and we have no reason, from a technical perspective, to be involved in those markets.

- There are, however, repeatable patterns in prices. This is the good news; it means we can make money using technical tools to trade.

- The biases and statistical edges provided by these patterns are very, very small. This is the bad news; it means that it is exceedingly difficult to make money trading. We must be able to identify those points where markets are something a little “less than random” and where there might be a statistical edge present, and then put on trades in very competitive markets.

- Technical trading is nothing more than a statistical game. The parallels to gambling and other games of chance are very, very close. A technical trader simply identifies the patterns where an edge might be present, takes the correct position at the correct time, and manages the risk in the trade. This is, of course, a very simplified summary of the trading process, but it is useful to see things from this perspective. This is the essence of trading: find the pattern, put on the trade, manage the risk, and take profits.

- Because all we are doing is playing the small edges as they occur in the markets, it is important to be utterly consistent in every aspect of our trading. Many markets have gotten harder (i.e. more efficient, more of the time) over the past decade and things that once worked no longer work. Iron discipline is a key component of successful trading. If you are not disciplined every time, every moment of your interaction with the market, do not say you are disciplined.

Great Trading Books -Just Read If U Have Time

Trading Psychology :

- “Trading to Win: The Psychology of Mastering the Markets”

- “Trading in the Zone: Maximizing Performance with Focus and Discipline”

- “The Psychology of Risk: Mastering Market Uncertainty”

- “The Mental Strategies of Top Traders: the Psychological Determinants of Trading Success”

- “Hedge Fund Masters: How top Hedge Funds Set Goals, Overcome Barriers and Achieve Peak Performance”

- “Mastering Trading Stress: Strategies for Maximizing Performance”

- Prior to his passing, I had been organizing a conference with Dr. Kiev. He revolutionized the hedge fund industry in terms of trader performance

- “Psychology of the Stock Market” – G.C. Selden

- The book was written in 1912, but offers great insight in stock market speculation.

- “On Managing Yourself” – Dr. Mario F. Conforti

- “As a Man Thinketh” – James Allen

- A timeless classic in my opinion.

- “Fighting Attachment in Trading” – Jon Ossoff (Active Trader, August 2011)

- “The Crowd: A Study of the Popular Mind” – Gustave Le Bon, 1896

- “Who Are You?” – Linda Bradford Raschke (SFO, Aug. / Sept. 2003)

- Linda has made a number of contributions to trading and I have utilized several of her general market observations and concepts.

- “Maintain Your Mindset: Using the Three R’s & Positive Thinking” – Linda Bradford Raschke (SFO, July 2004)

- “The Hour Between Dog and Wolf: Risk Taking, Gut Feelings and the Biology of Boom and Bust” – John Coates, 2012

- “Deny Your Inner Gamble Monkey” – MarketWatch.com (December 11, 2012)

- “Why Smart Traders Do Dumb Things: Understanding Prospect Theory” – David Silverman (SFO, July 2005)

- “Self-Attribution Bias in Consumer Financial Decision-Making: How Investment Returns Affect Individuals’ Belief in Skill” – Arvid O. I. Hoffmann Thomas Post

- “Conquering Sabotage Traps in Your Trading” – Adrienne Toghraie – INO.com

- “Five Guiding Principles of Trading Psychology” – Brett N. Steenbarger, Ph.D.

- Brett is one the must follows in the field of trading psychology. He has written so much on the topic and all is easily accessible on the web.

- “Explaining the Wisdom of Crowds: Applying the Logic of Diversity” – Michael J. Mauboussin (Legg Mason, Mar.2012)

- “The Playbook: An Inside Look at How to Think Like a Professional Trader” – Mike Bellafiore, 2014

- The most comprehensive book I’ve read on what it takes to become a professional trader. A lot of books talk about the concept, but this lays out a step-by-step blueprint. Very well written.

“Markets Will Fluctuate”

In the 1927 book “Security Speculation – The Dazzling Adventure,” Laurence H. Sloan repeated the now famous anecdote 1 about J.P.Morgan’s view of the stock markets:

History has it that young man once found himself in the immediate presence of the late Mr. J. P. Morgan. Seeking to improve the golden moment, he ventured to inquire Mr. Morgan’s opinion as to the future course of the stock market. The alleged reply has become classic: “Young man, I believe the market is going to fluctuate.

Fluctuate indeed.

That simple truism seems to been lost to some folks, who were taken aback by yesterday’s market decline. The Dow Jones Industrial Average fell 274 points, but that sounds worse than it is; in percentage terms the retreat amounted to 1.24 percent. The Standard & Poor’s 500 Index fell 38.1 points, or 1.54 percent; the Russell 2000 Index of small cap companies fell 1.78 percent (24.6 points) while the Nasdaq Composite Index had a 1.94 percent (123.2 point) fall.

As Bloomberg News noted, “Evidence is building that the market’s long stretch of tranquility is breaking. The S&P 500 swung at least 1 percent in three of the last six sessions after spending the previous three weeks without a move of more than 0.3 percent.”

The collective question investors are asking is “Why here and now?” It is tempting, and probably correct, to simply declare this the well-known random walk of markets. But rather than leave it at that, let us turn a critical eye to some of the explanations that were circulating. Here they are from least convincing to most . . .

Continues at: The Real Reason Markets Swooned Yesterday

The Most Dangerous Trade -Book Review

Of all the ways to make money in the financial markets, being a short seller is one of the toughest. The short seller is fighting the upward bias of the equity markets as well as the wrath of deep-pocketed, litigious individuals with vested interests in the stocks he is targeting. He has to be both a sleuth and a promoter; after all, what good is all his detective work if other investors don’t know what he uncovered and don’t join him in putting downward pressure on the stock?

Of all the ways to make money in the financial markets, being a short seller is one of the toughest. The short seller is fighting the upward bias of the equity markets as well as the wrath of deep-pocketed, litigious individuals with vested interests in the stocks he is targeting. He has to be both a sleuth and a promoter; after all, what good is all his detective work if other investors don’t know what he uncovered and don’t join him in putting downward pressure on the stock?

In The Most Dangerous Trade: How Short Sellers Uncover Fraud, Keep Markets Honest, and Make and Lose Billions (Wiley, 2015), Richard Teitelbaum, a financial journalist, has written illuminating profiles of ten top short sellers, complete with their investing strategies. Combining interviews with well-researched back stories, he explores the highs and lows (and there are a lot of lows) of short selling.

Bill Ackman, Manuel Asensio, Jim Chanos, David Einhorn, Carson Block, Bill Fleckenstein, Doug Kass, David Tice, Paolo Pellegrini, and Marc Cohodes are the featured investors. We learn about their early years, how they ended up being short sellers, even the significance of their fund names. Why Muddy Waters, for instance? Block, trying to find a good name for his nascent firm, recalled a Chinese proverb: “Muddy waters make it easy to catch fish.”

We read about positions that worked and those that didn’t—and what these investors learned from the latter. We learn how they construct their portfolios (including long positions) and how they try to mitigate risk (sometimes with options).

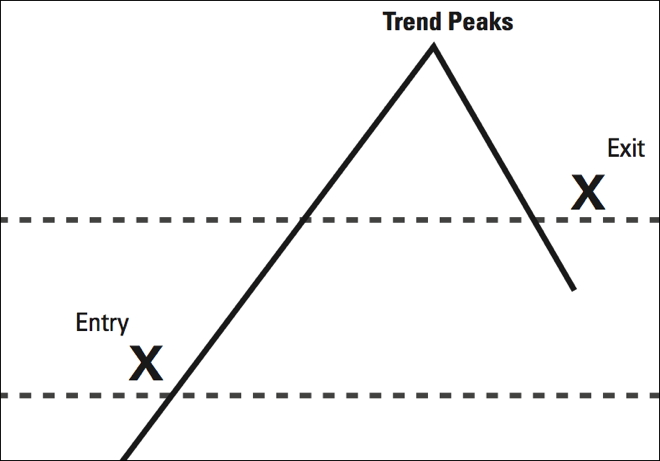

Trend Following Goes for the Middle Meat

Consider an illustration that can make you rich:

Trend following does not pick bottoms or tops. You always get into a trend late, and get out late. You cannot predict a trend. That chart might not seem like a great strategy at first glance, but it is the foundation of one of the most profitable insights in the history of market speculation: capture the middle meat and you can make a fortune.

Technical Analyst & Fundamental Analyst -Chat

“A technical analyst and a fundamental analyst are chatting about the markets in the kitchen. Accidentally one of them knocks a kitchen knife off the table landing right in the fundamental analyst’s foot! The fundamental analyst yells at the technician, asking him why he didn’t catch the knife? “You know technicians don’t catch falling knives!,” the technician responded. He in turn asks the fundamental analyst why he didn’t move his foot out of the way? The fundamental analyst responds, “ I didn’t think it could go that low.”

Trading Mathematics and Trend Following

Some quick points, to be making money, Profit Factor must be greater than 1.

- Profit Factor (PF)

- = Gross Gains / Gross Losses

- = (Average win * number of wins) / (Average loss * number of losses)

- = R * w / (1-w)

- where R = Average win / Average loss

- w = win rate, i.e. % number of winners compared to total number of trades

Re-arranging, we have

- w = PF / (PF + R)

- R = PF * (1 – w) / w

Sample numbers showing the minimum R required to break-even (i.e. PF = 1, assuming no transaction costs) for varying win rates.

- w = 90% >> R = 0.11

- w = 80% >> R = 0.25

- w = 70% >> R = 0.43

- w = 60% >> R = 0.67

- w = 50% >> R = 1

- w = 40% >> R = 1.5

- w = 30% >> R = 2.33

- w = 20% >> R = 4

- w = 10% >> R = 9

The style of trading strongly influences the win rate and R (average winner / average loser). For example, (more…)