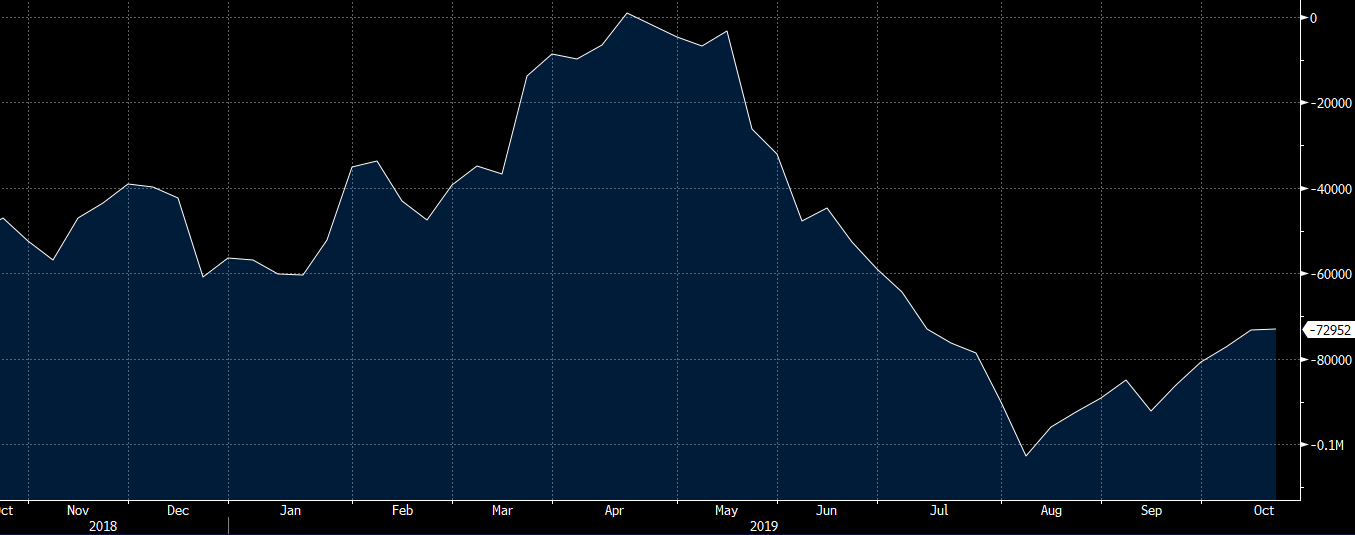

Forex futures positioning data from the CFTC for the week ending October 15, 2019:

- EUR short 75K vs 75K short last week. Unchanged

- GBP short 73K vs 73K short last week. Unchanged

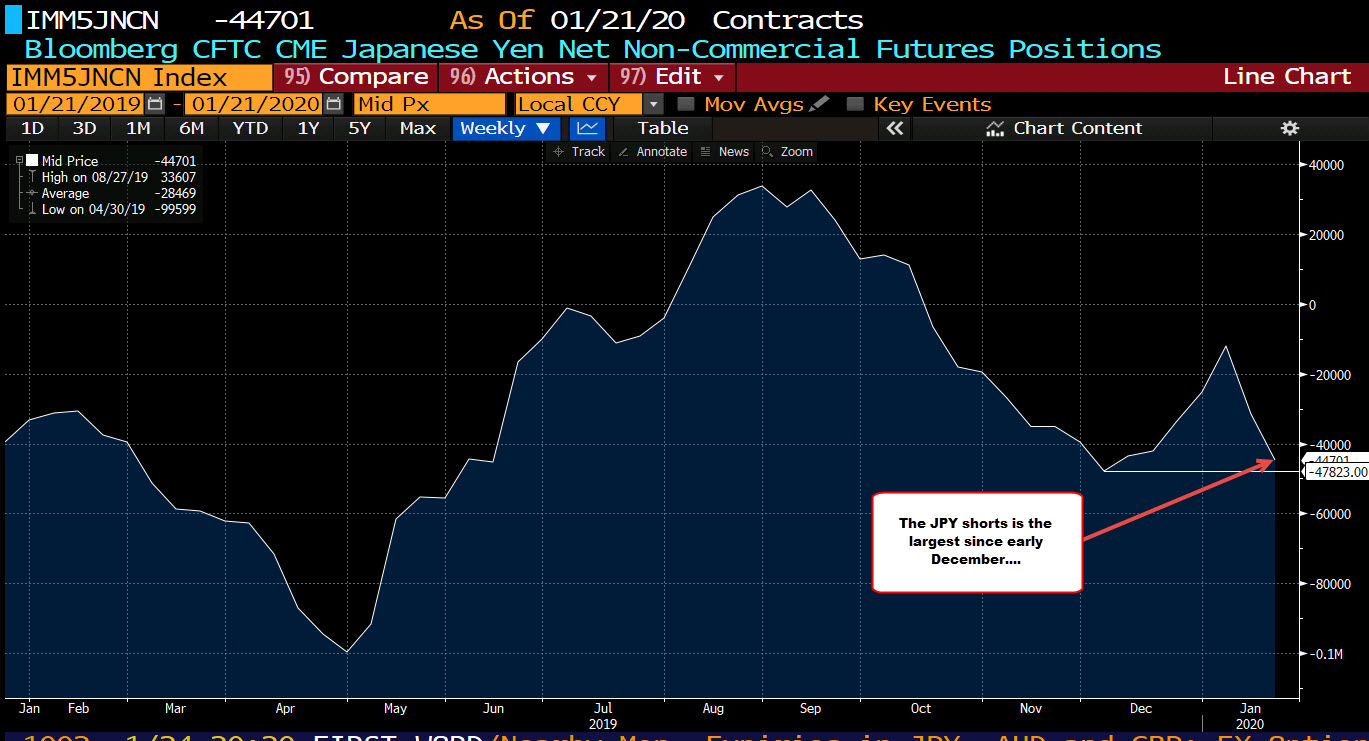

- JPY short 7K vs 11K long last week. Longs switch to shorts in an 18K drop

- CHF short 13k vs 11k short last week. Shorts trimmed by 1K

- AUD short 48k vs 46k short last week. Shorts increased by 2K

- NZD short 40K vs 38K short last week. Shorts increased by 2K

- CAD long 13K vs 5K long last week. Longs trimmed by 1K

- Prior week

The big moves in sterling came last week and I’m surprised there wasn’t any covering through Tuesday. That’s good news if you’re long GBP because it leaves lots of juice to squeeze.