Rough week for equity markets:

- UK FTSE 100 -1.0%

- German DAX -0.9%

- French CAC -0.4%

- Spain IBEX +0.2%

- Italy MIB -0.7%

- UK FTSE 100 -0.3%

- German DAX -2.3%

- French CAC –1.8

- Spain IBEX -0.9%

- Italy MIB -1.3%

Major indices close lower last week. The week is getting off to a better start

Major indices close lower last week. The week is getting off to a better startLast week, the European indices all closed lower for the week. Today however, the indices are getting off to a better start. All the major indices are higher. The provisional closes are showing:

The European shares are closing lower on the day after trading higher earlier. The provisional closes are showing:

The major European stock indices are ending the session flat or higher. The German DAX was the weakest as it closes near flat for the day. Spain’s Ibex is the strongest with a gain of near 1.4%.

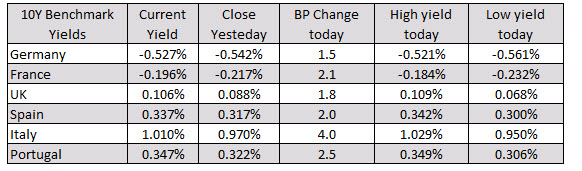

In the benchmark 10 year yields today, yields have moved back higher after being negative at the start of the North American session

Some updates to the virus situation across Europe recently warning by Saxony state premier UK imposing a 14-days quarantine for travelers from Spain The country recorded a rise of 340 new cases today, a more modest figure but could be skewed due to the ‘weekend effect’. This compares to the slight jump of 816 and 784 new virus cases seen on 24 and 25 July respectively.The rise comes amid localised outbreaks, with a farm in Bavaria seeing more than 500 people quarantined after 174 workers were tested positive for the virus.RKI estimates the 4-day virus reproduction rate to be at 1.22 and the 7-day average to be 1.16 as of yesterday; keeping above the threshold of 1.00.There have been concerns about the rising cases across the country, with the virus reproduction rate keeping above 1.00 threshold (it was 1.3 on Saturday) while daily new infections rose by 1,130 on last Friday.On the latter, that has seen the 7-day average in terms of cases rise above 1,000 for the first time since early June.Local authorities are warning about complacency but besides , they are maintaining their course to keep the economy running.

The situation in Italy appears relatively ‘under control’ with 275 new cases reported in the past day. Regional governments are continuing to stay prudent by reinforcing the need to wear masks in public spaces so that is encouraging.The slight rise in cases in Spain is seeing countries take notice with the UK imposing a 14-day quarantine for travelers from the country, following Norway’s decision to reimpose a 10-day quarantine as well for people arriving from Spain.This comes amid a surge in cases in Catalonia but the Spanish government’s virus expert has warned that the infection is already spreading among the general community in Barcelona and Zaragoza – saying that the rate of contagion has tripled.French prime minister, Jean Castex, has also “strongly recommended” its citizens to avoid going to Catalonia (the border remains open) though the region itself announced closure of bars and nightclubs for 15 days on Friday last week.Catalonia (counted separately from Spain’s total) itself reported nearly 1,500 new cases on Saturday, as the number of new cases in the region is starting to pick up again.Despite warnings of complacency and what not, local authorities are continuing to reaffirm that these outbreaks are “localised” and have not spread out of control. The right now remains on the – or at least continuing down that path.In due time, we’ll see how this all plays out but no doubt further reopening of international borders are going to be extremely tricky.The positive takeaway is that the death rate in most places isn’t as high as when the initial outbreak began but as infection numbers rise, there could be a delayed effect on that as medical capacity also starts to be burdened even more.

The European shares are ending the session with mixed results. France and Spain indices are lower. Germany, UK, Italy are trading higher.

The deal will also involve the International Monetary Fund and is expected to include 22 billion euros of funding for Greece, sources said.

The deal will also involve the International Monetary Fund and is expected to include 22 billion euros of funding for Greece, sources said.

It is now up to European Union President Herman Van Rompuy to call a summit of eurozone leaders possibly later tonight to consider the French-German deal, after talks attended by all 27 European Union heads of state.

The meeting would ask Van Rompuy to draw up detailed plans “before year end to show all the options possible” for bailing out eurozone nations in future. That would include preventive measures and sanctions, a diplomat said.

Spanish government spokeswoman Cristina Gallach said she could not confirm any deal but that Spain – which heads most European Union talks because it holds the EU’s rotating presidency – was “hopeful” that a solution could be found at the talks for Greece’s debt woes.

Below 1097 ,It will favour Bears only.

-It looks very soon will crash upto 990-955 level.

1:1 Down wave target 954

1.618 Target 806 level.

Yes ,Greece Index Looking weak only and Now watch panic in Spain -General Index too.

I will update more very soon.

Updated at 11:55/29th April/Baroda