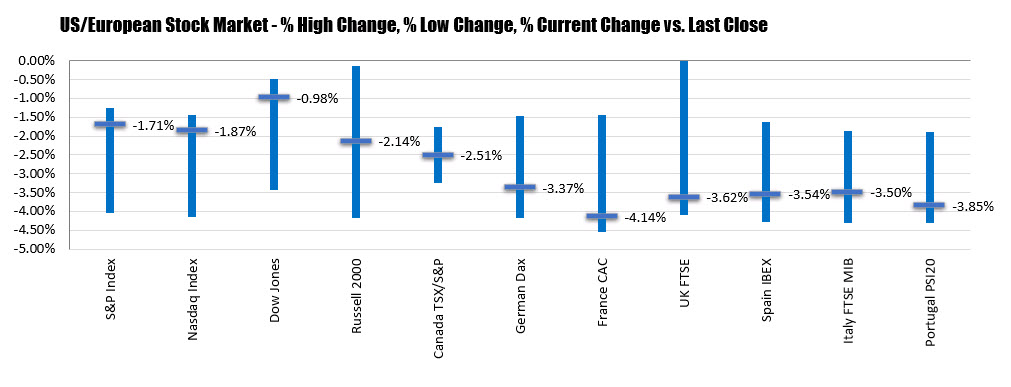

Another big move in the last hour of trading

- S&P index 2584.95, down -45.12 points or -1.72%

- NASDAQ index 7648.96, down -148.57 points or -1.91%

- Dow 22046.95, down -505.18 points or -2.24%

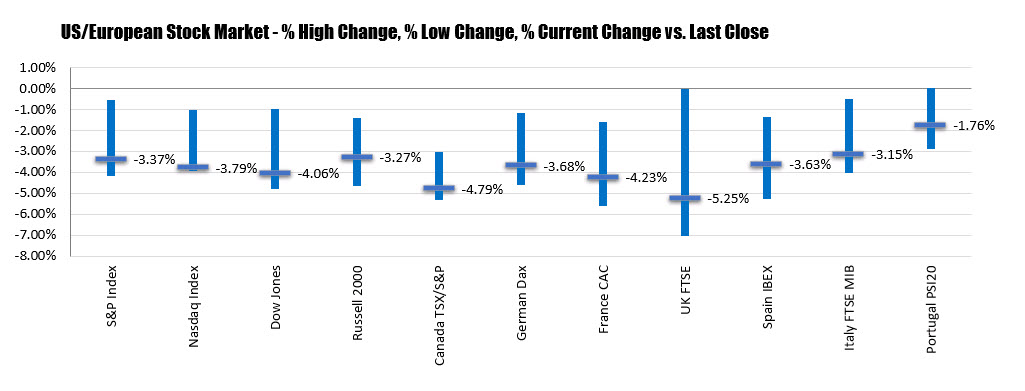

The closing levels are lower at:

- S&P index fell -88.62 points or -3.37% to 2541.45

- NASDAQ index fell -295.15 points or -3.79% to 7502.37

- Dow fell -915.39 points or -4.06% to 21636.78

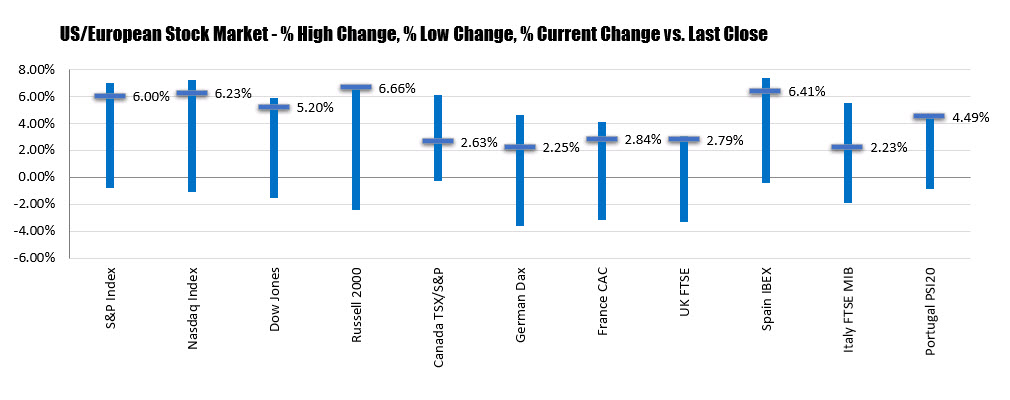

- S&P index went from a high of 2615.91 to a low of 2534.99 or a range of 80.92 points

- Nasdaq index went from a high of 7716.24 to a low of 7497.02 or a range of 219.2 points

- Dow went from a high of 22327 to a low of 21602 or a range of 725 points

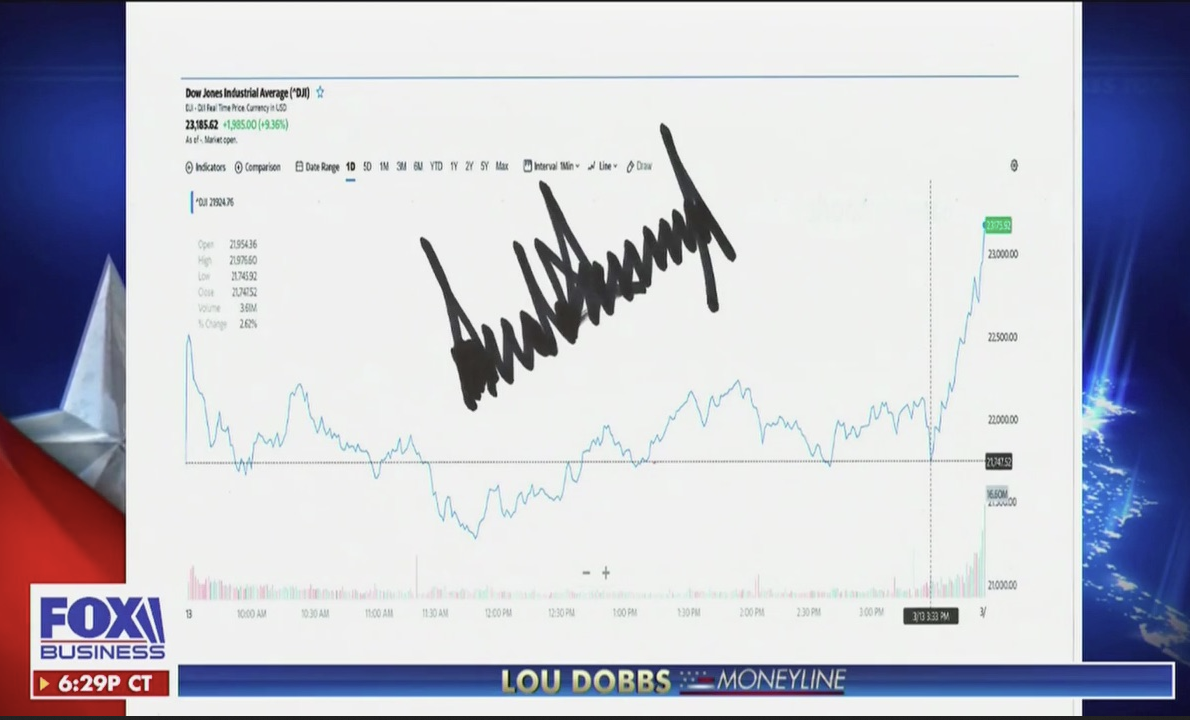

Although lower for the day for all major indices closed with gains.

Although lower for the day for all major indices closed with gains.

- Delta Air Lines +38.36%

- United Airlines +33.8%

- Slack +28.3%

- Home Depot up 25.05%

- intuitive surgical, +24.41%

- Nike up 23.51%

- Nvidia, +22.75%

- Micron, +20.41%

- Tesla, +20.36%

- Broadcom, +20.2%

- American Express up 19.56%

- United Technologies up 17.69%

- United health up 17.04%

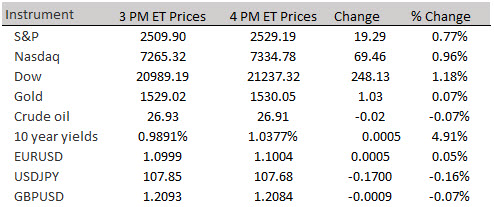

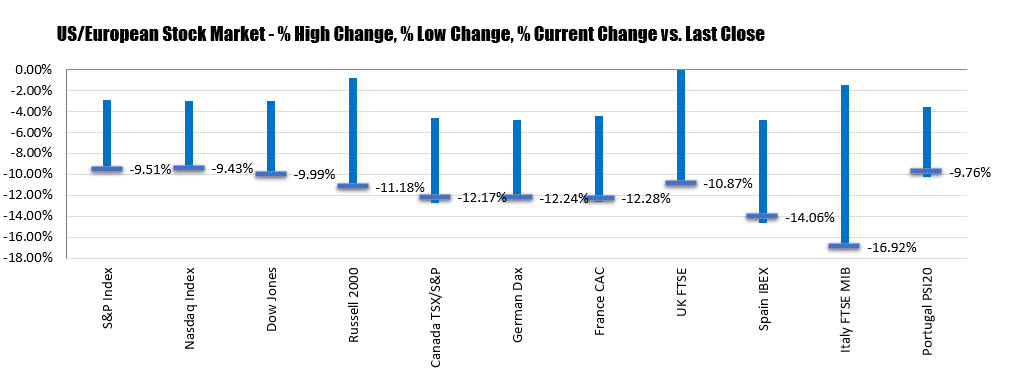

Year to date numbers are showing:

Year to date numbers are showing: