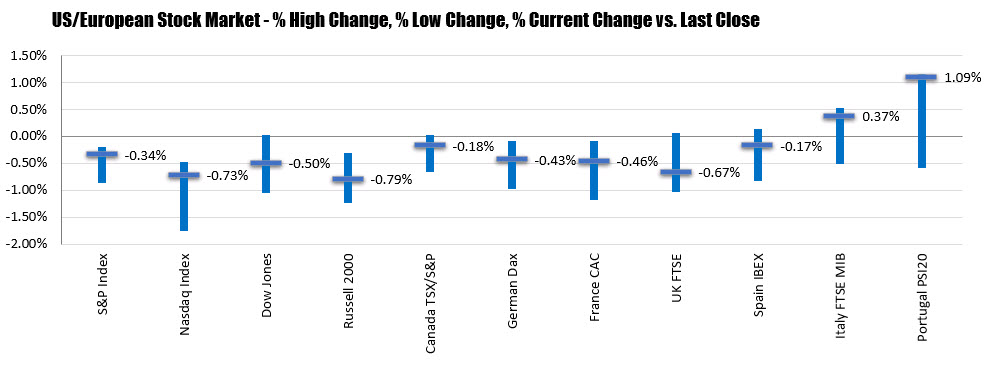

S&P and NASDAQ break a today winning streak. Dow industrial average breaks its 4 day winning streak

The major indices have broken their recent winning streaks. Admittedly the NASDAQ and the S&P index is at only reason for 2 straight days, but the Dow industrial average had a 4 day winning streak snapped in trading today.

- S&P index -10.99 points or -0.34% at 3215.57

- NASDAQ index -76.66 points or -0.73% at 10473.83

- Dow industrial average -135.39 points or -0.50% at 26734.73

After the close Netflix showed a greater than expected rise in new subscribers (10.1 million vs. 8.2M estimate),. But forecast Q3 subscribers much less than expectations at 2.5 million vs. 5.1 million estimate

After the close Netflix showed a greater than expected rise in new subscribers (10.1 million vs. 8.2M estimate),. But forecast Q3 subscribers much less than expectations at 2.5 million vs. 5.1 million estimate

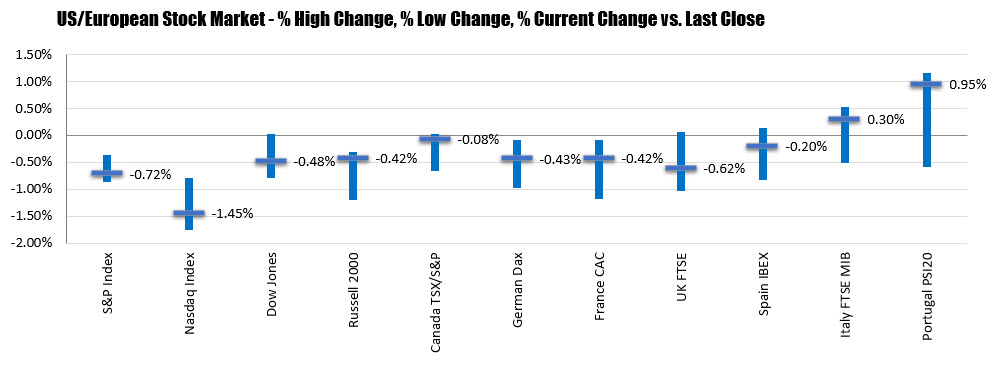

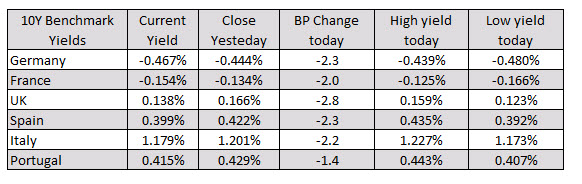

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit: The week’s biggest (sovereign) CDS movers have been released, and we have some new entrants in the most endangered species list. While by now nobody will be surprised that the UK is a consistent top 2 player (coming in this week with $319 million in net notional derisking, this making it the 8th week or so the country has made the top 3), only behind Italy and its $452 million in net notional, and just in front of last week’s #1 Brazil, the presence of the United States at #4 should be a little unsettling. It has been months since the US appeared in the top 5. And just like in the long gold case, the same types of existential questions once again arise when the interest in US CDS picks up: who gets to pay off your contracts in the case of an event of default? Elsewhere, the presence of Korea and Turkey (or Australia) in the top 10 should not come as too surprising. On the other end, short covering was violent in CDS of Spain, Hungary and Portugal – Europe’s newest lepers. Is the CDS community concerned the EU can actually pull out a rabbit out of the hat that actually works for once? Hardly. The top 10 reriskers also saw the inclusion of France and long-forgotten insolvent Greece.

The week’s biggest (sovereign) CDS movers have been released, and we have some new entrants in the most endangered species list. While by now nobody will be surprised that the UK is a consistent top 2 player (coming in this week with $319 million in net notional derisking, this making it the 8th week or so the country has made the top 3), only behind Italy and its $452 million in net notional, and just in front of last week’s #1 Brazil, the presence of the United States at #4 should be a little unsettling. It has been months since the US appeared in the top 5. And just like in the long gold case, the same types of existential questions once again arise when the interest in US CDS picks up: who gets to pay off your contracts in the case of an event of default? Elsewhere, the presence of Korea and Turkey (or Australia) in the top 10 should not come as too surprising. On the other end, short covering was violent in CDS of Spain, Hungary and Portugal – Europe’s newest lepers. Is the CDS community concerned the EU can actually pull out a rabbit out of the hat that actually works for once? Hardly. The top 10 reriskers also saw the inclusion of France and long-forgotten insolvent Greece.