A summary of the main point Lloyds make about Wednesday’s Federal Open Market Committee

- policy update contained no surprises.

- left interest rates and its asset purchase target unchanged

- The Fed continues to promise that it stands ready to offer more support to the economy if warranted but there seems to be growing confidence that more action may not be needed. Nevertheless. any tightenng in monetary policy is still probably a very long way away and markets don’t expect an interest rate hike until 2024.

More:

- Recent US economic data has actually been mixed

- the signs are that the vaccine rollout is increasing the Fed’s confidence that economic conditions will improve significantly later this year

- Hopes of further fiscal stimulus from the Biden Administration probably have provided a further boost

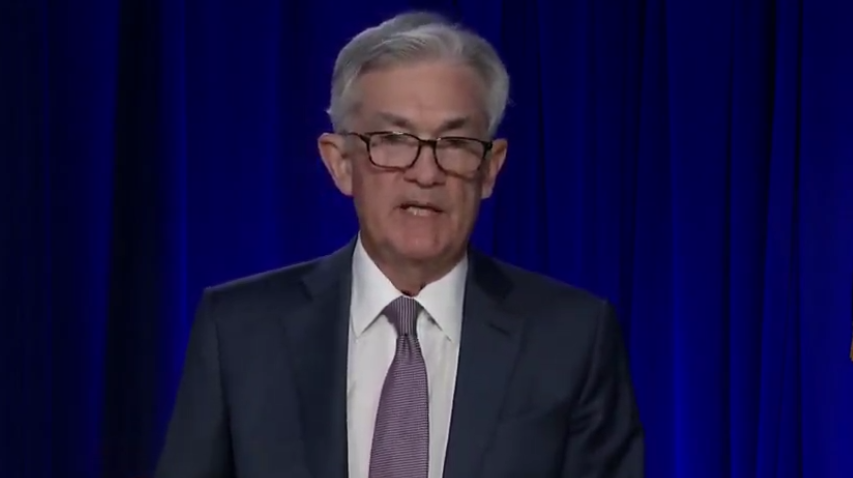

On the ‘tapering’ of QE question, which some officials at the Fed have indicated may commence in 2021, Lloyds remind that Powell has been quick to “stamp on this idea” and reiterated the point again at his presser.