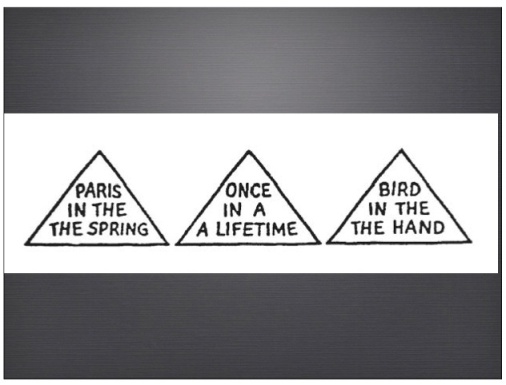

Perceptions are a normal part of daily life. It is normal to have a perception of someone, something or a situation, but this perception is often judgmental. One tends to allow feelings, emotions and looks to affect the perception. Despite being a normal and inherent part of human psychology, perceptions can be highly problematic if left uncontrolled in the case of traders.

Perceptions are a normal part of daily life. It is normal to have a perception of someone, something or a situation, but this perception is often judgmental. One tends to allow feelings, emotions and looks to affect the perception. Despite being a normal and inherent part of human psychology, perceptions can be highly problematic if left uncontrolled in the case of traders.

A trader cannot allow perceptions to cloud his/her judgement and decisions. Perceptions can be deceiving and they thus need to be kept in check as they could lead to erroneous decisions.

In a perfect world, a trader will manage to be completely rational. He/she would be able to assess all facts so as to base decisions and choices on sound information and data. Such a perfect scenario would not allow emotions, perceptions and feelings to come into the picture. As a result the decision making process and the resultant decisions should be ideal. However this is an unreal scenario as we all know that this is not possible in a real world. This is what makes trading psychology so interesting, and yet so complicated and complex. However one should consider this in a positive way as it after all lies at the foundation of why the market and the life of a trader is so challenging and exciting.

The basic idea is to try to keep perceptions under control as much as possible. Despite all efforts though, even seasoned traders may find it hard to be veyr rational at times. One cannot forget that there is tension, pressure, emotion and various other aspects which come into play while a trader is trying to make up his/her mind about the best and the safest course of action. (more…)