Price cracks above the recent ceiling near 1.385%

In a surprise, the Baker Hughes rig counts moved higher this week.

The Department of Energy will release their weekly inventory data.

the US 5 yield has fallen below the 0.20% level to a low yield of 0.1949%. That is a new all time low. The high yield today reached 0.2232%.

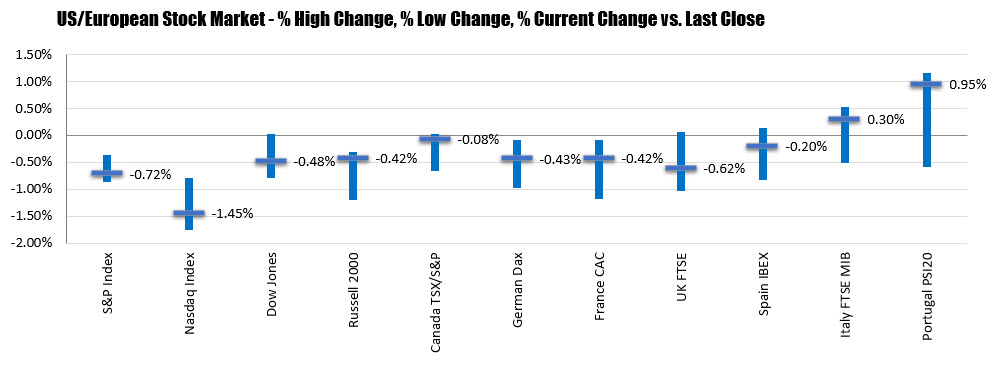

the major European indices are ending the session with mixed results. Germany, France, UK and Spain show declines while Italy and Portugal eked out gains. The closes are showing:

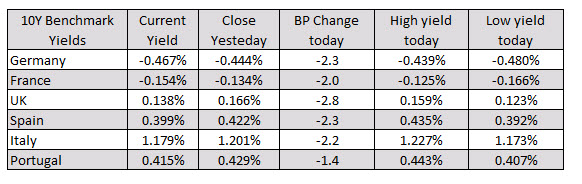

In other markets as London/European traders look to exit:

In other markets as London/European traders look to exit: The title of this book by Rick Swope and W. Shawn Howell is somewhat misleading. It’s not intuitively obvious, or at least it wasn’t to me, that Trading by Numbers: Scoring Strategies for Every Market (Wiley, 2012) is primarily about options.

The title of this book by Rick Swope and W. Shawn Howell is somewhat misleading. It’s not intuitively obvious, or at least it wasn’t to me, that Trading by Numbers: Scoring Strategies for Every Market (Wiley, 2012) is primarily about options.

But let’s start, as the authors do, with their trend and volatility scoring methods. The trend score has four components: market sentiment (the relationship between a long-term moving average and a short-term moving average and the position of price in relation to each moving average), stock sentiment (the same parameters as market sentiment), single candle structure (body length relative to closing price), and volume (OBV trend). The range is -10 to +10. Volatility scoring has three legs: historical market volatility, historical stock volatility, and expected market volatility. The range is 0 to +10.

Before moving on to the standard option strategies, the authors address risk management, which they wisely describe as nonnegotiable. Risk management again has three legs: risk/reward, concentration check, and position sizing.

And, with chapter five (of sixteen), we’ve reached covered calls. The reader who has no experience with options will be lost. Even though the authors push all the right buttons (ITM, ATM, OTM strategies; the Greeks; position adjustments), they push the buttons almost as if they were playing a video game. Very fast.

Assuming that the reader is not new to the option market, what can he/she learn from this book? Let’s look very briefly at three strategies and see how they reflect three different market or individual stock conditions: a long call, a straddle/strangle, and an iron condor. Traditionally described, in the simplest of terms, the first is looking for a significant bullish directional move, the second anticipates a surge in volatility, and the third expects a rangebound market. (more…)

1. Forget the news, remember the chart. You’re not smart enough to know how news will affect price. The chart already knows the news is coming.

2. Buy the first pullback from a new high. Sell the first pullback from a new low. There’s always a crowd that missed the first boat.

3. Buy at support, sell at resistance. Everyone sees the same thing and they’re all just waiting to jump in the pool.

4. Short rallies not selloffs. When markets drop, shorts finally turn a profit and get ready to cover.

5. Don’t buy up into a major moving average or sell down into one. See #3.

6. Don’t chase momentum if you can’t find the exit. Assume the market will reverse the minute you get in. If it’s a long way to the door, you’re in big trouble.

7. Exhaustion gaps get filled. Breakaway and continuation gaps don’t. The old trader’s wisdom is a lie. Trade in the direction of gap support whenever you can. (more…)

“Old Rules…but Very Good Rules”

There is no “genius” in these rules. They are common sense and nothing else, but as Voltaire said, “Common sense is uncommon.” Trading is a common-sense business. When we trade contrary to common sense, we will lose. Perhaps not always, but enormously and eventually. Trade simply. Avoid complex methodologies concerning obscure technical systems and trade according to the major trends only.

The title of this book is misleading, this book is not about trend trading. This book is about swing trading. This is a book about specific trading setups for swing trading using technical analysis. It gives you criteria for generating long and short trading ideas using any simple trading software.

The title of this book is misleading, this book is not about trend trading. This book is about swing trading. This is a book about specific trading setups for swing trading using technical analysis. It gives you criteria for generating long and short trading ideas using any simple trading software.