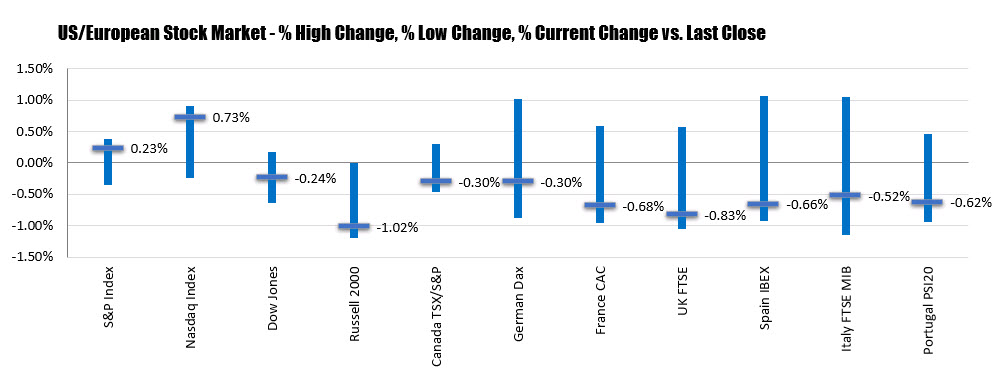

Dow industrial average leads the way

the S&P and NASDAQ index both closed at record levels, but for the day the Dow industrial average was the biggest percentage gainer.

- S&P index up 11.73 points or 0.35% at 3397.24.

- The NASDAQ index rose 46.848 points or 0.42% at 11311.80

- Dow industrial average rose 190.84 points or 0.69% at 27930.53

For the week, the NASDAQ led the way. The Dow industrial average ended the week unchanged.

- S&P index rose 0.72%

- NASDAQ index rose 2.65%

- Dow industrial average was unchanged

For the year to date, the Dow industrial average still remains down. The NASDAQ index continues its stellar performance.

- S&P index +5.15%

- NASDAQ index +26.07%

- Dow industrial average -2.13%

- Apple, +5.14%

- dear and Company, +4.39%

- Nvidia, +4.43%

- Tesla, +2.39%

- Qualcomm, +2.15%

- Corning, +1.88%

- Nike, +1.63%

- Marriott, +1.35%

- AMD, +1.27%

- Chipotle, +1.13%

- Costco, +1.12%

- J&J, +0.9%

- Home Depot, +0.9%

- Slack, -2.97%

- United Airlines, -2.97%

- Papa John’s, -2.16%

- Uber, -1.85%

- Box, -1.83%

- Deutsche Bank, -1.71%

- Beyond Meat, -1.5%

- Delta, -1.27%

- Boeing -1.25%

- Raytheon technologies, -1.21%

- Whirlpool, -1.17%

- Netflix, -1.1%