5 days in a row of record closes comes to an end for the NASDAQ

Well, the S&P index close at a record level, but could not push above 3500 at the close. It has closed higher for 6 consecutive days. The NASDAQ index failed to extend its 5 day record close string. It fell in trading today. The Dow industrial average also failed to close positive for the year for the 1st time since February 21.

- S&P index rose by 5.86 points or 0.17% at 3484.60

- NASDAQ index fell -39.725 points or -0.34% at 11625.33

- Dow industrial average rose 160.22 points or 0.57% to 28492.05. It closed -0.16% from the end of 2019 level of 28538.

- United Airlines, +5.75%

- American Airlines, +3.79%

- Southwest Airlines, +3.49%

- Delta Air Lines, +2.87%

- J.P. Morgan, +3.28%

- Wells Fargo, +2.27%

- PNC financial, +2.01%

- Bank of America, +1.96%

- Charles Schwab, +1.89%

- Morgan Stanley, +1.74%

- Citigroup, +1.73%

- Goldman Sachs, +1.39%

- Box, +4.87%

- Walmart, +4.55%

- Marriott, +4.54%

- Tesla, +4.02%

- Stryker, +3.85%

- Northrop Grumman, +2.23%

- Slack, +2.05%

- Uber, +1.55%

- Salesforce, +1.48%

- Ford, +1.47%

- MasterCard, +1.42%

- General Dynamics, +1.37%

- Netflix -3.84%

- Facebook -3.543%

- Adobe, -3.34%

- AliBaba, -2.67%

- AMD, -2.53%

- Chewy, -2.45%

- Twitter, -1.66%

- Exxon Mobil, -1.33%

- Corning, -1.29%

- Amazon, -1.26%

- Apple, -1.19%

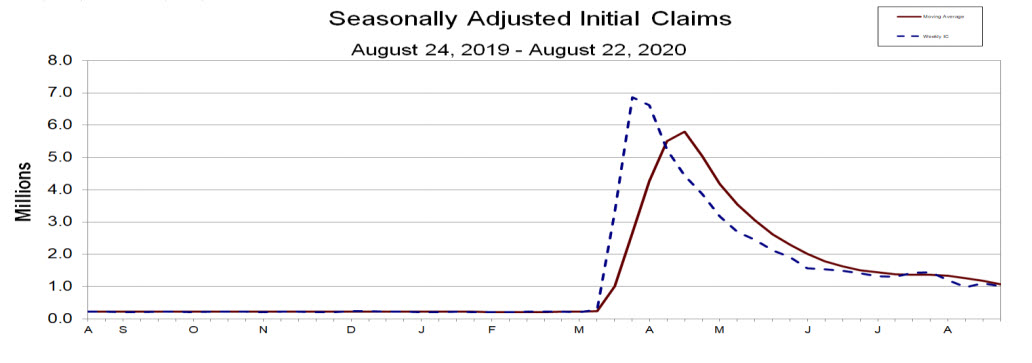

The claims data continues to disappoint with the weekly numbers back above 1 million for the 2nd week in a row after dipping below for one week early in August (to 971).

The claims data continues to disappoint with the weekly numbers back above 1 million for the 2nd week in a row after dipping below for one week early in August (to 971).