A good week for European equities as they benefit from flow of funds

The major European indices are ending the week with mixed results. The German Dax broke its four day streak that also saw new all time highs being made.

The provisional closes are showing:

- German DAX, -0.5%

- France’s CAC, +0.2%

- UK’s FTSE 100, +0.4%

- Spain’s Ibex, +0.45%

- Italy’s FTSE MIB, unchanged

For the week, the major indices are all solidly higher:

- German Dax, +4.18%

- France’s CAC, +4.5%

- UK’s FTSE 100, +1.9%

- Spain’s Ibex, +4.1%

- Italy’s 4.9%

Year to date, all the indices are also higher:

- German Dax, +5.71%

- France’s CAC, +8.87%

- UK’s FTSE 100, +4.62%

- Spain’s Ibex, +6.9%

- Italy’s footsie MIB, +8.4%

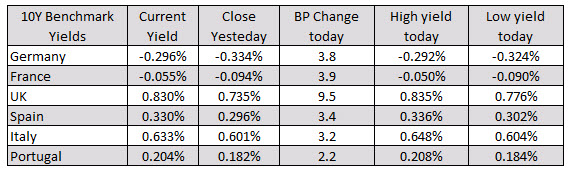

In the European debt market, the benchmark 10 year yields are ending the day higher across the board

In the forex, the snapshot of the strongest weakest as London/European traders look to exit shows the CAD is extending its lead to the upside after a trauma than expected jobs report today. The NZD and GBP remain the weakest. The USD is stronger but losing ground vs the CAD.