Fed’s Powell is to speak at a Peterson Institute for International Economics event (webinar)

- He is billed to discuss his economic outlook, but is also to expected to address monetary policy (more on this below)

- text with a Q&A to follow

- Wednesday 13 May at 1300GMT

In brief – while there has been intense speculation about the Fed moving to negative interest rates, it seems likely Powell will push back on this. Other Fed officials who have spoken recently have all expressed caution on moving to negative rates but it may be time to wheel out Powell to more effectively quash the chatter.

Some of the recent remarks on likely negative rates have come from big hitters in the industry, while market pricing has also indicated sub-zero rates.

- Scott Minerd, global chief investment officer of Guggenheim Partners said on Friday he expects rates below zero ‘soon’ – he cited declining Treasury yields

- Other market movements are also reflecting expectations – eg. falling LIBOR,

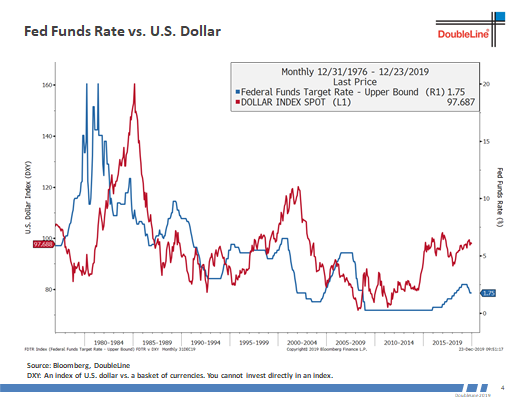

- Jeffrey Gundlach, co-founder of DoubleLine Capital tweeted last week on mounting pressure on fed funds to go negative and said “fatal” consequences may have brought the expectations to the fore (more here: Jeffrey Gundlach says pressure building on Fed funds to go negative)