1. Never, Ever, Ever, Under Any Circumstance, Add to a Losing Position… not ever, not never! Adding to losing positions is trading’s carcinogen; it is trading’s driving while intoxicated. It will lead to ruin. Count on it!

2. Trade Like a Wizened Mercenary Soldier: We must fight on the winning side, not on the side we may believe to be correct economically.

3. Mental Capital Trumps Real Capital: Capital comes in two types, mental and real, and the former is far more valuable than the latter. Holding losing positions costs measurable real capital, but it costs immeasurable mental capital.

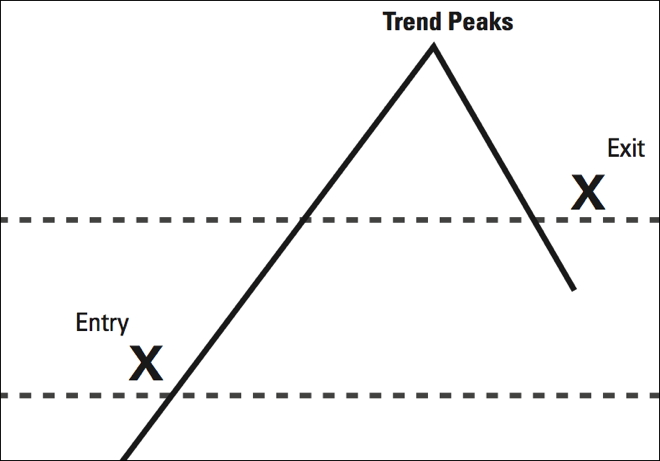

4. This is Not a Business of Buying Low and Selling High: It is, however, a business of buying high and selling higher. Strength tends to beget strength, and weakness, weakness.

5. In Bull Markets One Can Only Be Long or Neutral, and in bear markets, one can only be short or neutral. This may seem self-evident; few understand it, however, and fewer still embrace it.

6. “Markets Can Remain lllogical Far Longer Than You or I Can Remain Solvent.” These are Keynes’ words, and illogic does often reign, despite what the academics would have us believe.

7. Buy Markets That Show the Greatest Strength; Sell Markets That Show the Greatest Weakness: Metaphorically, when bearish we need to throw rocks into the wettest paper sacks, for they break the most easily. When bullish we need to sail the strongest winds, for they carry the farthest.

8. Think Like a Fundamentalist; Trade Like a Simple Technician: The fundamentals may drive a market and we need to understand them, but if the chart is not bullish, why be bullish? Be bullish when the technicals and fundamentals, as you understand them, run in tandem.

9. Trading Runs in Cycles, Some Good, Most Bad: Trade large and aggressively when trading well; trade small and ever smaller when trading poorly. In “good times,” even errors turn to profits; in “bad times,” the most well-researched trade will go awry. This is the nature of trading; accept it and move on.

10. Keep Your Technical Systems Simple: Complicated systems breed confusion; simplicity breeds elegance. The great traders we’ve known have the simplest methods of trading. There is a correlation here! (more…)