The market is like an ocean – it moves up and down regardless of what you want. You may feel joy when you buy a stock and it explodes in a rally. You may feel drenched with fear when you go short but the market rises and your equity melts with every uptick. These feelings have nothing to do with the market – they exist only inside you.

The market is like an ocean – it moves up and down regardless of what you want. You may feel joy when you buy a stock and it explodes in a rally. You may feel drenched with fear when you go short but the market rises and your equity melts with every uptick. These feelings have nothing to do with the market – they exist only inside you.

The market does not know you exist. You can do nothing to influence it. You can only control your behavior.

The ocean does not care about your welfare, but it has no wish to hurt you either. You may feel joy on a sunny day, when a gentle wind pushes your sailboat where you want it to go. You may feel panic on a stormy day when the ocean pushes your boat toward the rocks. Your feelings about the ocean exist only in your mind. They threaten your survival when you let your feelings rather than intellect control your behavior.

A sailor cannot control the ocean, but he can control himself. He studies currents and weather patterns. He learns safe sailing techniques and gains experience. He knows when to sail and when to stay in the harbor. A successful sailor uses his intelligence.

An ocean can be useful – you can fish in it and use its surface to get to other islands. An ocean can be dangerous – you can drown in it. The more rational your approach, the more likely you are to get what you want. When you act out your emotions, you cannot focus on the reality of the ocean.

A trader has to study trends and reversals in the market the way a sailor studies the ocean. He must trade on a small scale while learning to handle himself in the market. You can never control the market but you can learn to control yourself.

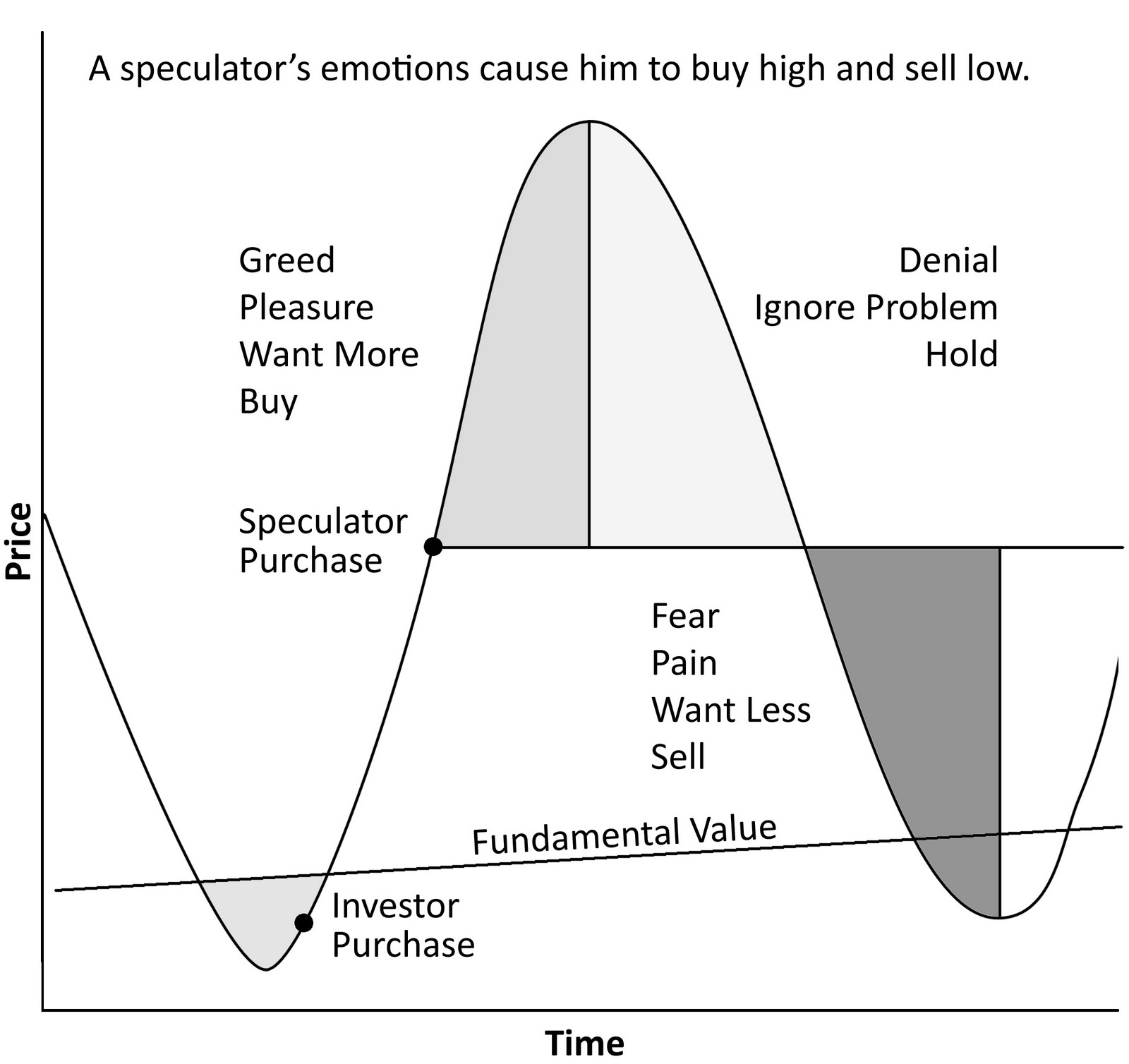

A beginner who has a string of profitable trades often feels he can walk on water. He starts taking wild risks and blows up his account. On the other hand, an amateur who takes several losses in a row often feels so demoralized that he cannot place an order even when his system gives him a strong signal to buy or sell. If trading makes you feel elated or frightened, you cannot fully use your intellect. When joy sweeps you off your feet, you will make irrational trades and lose. When fear grips you, you’ll miss profitable trades.

A professional trader uses his head and stays calm. Only amateurs become excited or depressed because of their trades. Emotional reactions are a luxury that you cannot afford in the markets.

No matter how much success you enjoy as a trader, you’ll never outsmart the market. If you think you can, you’re in for a very humbling experience. The market rules, always, and for everyone.

No matter how much success you enjoy as a trader, you’ll never outsmart the market. If you think you can, you’re in for a very humbling experience. The market rules, always, and for everyone.

The market is like an ocean – it moves up and down regardless of what you want. You may feel joy when you buy a stock and it explodes in a rally. You may feel drenched with fear when you go short but the market rises and your equity melts with every uptick. These feelings have nothing to do with the market – they exist only inside you.

The market is like an ocean – it moves up and down regardless of what you want. You may feel joy when you buy a stock and it explodes in a rally. You may feel drenched with fear when you go short but the market rises and your equity melts with every uptick. These feelings have nothing to do with the market – they exist only inside you. Your heart has a mind, and your mind has a heart. In trading we need to bring heart and mind together. We need to feel intelligently and think with informed emotion. The mind has intellectual emotion and the heart has emotional intellect.

Your heart has a mind, and your mind has a heart. In trading we need to bring heart and mind together. We need to feel intelligently and think with informed emotion. The mind has intellectual emotion and the heart has emotional intellect.